Question

AUDITING AND ASSURANCE SERVICES - QUESTION 11 - PLEASE AND THANK YOU! (QUESTION ANSWERS MUST BE 100-200 WORDS LONG) QUESTION 6. Using the information flowcharts

AUDITING AND ASSURANCE SERVICES - QUESTION 11 - PLEASE AND THANK YOU! (QUESTION ANSWERS MUST BE 100-200 WORDS LONG)

QUESTION 6. Using the information flowcharts I provided in the chapter slides and referring to my discussions on the "direction of testing" in my lectures, discuss how you would audit overstatement in sales and understatement in purchases, and why? (100-200 WORDS)

BELOW IS THE FLOWCHARTS AND PROVIDED CHAPTER SLIDES AND NOTES IN REFERNECE TO THE DISCUSSIONS ON THE "DIRECTION OF TESTING"

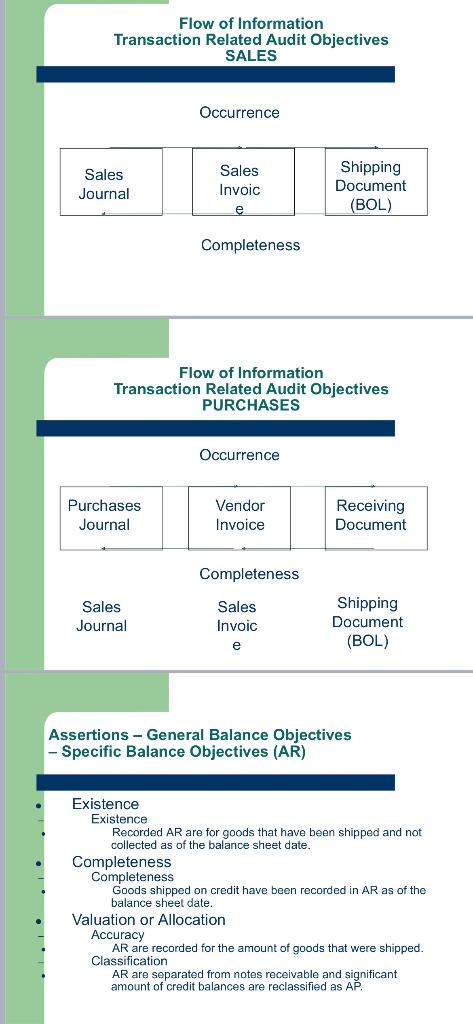

INFORMATION FLOWCHARTS:

slide 12, 13, & 14:

slide 15, 16 & 17:

LECTURE NOTES ON INFORMATION FLOWCHART SLIDES:

Slides 12 and 13.

Information flowchart, which you became familiar with since your system class, is a good way of explaining how to test for occurrence/existence and completeness. The learning point here is "direction of audit testing."

Auditors' job is detecting material misstatements. Misstatements are either overstatements or understatements. Right? Recall that -- as we discussed when talking about information risk -- independent auditors are needed because management has incentive to misreport. Hence, the auditor's primary concern is managers/accountants making up things that never occurred (consequently an overstatement) and omitting things that ought be recorded (consequently an understatement).

It is true that factors addressed by other audit objectives -- accuracy, posting and summarization, classification, and timing -- also can cause an overstatement or an understatement. But auditors are mostly concerned about occurrence and completeness related ones. In other words, when you think of overstatement and understatement as an auditor, you are more concerned about fraud than unintentional human error. It's true that a financial statement audit is not a forensic audit and that a financial statement auditor is focused on detecting all material misstatements, not just one kind. But unlike human errors which can cause misstatements only occasionally and randomly, fraud, because it is intentional and planned, can cause misstatements always in worst places that are most consequential. Coupled with this is that it is very difficult to detect misstatements caused by fraud -- again because it is intentional (committed in a way that makes it hard to detect). Because of these reasons, financial statement auditors are always very concerned about fraud. We will have more discussions on this in Ch. 10.

Information flowcharts, like those on Slides 12, 13, 16, 17 are useful because they show you, when testing for occurrence/existence and completeness, where you need to start, what are things in the middle, and where to end. They provide good "maps" for the audit work.

Let's see Slide 12. To test occurrence in sales, the starting point is recorded sales in sales journal or where the sales were recorded. Sales invoice is source document, evidence of sales that you need to get and examine, but you don't end there, because GAAP says shipping establishes sales.

Now, in testing for completeness, you go the other way around, starting from the shipping documents (BOL stands for "bill of lading") and ending in recorded sales, to make sure all the sales that ought to be recorded were indeed recorded.

Slow down your reading here. Make sure you get it. If you do, then the next slide is easy to follow. Purchases is just the flip side of sales. Same logic. Think about these two slides and my explanations above. Believe it or not, they are one of the most important learning subjects in auditing.

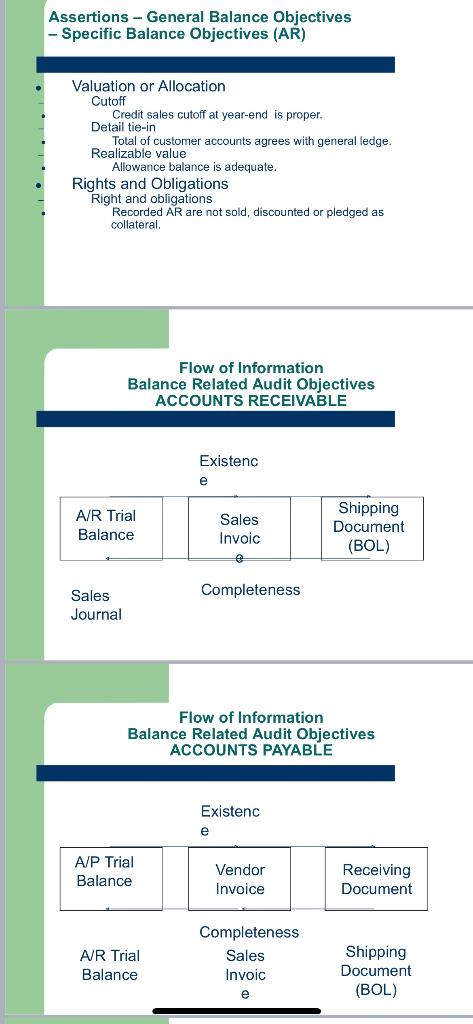

Slides 14-17.

Now balance-related audit objectives. The example area is AR. Sales and purchases are transactions. AR and AP are resulting balances. Certainly sales and purchases are accounts having balances too, but in auditing, "balances" are more related to balance sheet accounts. Balance sheet accounts are not transaction accounts; they are related to transaction accounts. Auditors want to make sure that the whole set of financial statements are coherent, properly related.

Slides 14 and 15 show three levels of the terms in the area of AR,

A specific existence audit objective in AR is "Recorded AR are for goods that have been shipped and not collected as of the balance sheet date." Note that there are two conditions for AR to be outstanding: (1) that credit sales occurred and (2) that payment has not been received (at the end of period).

The rest of these two slides are easy to follow. Make sure you go through them.

On Slides 16 and 17, note that AR/AP are recorded in AR/AP trial balances, part of the accounting book. From there, they then appear in AR/AP subsidiary ledgers (master files). That's the accounting stuff you know.

Flow of Information Transaction Related Audit Objectives SALES Occurrence Sales Journal Sales Invoic Shipping Document (BOL) e Completeness Flow of Information Transaction Related Audit Objectives PURCHASES Occurrence Purchases Journal Vendor Invoice Receiving Document Completeness Sales Sales Invoic Journal Shipping Document (BOL) e Assertions - General Balance Objectives - Specific Balance Objectives (AR) Existence Existence Recorded AR are for goods that have been shipped and not collected as of the balance sheet date. Completeness Completeness Goods shipped on credit have been recorded in AR as of the balance sheet date. Valuation or Allocation Accuracy AR are recorded for the amount of goods that were shipped. Classification AR are separated from notes receivable and significant amount of credit balances are reclassified as AP. Assertions - General Balance Objectives - Specific Balance Objectives (AR) Valuation or Allocation Cutoff Credit sales cutoff at year-end is proper. Detail tie-in Total of customer accounts agrees with general ledge. Realizable value Allowance balance adequate. Rights and Obligations Right and obligations Recorded AR are not sold, discounted or pledged as collateral. Flow of Information Balance Related Audit Objectives ACCOUNTS RECEIVABLE Existenc e A/R Trial Balance Sales Invoic Shipping Document (BOL) e Completeness Sales Journal Flow of Information Balance Related Audit Objectives ACCOUNTS PAYABLE Existenc e A/P Trial Balance Vendor Invoice Receiving Document A/R Trial Balance Completeness Sales Invoic Shipping Document (BOL) e Flow of Information Transaction Related Audit Objectives SALES Occurrence Sales Journal Sales Invoic Shipping Document (BOL) e Completeness Flow of Information Transaction Related Audit Objectives PURCHASES Occurrence Purchases Journal Vendor Invoice Receiving Document Completeness Sales Sales Invoic Journal Shipping Document (BOL) e Assertions - General Balance Objectives - Specific Balance Objectives (AR) Existence Existence Recorded AR are for goods that have been shipped and not collected as of the balance sheet date. Completeness Completeness Goods shipped on credit have been recorded in AR as of the balance sheet date. Valuation or Allocation Accuracy AR are recorded for the amount of goods that were shipped. Classification AR are separated from notes receivable and significant amount of credit balances are reclassified as AP. Assertions - General Balance Objectives - Specific Balance Objectives (AR) Valuation or Allocation Cutoff Credit sales cutoff at year-end is proper. Detail tie-in Total of customer accounts agrees with general ledge. Realizable value Allowance balance adequate. Rights and Obligations Right and obligations Recorded AR are not sold, discounted or pledged as collateral. Flow of Information Balance Related Audit Objectives ACCOUNTS RECEIVABLE Existenc e A/R Trial Balance Sales Invoic Shipping Document (BOL) e Completeness Sales Journal Flow of Information Balance Related Audit Objectives ACCOUNTS PAYABLE Existenc e A/P Trial Balance Vendor Invoice Receiving Document A/R Trial Balance Completeness Sales Invoic Shipping Document (BOL) eStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started