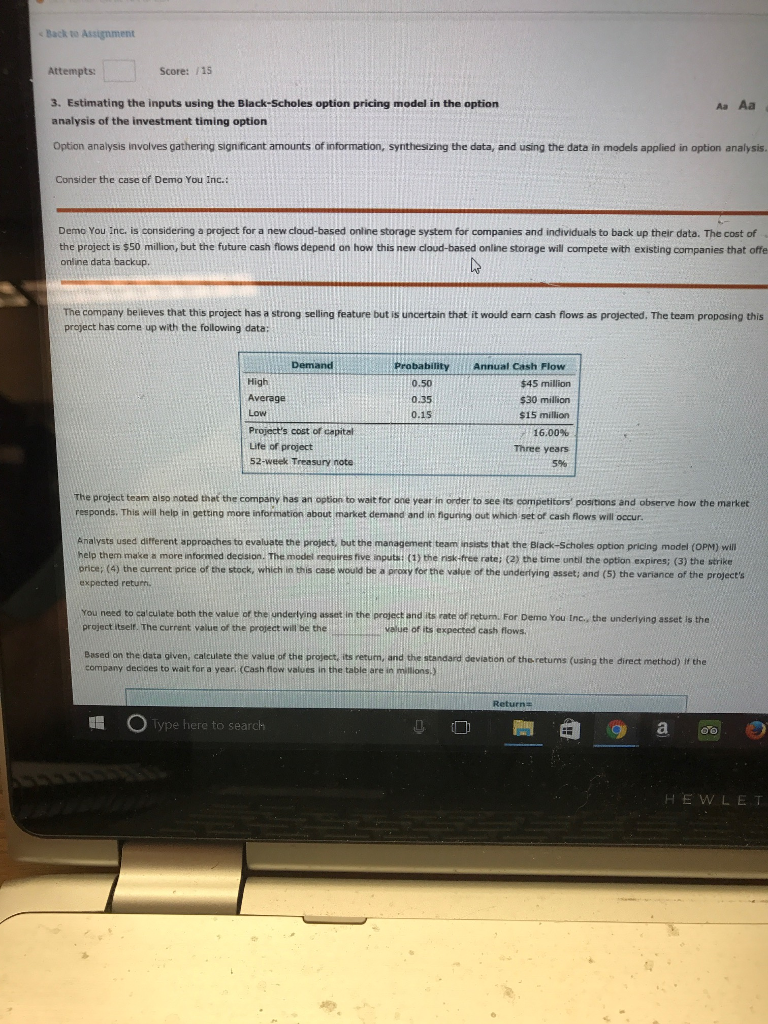

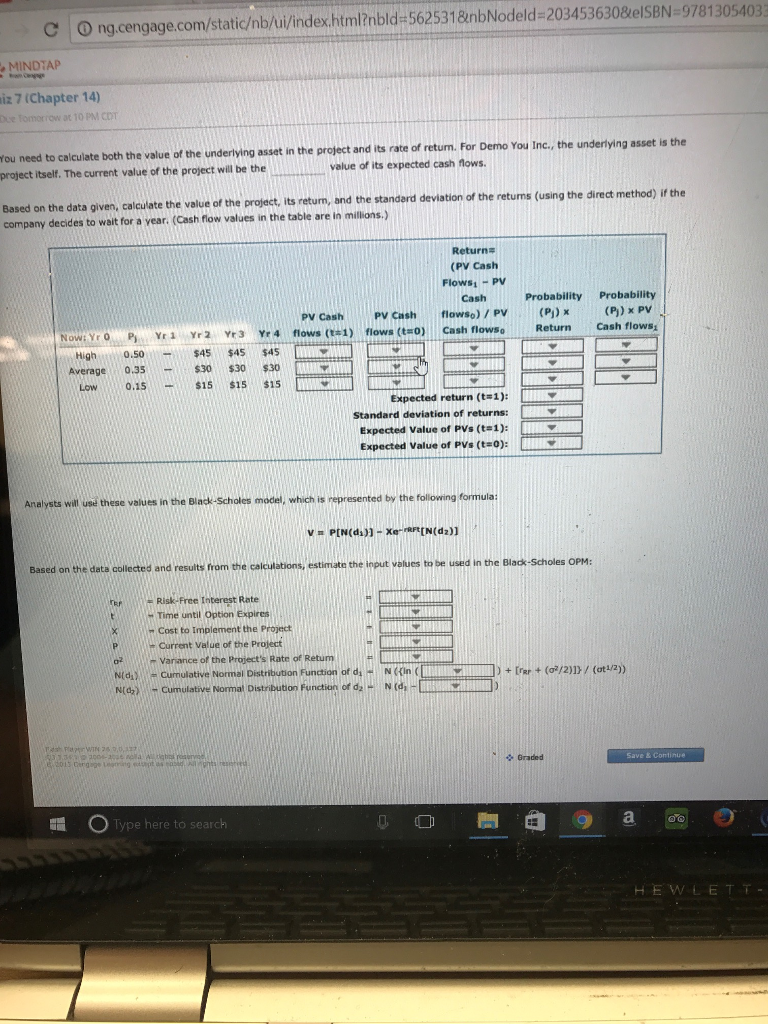

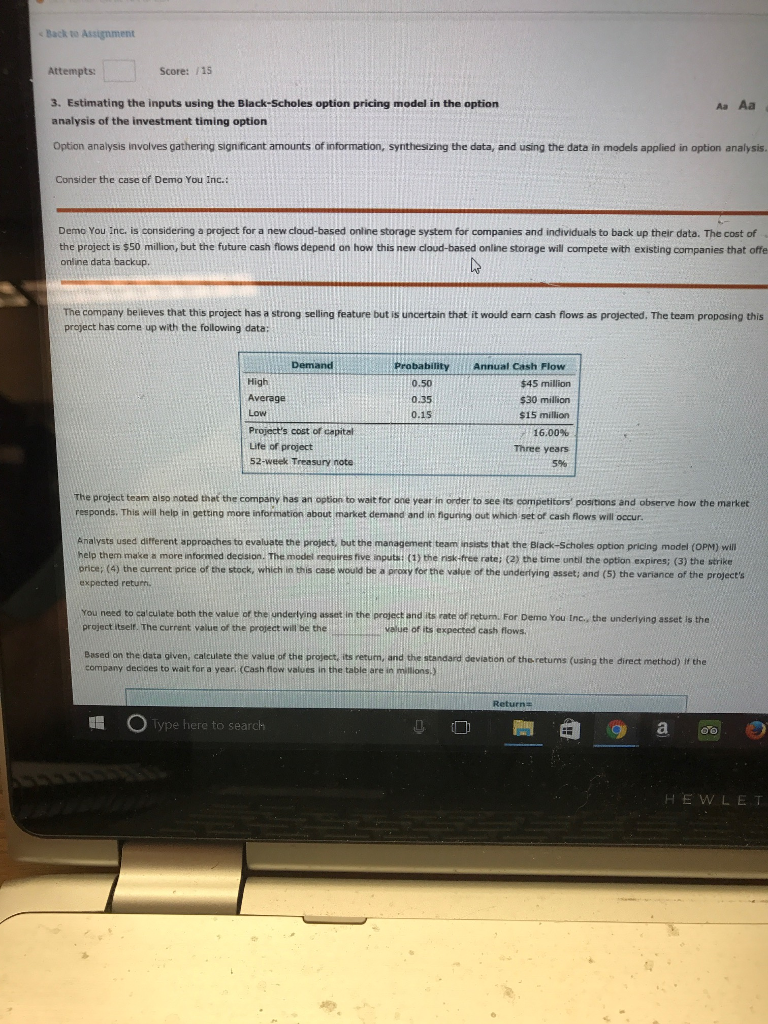

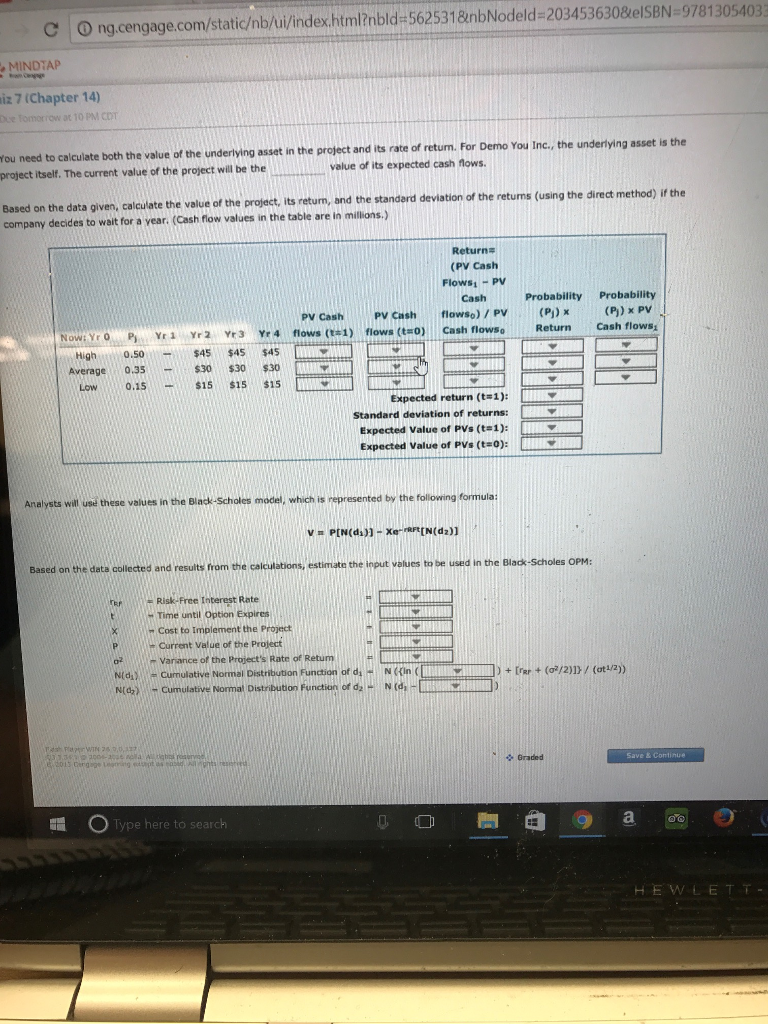

Attempts Score: 1s 3. Estimating the inputs using the Black-Scholes option pricing model in the option analysis of the investment timing option option analysis involves gathering significant amounts of information, synthesizing the data, and using the data in models applied in option analysis Consider the case of Demo You Inc. Demo You Incis considering a project for a new cloud-based online storage system for companies and individuals to back up their data. The cost of the project is $50 million, but the future cash flows depend on how this new cloud-based online storage will compete with existing companies that often online data backup. The company believes that this project has a strong selling feature but is uncertain that it would earn cash flows as projected. The team proposing this project has come up with the following data: Demand High Annual Cash Flow $45 million Averge probability I 0.50 0.35 0.15 $30 million Low Project's cost of capital Ute of project 52-week Treasury note $15 million 16.00% Three years The project team also noted that the company has an option to wait for one year in order to see its competitors' positions and observe how the market responds. This win help in getting more information about market demand and in nouring out which set of cash lows will occur Analysts used darterent approaches to evaluate the project, but the management team states that the Black-Scholes option pricing model (opm) win help them make a more informed decision. The model resources move inputs (a) the roak tree rate , as the time until the option expires : (a) the series once, (4) the current price of the stock, which in his case would be aprony for the value of the underlying assets , and (s) the variance of the projects expected return. You need to calculate both the value of the underlying asset in the protect and its rate of return for Demo You Inc., the underlying asset in the project itselt. The current value of the project will be the value of its expected cash flows. Based on the data oven, calculate the value of the protect its return, and the standard deviation of the returns (using the direct method) in the company decides to wait for a year, Cash home values in the table are in mentions Returns