Question

ATTEND THE QUESTION ONLY IF YOU CAN SOLVE BOTH THE QUESTIONS. AWARE OF CHEGG POLICIES SO DO NOT SAY ONLY ONE CAN BE DONE. ANSWER

ATTEND THE QUESTION ONLY IF YOU CAN SOLVE BOTH THE QUESTIONS. AWARE OF CHEGG POLICIES SO DO NOT SAY ONLY ONE CAN BE DONE.

ANSWER BOTH OR MAKE WAY TO OTHERS TO ANSWER.

WILL REPORT THE ANSWER IF ONE IS ANSWERED.

Initial Public Offering. A Brazilian company called Netshoes completed its IPO on April 12,2017 , and listed on the NYSE. Later, Netshoes sold 8,250,000 shares of stock to primary market investors at an IPO offer price of $18.76 , with an underwriting discount of 6.4 %. Secondary market investors, however, were paying only $15.86 per share for Netshoes' 31,025,936 shares of stock outstanding.

a. Calculate the total proceeds for Netshoes' IPO.

b. Calculate the dollar amount of the underwriting fee for Netshhoes' IPO.

c. Calculate the net proceeds for Netshoes' IPO.

d. Calculate market capitalization for Netshoes' outstanding stock.

e. Calculate IPO underpricing for Netshoes' IPO.

f. Explain the IPO underpricing for Netshoes.

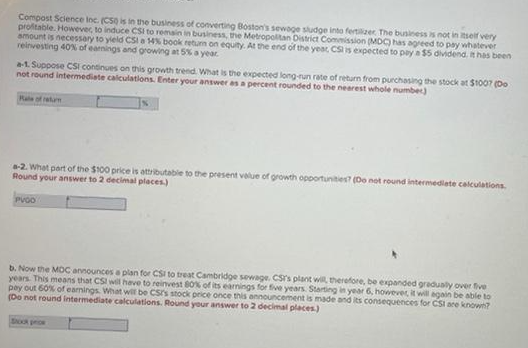

Compost Science inc, (CSQ is in the business of converting Bostonis sewoge slodge inta fertilaec the bunibess is not in laseli very? smount is necessary to yield cSi a 436 book tetum on equaty. At the end of the yeac CSi is expected to pby a 55 didetend, it has been reinvesting 40N of eaenings and orowhn at 5% a year a.1. Suppose CSi consinaes on this growth trend. What is the expected long -run rote of retham from purchowhg the stock at $ toor (Do not round intermediste calculations. Enter your antwer os a percent rounded to the nearest whole numbec) A-2. What port of the 3100 price is attibutable to the present velue of growth opoortunter? (Do net round intermediete calculations. Mound your answer to 2 eecimal places.) b. Now the MOC amounces a plan for CSir to trast Canbridge sewage, CSr's plant wint therelore, be expanded gredualy ower five Years. This means that CSI wil have to reinvest gok of its earings for five years. Sisting in year 6 , howeres, it will ggain be able to poy out 602 of earnings. What wir bo CSirs ttock price once this announcement is made and its consequences for CSt ace know? (bo not round intermediate calculations. Pound your answer to 2 decimal placez)

Compost Science inc, (CSQ is in the business of converting Bostonis sewoge slodge inta fertilaec the bunibess is not in laseli very? smount is necessary to yield cSi a 436 book tetum on equaty. At the end of the yeac CSi is expected to pby a 55 didetend, it has been reinvesting 40N of eaenings and orowhn at 5% a year a.1. Suppose CSi consinaes on this growth trend. What is the expected long -run rote of retham from purchowhg the stock at $ toor (Do not round intermediste calculations. Enter your antwer os a percent rounded to the nearest whole numbec) A-2. What port of the 3100 price is attibutable to the present velue of growth opoortunter? (Do net round intermediete calculations. Mound your answer to 2 eecimal places.) b. Now the MOC amounces a plan for CSir to trast Canbridge sewage, CSr's plant wint therelore, be expanded gredualy ower five Years. This means that CSI wil have to reinvest gok of its earings for five years. Sisting in year 6 , howeres, it will ggain be able to poy out 602 of earnings. What wir bo CSirs ttock price once this announcement is made and its consequences for CSt ace know? (bo not round intermediate calculations. Pound your answer to 2 decimal placez) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started