Answered step by step

Verified Expert Solution

Question

1 Approved Answer

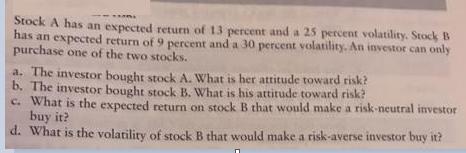

Stock A has an expected return of 13 percent and a 25 percent volatility. Stock B has an expected return of 9 percent and

Stock A has an expected return of 13 percent and a 25 percent volatility. Stock B has an expected return of 9 percent and a 30 percent volatility. An investor can only purchase one of the two stocks. a. The investor bought stock A. What is her attitude toward risk? b. The investor bought stock B. What is his attitude toward risk? c. What is the expected return on stock B that would make a risk-neutral investor buy it? d. What is the volatility of stock B that would make a risk-averse investor buy it?

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Required solution of all parts is given below formula of Utility theory U Er A 2 Where U is the ut...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635dd2567b01d_179152.pdf

180 KBs PDF File

635dd2567b01d_179152.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started