Answered step by step

Verified Expert Solution

Question

1 Approved Answer

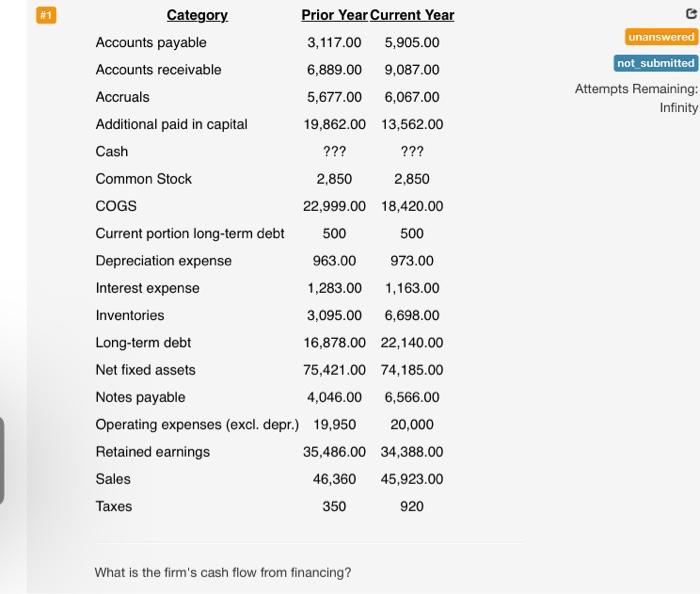

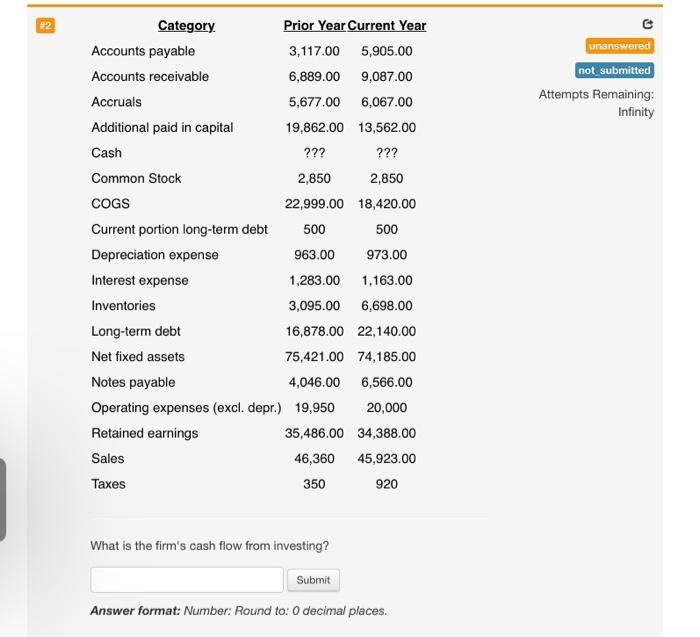

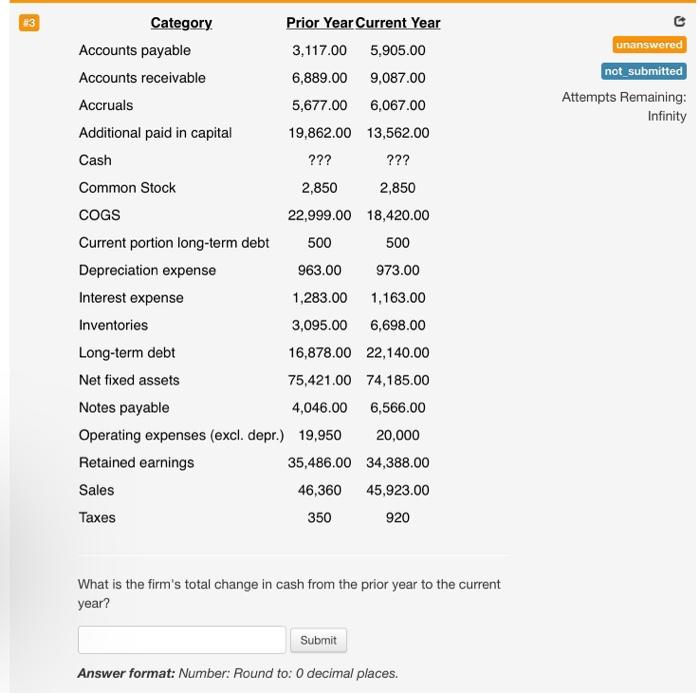

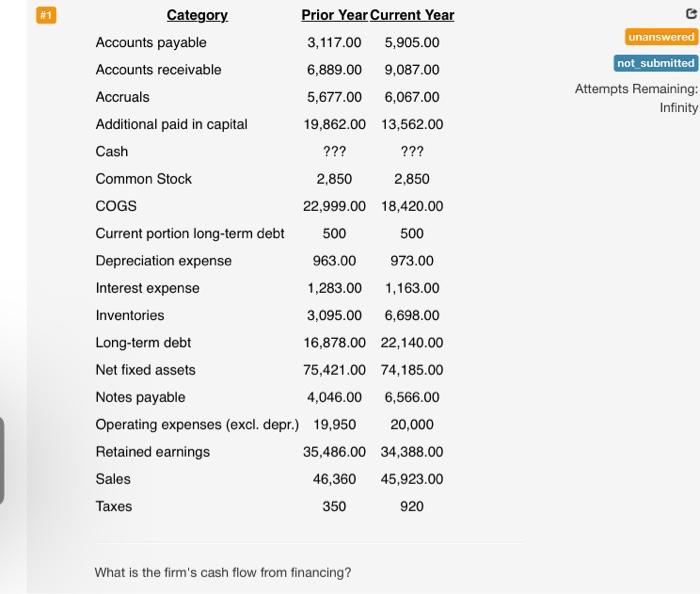

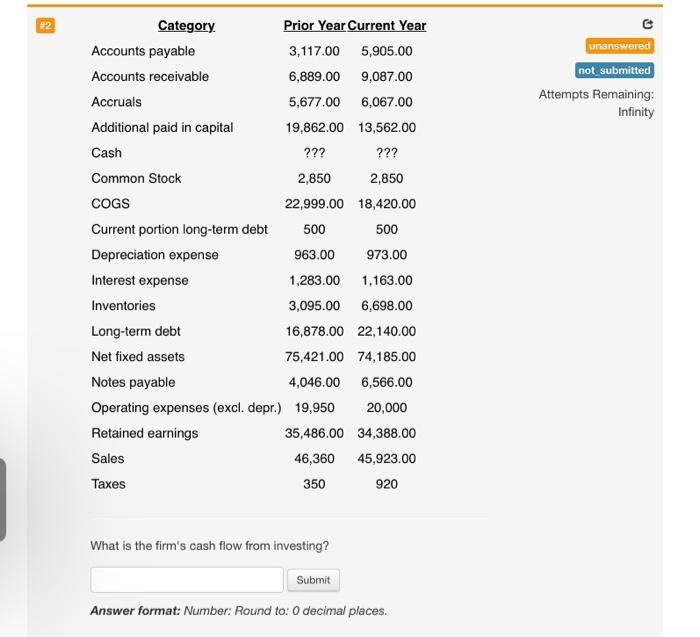

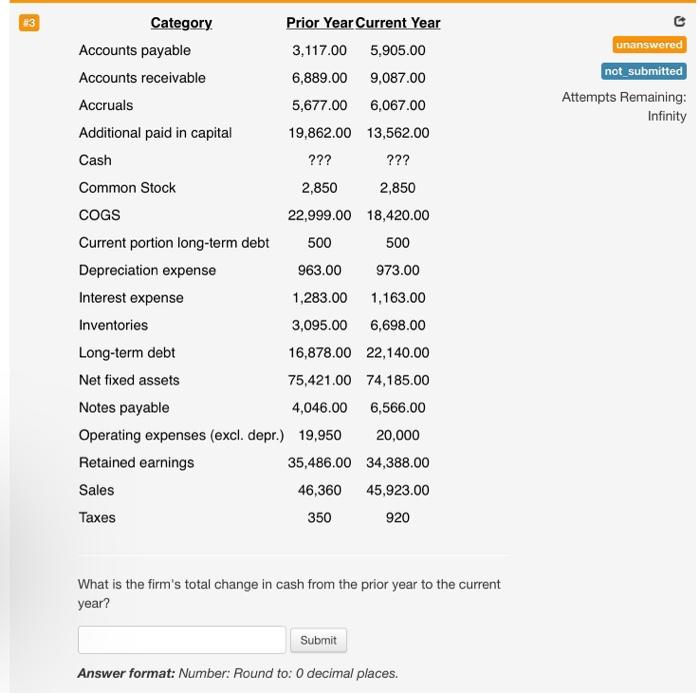

Attempts Remaining: Infinity What is the firm's cash flow from financing? What is the firm's cash flow from investing? Answer format: Number: Round to: 0

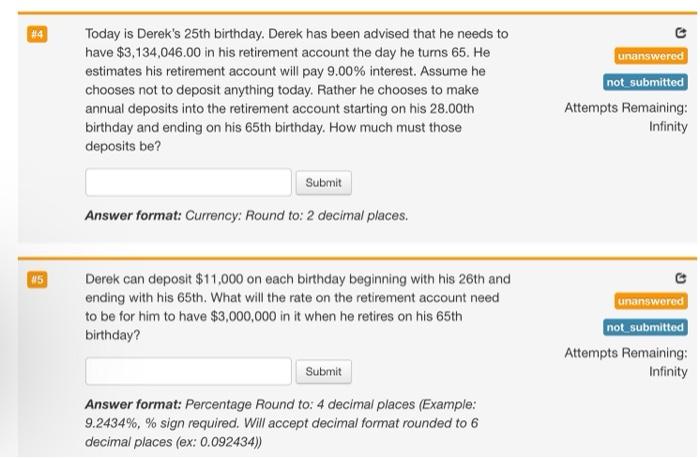

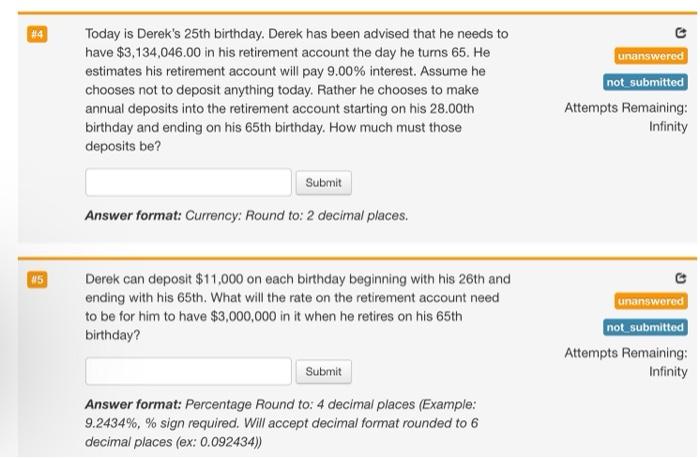

Attempts Remaining: Infinity What is the firm's cash flow from financing? What is the firm's cash flow from investing? Answer format: Number: Round to: 0 decimal places. What is the firm's total change in cash from the prior year to the current year? Answer format: Number: Round to: O decimal places. Today is Derek's 25 th birthday. Derek has been advised that he needs to have $3,134,046.00 in his retirement account the day he turns 65.He estimates his retirement account will pay 9.00% interest. Assume he chooses not to deposit anything today. Rather he chooses to make annual deposits into the retirement account starting on his 28.00 th Attempts Remaining: birthday and ending on his 65 th birthday. How much must those Infinity deposits be? Answer format: Currency: Round to: 2 decimal places. Derek can deposit $11,000 on each birthday beginning with his 26 th and ending with his 65 th. What will the rate on the retirement account need to be for him to have $3,000,000 in it when he retires on his 65 th birthday? Attempts Remaining: Infinity Answer format: Percentage Round to: 4 decimal places (Example: 9.2434%,% sign required. Will accept decimal format rounded to 6 decimal places (ex: 0.092434))

Attempts Remaining: Infinity What is the firm's cash flow from financing? What is the firm's cash flow from investing? Answer format: Number: Round to: 0 decimal places. What is the firm's total change in cash from the prior year to the current year? Answer format: Number: Round to: O decimal places. Today is Derek's 25 th birthday. Derek has been advised that he needs to have $3,134,046.00 in his retirement account the day he turns 65.He estimates his retirement account will pay 9.00% interest. Assume he chooses not to deposit anything today. Rather he chooses to make annual deposits into the retirement account starting on his 28.00 th Attempts Remaining: birthday and ending on his 65 th birthday. How much must those Infinity deposits be? Answer format: Currency: Round to: 2 decimal places. Derek can deposit $11,000 on each birthday beginning with his 26 th and ending with his 65 th. What will the rate on the retirement account need to be for him to have $3,000,000 in it when he retires on his 65 th birthday? Attempts Remaining: Infinity Answer format: Percentage Round to: 4 decimal places (Example: 9.2434%,% sign required. Will accept decimal format rounded to 6 decimal places (ex: 0.092434))

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started