Question

Audit Question For this exercise, your client, Bright IDEAs Inc., has provided you with a listing of sales invoices. To test whether the client appears

Audit Question

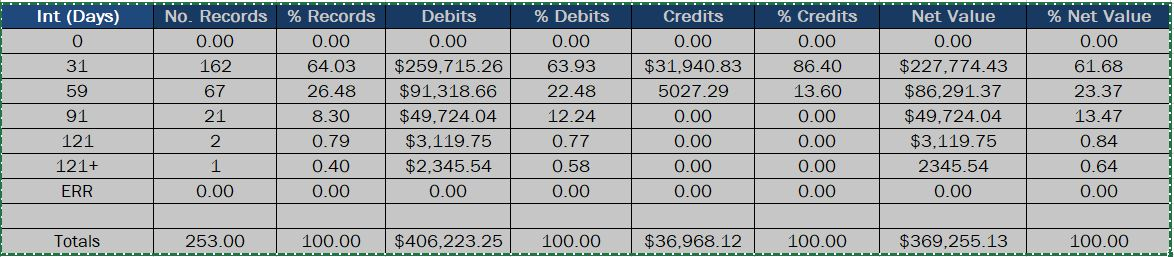

For this exercise, your client, Bright IDEAs Inc., has provided you with a listing of sales invoices. To test whether the client appears to have a receivables collectability problem, you must complete a series of related steps.

Information file from Bright IDEAs Inc.

1. What percentage of customers have accounts that are aged greater than 90 days?

2. What percentage of customer balances (net value) are aged greater than 90 days?

3. Determine the effect that your findings in part (1) and (2) would have on the auditor's assessment of the risk of material misstatement. (choose one a-d)

a. As a result of these findings, the risk of material misstatement should be assessed lower

b. As a result of these findings, the risk of material misstatement should remain the same.

c. As a result of these findings, the risk of material misstatement should be assessed higher.

d. As a result of these findings, either the risk of misstatement should be assessed lower or the risk of misstatement should be assessed the same.

4. Determine which of the given accounts and assertions are most likely influenced by your findings. (choose one a-d)

a. The risk of material misstatement related to the completeness of accounts receivable is likely to be higher

b. The risk of material misstatement related to the valuation of accounts receivables is likely to be higher

c. The risk of material misstatement related to the completeness of accounts receivables is likely to be lower

d. The risk of material misstatement related to the valuation of accounts receivables is likely to be lower

Int (Days) Net Value 0.00 31 162 59 91 121 121+ ERR No. Records % Records 0.00 0.00 64.03 67 26.48 21 8.30 2 0.79 0.40 0.00 0.00 Debits 0.00 $259,715.26 $91,318.66 $49.724.04 $3,119.751 $2,345.54 0.00 % Debits 0.00 63.93 22.48 12.24 0.77 0.58 0.00 Credits 0.00 $31.940.83 5027.29 0.00 0.00 0.00 0.00 % Credits 0.00 86.40 13.60 0.00 0.00 0.00 0.00 $227,774.43 $86,291.37 $49,724.04 $3,119.75 2345.54 0.00 % Net Value 0.00 61.68 23.37 13.47 0.84 0.64 0.00 Totals 253.00 2 100.00 $406,223.25 100.00 $36,968.12 100.00 $369,255.13 100.00 Int (Days) Net Value 0.00 31 162 59 91 121 121+ ERR No. Records % Records 0.00 0.00 64.03 67 26.48 21 8.30 2 0.79 0.40 0.00 0.00 Debits 0.00 $259,715.26 $91,318.66 $49.724.04 $3,119.751 $2,345.54 0.00 % Debits 0.00 63.93 22.48 12.24 0.77 0.58 0.00 Credits 0.00 $31.940.83 5027.29 0.00 0.00 0.00 0.00 % Credits 0.00 86.40 13.60 0.00 0.00 0.00 0.00 $227,774.43 $86,291.37 $49,724.04 $3,119.75 2345.54 0.00 % Net Value 0.00 61.68 23.37 13.47 0.84 0.64 0.00 Totals 253.00 2 100.00 $406,223.25 100.00 $36,968.12 100.00 $369,255.13 100.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started