Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Atty. Timothy began business on January 1, 2018. The following data were available on December 31, 2018. The thousands were omitted in the unadjusted

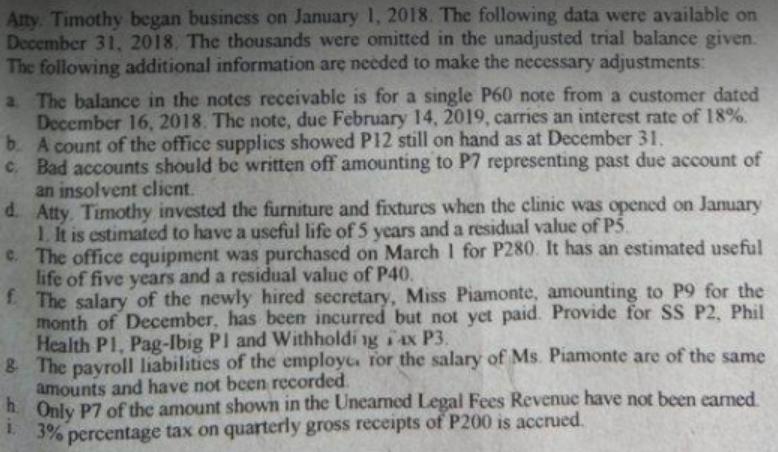

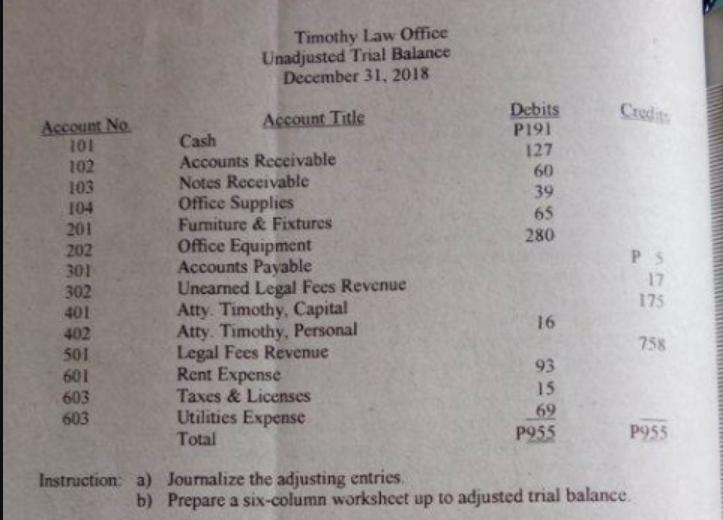

Atty. Timothy began business on January 1, 2018. The following data were available on December 31, 2018. The thousands were omitted in the unadjusted trial balance given. The following additional information are needed to make the necessary adjustments: a The balance in the notes receivable is for a single P60 note from a customer dated December 16, 2018. The note, due February 14, 2019, carries an interest rate of 18%. b. A count of the office supplies showed P12 still on hand as at December 31, c. Bad accounts should be written off amounting to P7 representing past due account of an insolvent client. d. Atty. Timothy invested the furniture and fixtures when the clinic was opened on January 1. It is estimated to have a useful life of 5 years and a residual value of P5. e. The office equipment was purchased on March 1 for P280. It has an estimated useful life of five years and a residual value of P40. f. The salary of the newly hired secretary, Miss Piamonte, amounting to P9 for the month of December, has been incurred but not yet paid. Provide for SS P2, Phil Health P1, Pag-Ibig Pl and Withholding ax P3. & The payroll liabilities of the employe, for the salary of Ms. Piamonte are of the same amounts and have not been recorded. h Only P7 of the amount shown in the Uneared Legal Fees Revenue have not been earned. 3% percentage tax on quarterly gross receipts of P200 is accrued. Account No 101 102 103 104 201 202 301 302 401 402 501 601 603 603 Timothy Law Office Unadjusted Trial Balance December 31, 2018 Account Title Cash Accounts Receivable Notes Receivable Office Supplies Furniture & Fixtures Office Equipment Accounts Payable Unearned Legal Fees Revenue Atty. Timothy, Capital Atty. Timothy, Personal Legal Fees Revenue Rent Expense Taxes & Licenses Utilities Expense Total Instruction: a) Journalize the adjusting entries. Debits P191 127 60 39 65 280 16 93 15 69 P955 PS 17 175 758 P955 b) Prepare a six-column worksheet up to adjusted trial balance.

Step by Step Solution

★★★★★

3.47 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

a Journalizing the Adjusting Entries 1 Notes Receivable Adjustment Debit Notes Receivable P60 Credit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started