Question

ATZ Inc., a company that provides wireless telecommunications network in the town for many years. As the marketing advisor of the company, you have recently

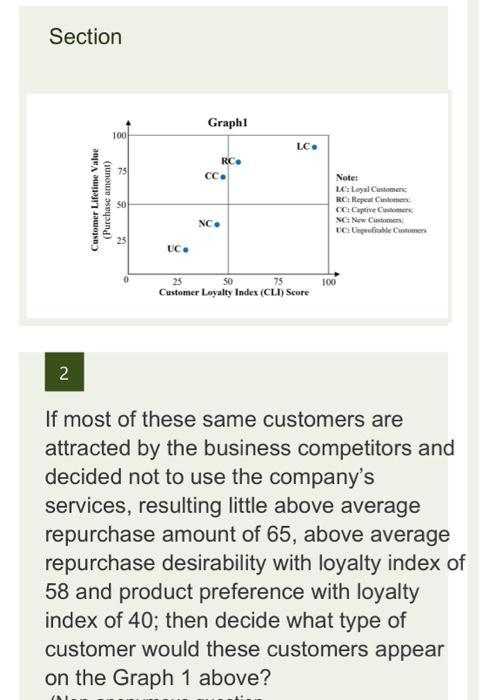

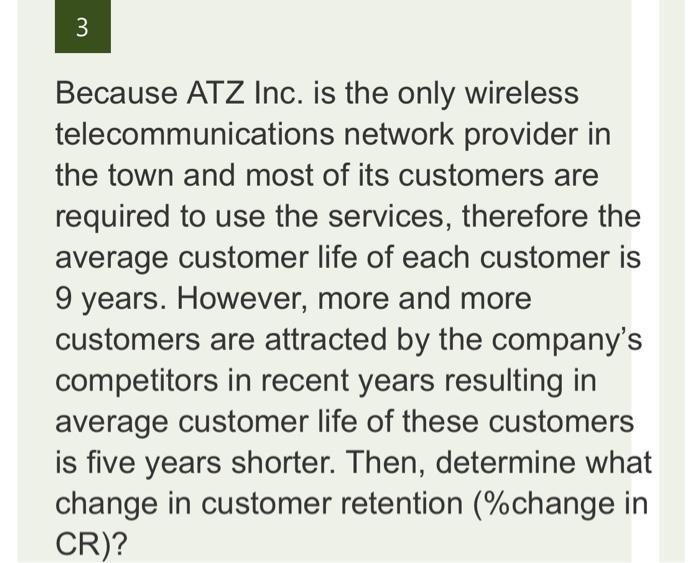

ATZ Inc., a company that provides wireless telecommunications network in the town for many years. As the marketing advisor of the company, you have recently conducted a survey to assess performance of the company’s 5,000 retained customers. As a result, you found that 40% of these customers has a long customer history with loyalty index of 85, high purchase amount with loyalty index of 78, repurchase desirability with above average loyalty index of 55, product preference with below average loyalty index of 45, and most of these customers did not want to recommend ATZ services to other potential customers. These customers are clearly somewhat dissatisfied, but since ATZ Inc. is the only wireless telecommunications network provider in the country they are compelled to use it.

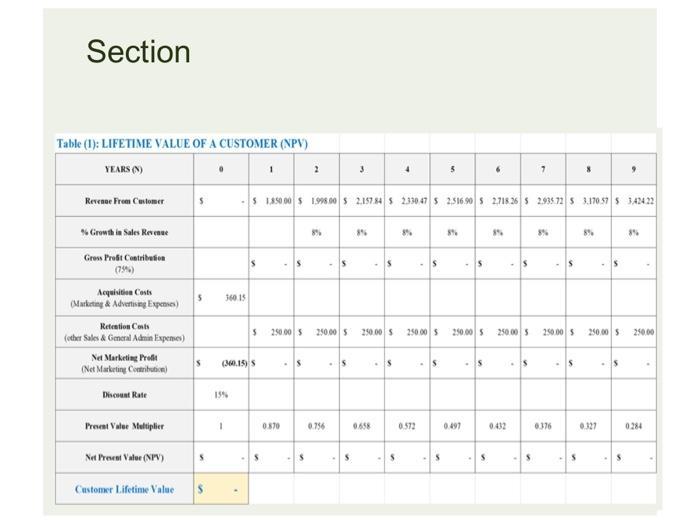

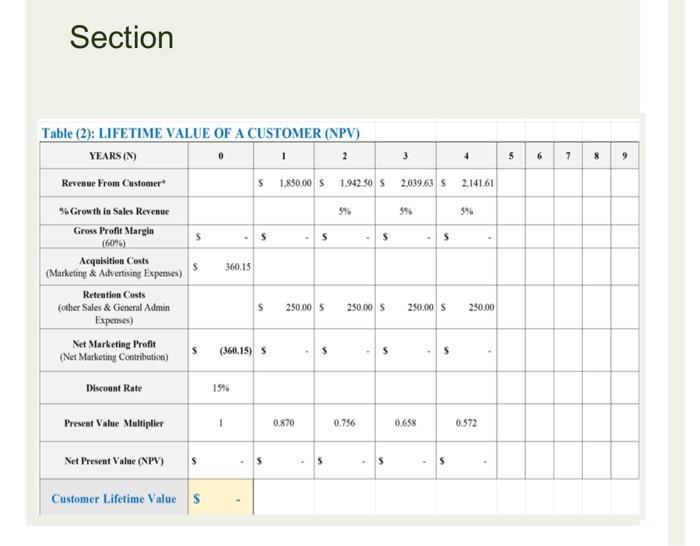

Section Table (1): LIFETIME VALUE OF A CUSTOMER (NPV) YEARS (N) Revenue From Customer % Growth in Sales Revenue Gross Profit Contribution (79%) Acquisition Costs (Marketing & Advertising Expenses) Retention Cents (other Sales & General Admin Expenses) Net Marketing Profit (Net Marketing Contribution) Discount Rate Present Value Multiplier Net Present Value (NPV) Customer Lifetime Value S 360.15 15% 1 (360.15) S -$ 1,850.00 $ 1998.00 $ 2.157.84 S 2330 47 S 2.516.90 $ 2718.26 $ 2.935.72 S 3.170.57 $ 342422 S 1 S S 0.870 2 -S 250.00 $ 250.00 5 -$ 8% S 0.756 5 S 8% -S 250.00 $ 0.658 S S 8% -S 250.00 $ 0.572 -S -S 8% -5 250.00 $ 0.497 S -S 8% -S 250.00 5 0.432 S -S 8% -$ 250.00 $ 0.376 -S -S 8% -S 250.00 $ 0.327 -5 -S 8% 250.00 .

Step by Step Solution

3.55 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Question Q2 In Graph 1 the customers with the high CLI of 85 long customer history ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started