Answered step by step

Verified Expert Solution

Question

1 Approved Answer

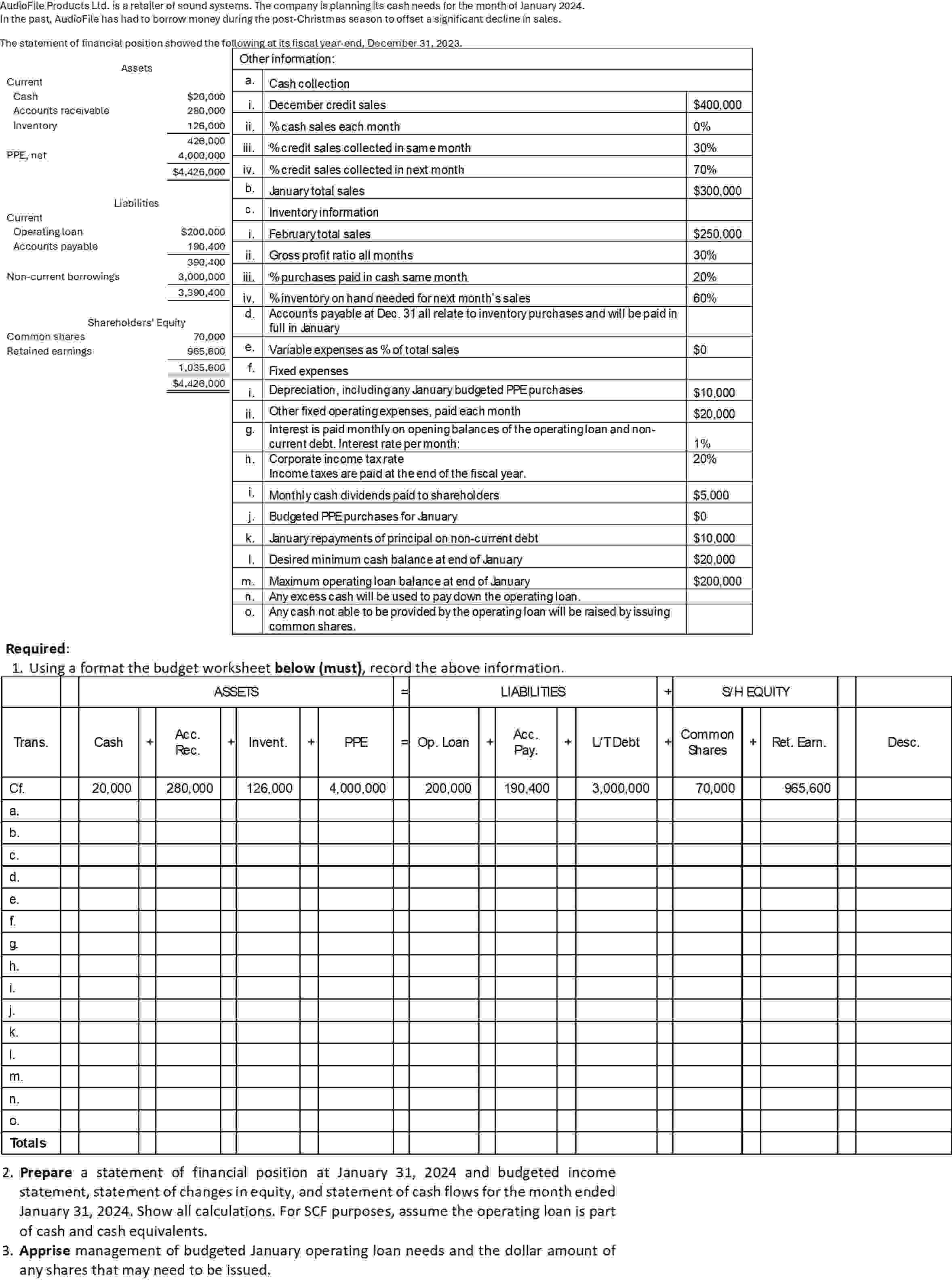

AudioFile Products Ltd. is a retailer of sound systems. The company is planning its cash needs for the month of January 2024. In the

AudioFile Products Ltd. is a retailer of sound systems. The company is planning its cash needs for the month of January 2024. In the past, AudioFile has had to borrow money during the post-Christmas season to offset a significant decline in sales. The statement of financial position showed the following at its fiscal year-end, December 31, 2023. Other information: Assets Current Cash Accounts receivable Inventory PPE, net a. Cash collection $20,000 280.000 126,000 426,000 i. December credit sales ii. % cash sales each month iii. %credit sales collected in same month $400,000 0% 30% 4,000,000 $4,426,000 iv. %credit sales collected in next month 70% Liabilities Current b. C. Inventory information January total sales $300,000 Operating loan $200,000 i. February total sales $250,000 Accounts payable 190,400 390,400 ii. Gross profit ratio all months 30% Non-current borrowings 3,000,000 iii. % purchases paid in cash same month 20% 3,390,400 iv. %inventory on hand needed for next month's sales 60% d. Shareholders' Equity Accounts payable at Dec. 31 all relate to inventory purchases and will be paid in full in January Common shares Retained earnings 70,000 965,600 e. Variable expenses as % of total sales $0 1.035.600 f. Fixed expenses $4,426,000 i. Depreciation, including any January budgeted PPE purchases $10,000 ii. Other fixed operating expenses, paid each month $20,000 g. Interest is paid monthly on opening balances of the operating loan and non- current debt. Interest rate per month: 1% h. Corporate income tax rate Income taxes are paid at the end of the fiscal year. i. Monthly cash dividends paid to shareholders j. Budgeted PPE purchases for January k. January repayments of principal on non-current debt 1. Desired minimum cash balance at end of January 20% $5,000 $0 $10,000 $20,000 m Maximum operating loan balance at end of January . Any excess cash will be used to pay down the operating loan. $200,000 Required: o. Any cash not able to be provided by the operating loan will be raised by issuing common shares. 1. Using a format the budget worksheet below (must), record the above information. ASSETS LIABILITIES S/H EQUITY Trans. Cash Acc. Rec. Invent. + PPE Op. Loan + Acc. Pay. + L/T Debt + Common Shares + Ret. Earn Desc. Cf. 20,000 280,000 126,000 4,000,000 200,000 190,400 3,000,000 70,000 965,600 a. b. C. d. e. f. g. h. i. j. k. 1. m. n. 0. Totals 2. Prepare a statement of financial position at January 31, 2024 and budgeted income statement, statement of changes in equity, and statement of cash flows for the month ended January 31, 2024. Show all calculations. For SCF purposes, assume the operating loan is part of cash and cash equivalents. 3. Apprise management of budgeted January operating loan needs and the dollar amount of any shares that may need to be issued.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started