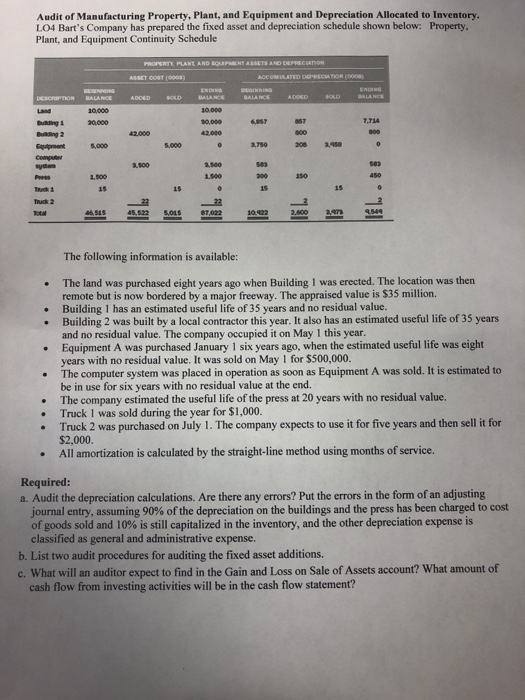

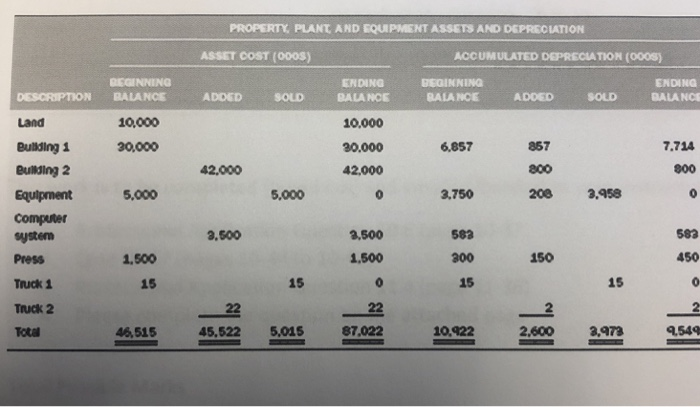

Audit of Manufacturing Property, Plant, and Equipment and Depreciation Allocated to Inventory. LO4 Bart's Company has prepared the fixed asset and depreciation schedule shown below: Property Plant, and Equipment Continuity Schedule uding&0.000 Builing 2 10.000 0,000 42000 800 0 .750 208 .98 3,500 150 1,500 15 15 TucK 2 45,522 sos 2,600 39 The following information is available: The land was purchased eight years ago when Building 1 was erected. The location was then remote but is now bordered by a major freeway. The appraised value is $35 million. Building 1 has an estimated useful life of 35 years and no residual value. Building 2 was built by a local contractor this year. It also has an estimated useful life of 35 years and no residual value. The company occupied it on May this year. Equipment A was purchased January 1 six years ago, when the estimated useful life was eight years with no residual value. It was sold on May 1 for $500,000. The computer system was placed in operation as soon as Equipment A was sold. It is estimated to be in use for six years with no residual value at the end. The company estimated the useful life of the press at 20 years with no residual value. Truck 1 was sold during the year for $1,000. Truck 2 was purchased on July 1. The company expects to use it for five years and then sell it for $2,000. All amortization is calculated by the straight-line method using months of service. Required: a. Audit the depreciation calculations. Are there any errors? Put the errors in the form of an adjusting journal entry, assuming 90% of the depreciation on the buildings and the press has been charged to cost of goods sold and 10% is still capitalized in the inventory, and the other depreciation expense is classified as general and administrative expense. b. List two audit procedures for auditing the fixed asset additions. c. What will an auditor expect to find in the Gain and Loss on Sale of Assets account? What amount of cash flow from investing activities will be in the cash flow statement? PROPERITY PLANT AND EQUIPMENT ASSETS AND DEPRECIATION ASSET COST (000S) ACCUMULATED DEPRECIATION (000s) DEGINNING DEGINNING BALA NOE ENDING ENDING BALANC DESCRIPTION BALANCE ADDED SOLD DALA NCE 10,000 30.000 42.000 ADDED SOLD 10,000 Bulding 1 30,000 Bulding 2 7.714 857 e00 208 6,857 42,000 800 5,000 5,000 3,750 3.958 3,500 systenn Press Truck 1 Truck 2 Tota 583 200 15 583 450 3,500 1,500 1,500 150 15 15 15 46,515 45,522 5,015 87,022 10.922 2,600 3.973 9,549