auditing assignment, thanks !

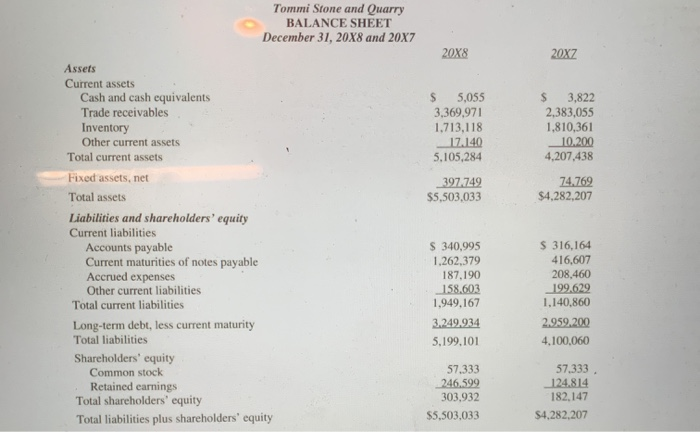

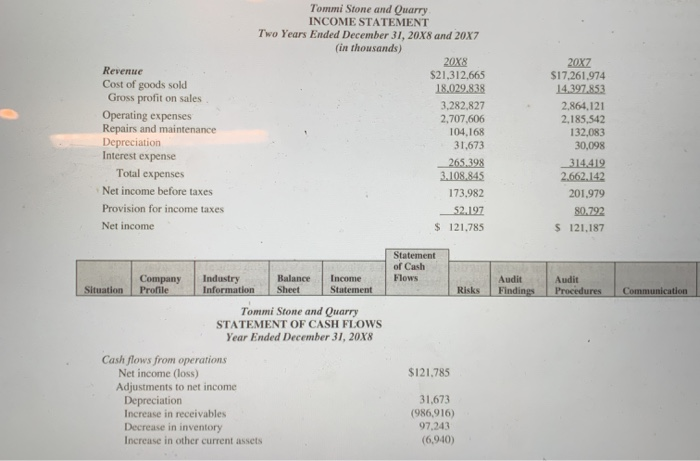

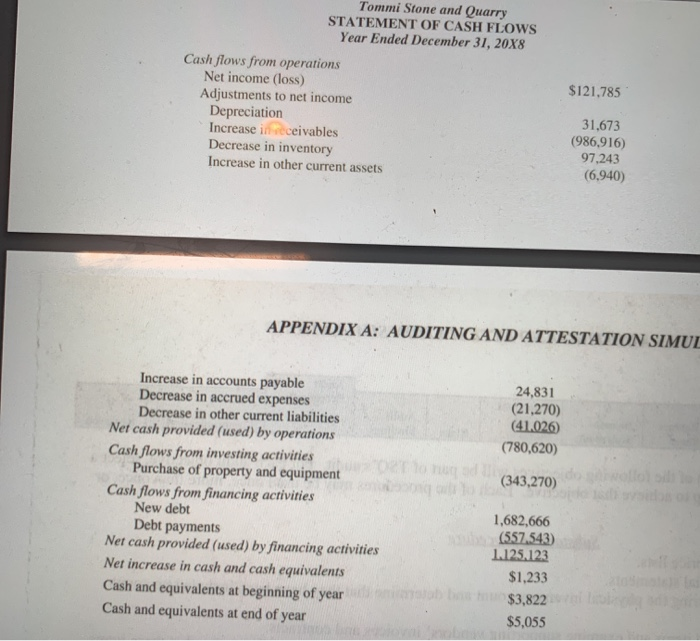

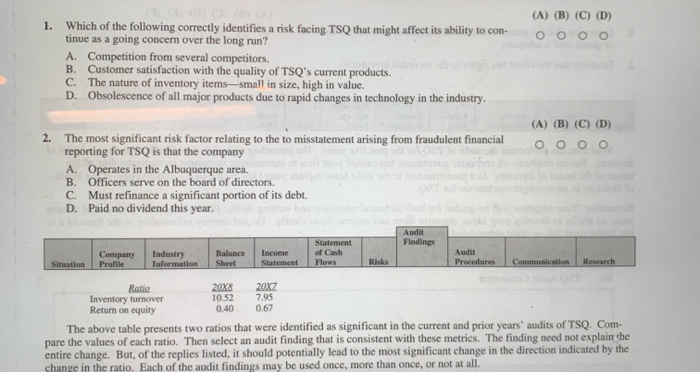

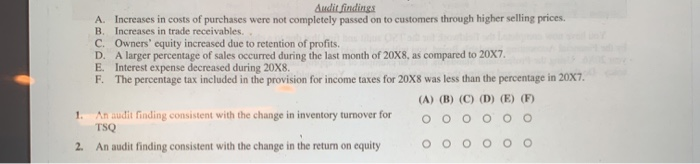

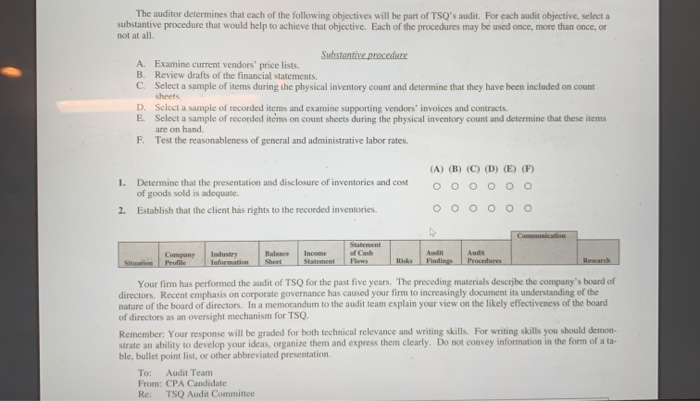

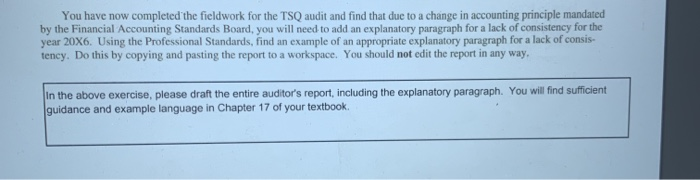

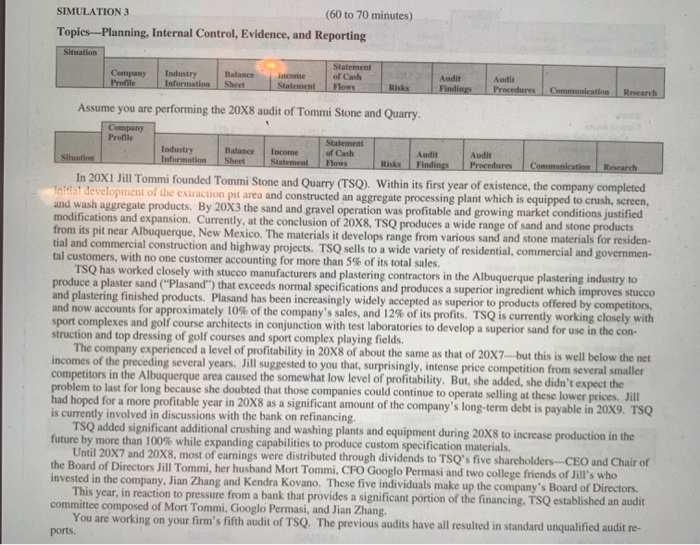

SIMULATION 3 (60 to 70 minutes) Topics-Planning, Internal Control, Evidence, and Reporting Situation Balance Statement of Cash Industry Information Audit income Statement Ricks Procedures Commun Assume you are performing the 20X8 audit of Tommi Stone and Quarry. Company Profile Industry Inalance Income a Cash Audit Information Sheet Statement Flows Findings Procedures Communication Research In 20X1 Jill Tommi founded Tommi Stone and Quarry (TSQ). Within its first year of existence, the company completed In development of the extraction pit area and constructed an aggregate processing plant which is equipped to crush, screen, and wash aggregate products. By 20X3 the sand and gravel operation was profitable and growing market conditions justified modifications and expansion. Currently, at the conclusion of 20X8, TSQ produces a wide range of sand and stone products from its pit near Albuquerque, New Mexico. The materials it develops range from various sand and stone materials for residen tial and commercial construction and highway projects. TSQ sells to a wide variety of residential, commercial and governmen- tal customers, with no one customer accounting for more than 5% of its total sales. TSQ has worked closely with stucco manufacturers and plastering contractors in the Albuquerque plastering industry to produce a plaster sand ("Plasand") that exceeds normal specifications and produces a superior ingredient which improves stucco and plastering finished products. Plasand has been increasingly widely accepted as superior to products offered by competitors, and now accounts for approximately 10% of the company's sales, and 12% of its profits. TSQ is currently working closely with sport complexes and golf course architects in conjunction with test laboratories to develop a superior sand for use in the con struction and top dressing of golf courses and sport complex playing fields. The company experienced a level of profitability in 20X8 of about the same as that of 20X7-but this is well below the net incomes of the preceding several years, Jill suggested to you that, surprisingly, intense price competition from several smaller competitors in the Albuquerque area caused the somewhat low level of profitability. But, she added, she didn't expect the problem to last for long because she doubted that those companies could continue to operate selling at these lower prices. Jill had hoped for a more profitable year in 20X8 as a significant amount of the company's long-term debt is payable in 20X9. TSQ is currently involved in discussions with the bank on refinancing TSQ added significant additional crushing and washing plants and equipment during 20X8 to increase production in the future by more than 100% while expanding capabilities to produce custom specification materials. Until 20X7 and 20X8, most of earnings were distributed through dividends to TSQ's five shareholders-CEO and Chair of the Board of Directors Jill Tommi, her husband Mort Tommi, CFO Googlo Permasi and two college friends of Jill's who invested in the company, Jian Zhang and Kendra Kovano. These five individuals make up the company's Board of Directors This year, in reaction to pressure from a bank that provides a significant portion of the financing, TSQ established an audit committee composed of Mort Tommi, Googlo Permasi, and Jian Zhang. You are working on your firm's fifth audit of TSQ. The previous audits have all resulted in standard unqualified audit re- ports. The industry consists of preparation for the mining and extraction of sand and rock products. These include the activities of cleaning, separating and sorting of quarried sand, and the crushing of rocks. The products are in the form of sand used in making concrete; sand used in laying bricks (contains little soil); sand used for fill (contains lots of soil, and quartz sand); and excluding the products of gravel quarrying (sandstone, gravel stone, and iron sand). While sales within the industry are relatively unaffected by changes in technology, or obsolescence, sales rely heavily upon woth the residential and commercial construction markets as well as government spending. During the past five years construc- tion has performed well and that trend is expected to continue at least for the coming several years. Sand and gravel production has increased at approximately 3% per year during this time period, as has construction within the central Ohio area. The sand and gravel market in central New Mexico has been particularly healthy due in large part to the growth of Albu. querque into a major metropolitan area. The most significant question facing the industry is whether the strong construction will continue as expected. During the past two years the economy of the United States has been in a recovery period, yet unem- ployment remains high as compared to previous periods of recovery. Thus, the questions concerning the continuing construc- tion demand. Tommi Stone and Quarry BALANCE SHEET December 31, 20X8 and 20X7 20X8 20XZ $ 5,055 3,369,971 1,713,118 17.140 5.105,284 $ 3,822 2,383,055 1,810,361 10.200 4,207,438 74.769 $4,282,207 397.749 $5,503,033 Assets Current assets Cash and cash equivalents Trade receivables Inventory Other current assets Total current assets Fixed assets, net Total assets Liabilities and shareholders' equity Current liabilities Accounts payable Current maturities of notes payable Accrued expenses Other current liabilities Total current liabilities Long-term debt, less current maturity Total liabilities Shareholders' equity Common stock Retained earnings Total shareholders' equity Total liabilities plus shareholders' equity $ 340,995 1,262,379 187,190 158.603 1,949,167 3.249.934 5.199.101 $ 316,164 416,607 208,460 199.629 1,140,860 2.959.200 4,100,060 57.333 246.599 303,932 $5,503,033 57.333 124.814 182,147 $4,282,207 Tommi Stone and Quarry STATEMENT OF CASH FLOWS Year Ended December 31, 20X8 $121.785 Cash flows from operations Net income (loss) Adjustments to net income Depreciation Increase in receivables Decrease in inventory Increase in other current assets 31,673 (986,916) 97,243 (6,940) APPENDIX A: AUDITING AND ATTESTATION SIMUL 24,831 (21,270) (41.026 (780,620) (343,270) Increase in accounts payable Decrease in accrued expenses Decrease in other current liabilities Net cash provided (used) by operations Cash flows from investing activities Purchase of property and equipment Cash flows from financing activities New debt Debt payments Net cash provided (used) by financing activities Net increase in cash and cash equivalents Cash and equivalents at beginning of year Cash and equivalents at end of year 1,682,666 (557.543) 1.125.123 $1,233 $3,822 $5,055 1. (A) (B) (C) (D) o o o o Which of the following correctly identifies a risk facing TSQ that might affect its ability to con- tinue as a going concern over the long run? A. Competition from several competitors. B. Customer satisfaction with the quality of TSQ's current products. C. The nature of inventory items-small in size, high in value. D. Obsolescence of all major products due to rapid changes in technology in the industry. 2. (A) (B) (C) (D) o o o o The most significant risk factor relating to the to misstatement arising from fraudulent financial reporting for TSQ is that the company A. Operates in the Albuquerque area. B. Officers serve on the board of directors. C. Must refinance a significant portion of its debt. D. Paid no dividend this year. Audit Findings Company Profile Industry Laformation Balance Sheet Income Statement Statement of Cash Flows Audit Procedures Situation Communication Research Ratio 20X8 20XZ Inventory turnover 10.52 7.95 Return on equity 0.40 0.67 The above table presents two ratios that were identified as significant in the current and prior years' audits of TSQ. Com- pare the values of each ratio. Then select an audit finding that is consistent with these metrics. The finding need not explain the entire change. But, of the replies listed, it should potentially lead to the most significant change in the direction indicated by the change in the ratio. Each of the audit findings may be used once, more than once, or not at all. Audit findings A. Increases in costs of purchases were not completely passed on to customers through higher selling prices. B. Increases in trade receivables.. C. Owners' equity increased due to retention of profits. D. A larger percentage of sales occurred during the last month of 20X8, as compared to 20x7. E. Interest expense decreased during 20X8. F. The percentage tax included in the provision for income taxes for 20X8 was less than the percentage in 20x7. (A) (B) (C) (D) (E) (F) An audit finding consistent with the change in inventory turnover for O O O O O O TSQ An audit finding consistent with the change in the return on equity OOOOOO 1. 2. The auditor determines that each of the following objectives will be part of TSO's audit. For each audit objective, select a substantive procedure that would help to achieve that objective. Each of the procedures may be used once more than once, or not at all Substantive procedure A Examine current vendors price lists B Reviewdrafts of the financial Statements C. Select a sample of items during the physical inventory count and determine that they have been included on count D. Select a sample of recorded items and examine supporting vendors invoices and contracts E Select a sample of recorded items on count sheets during the physical inventory count and determine that these items are on hand F Test the reasonableness of general and administrative labor rates 1. Determine that the presentation and disclosure of inventories and cost of goods sold is adequate Establish that the client has rights to the recorded inventories. (A) (B) (C) (D) (E) (F) 2. Cm Industry Imre A Your firm has performed the audit of TSQ for the past five years. The preceding materials describe the company's board of directors. Receat emphasis on corporate governance has caused your firm to increasingly document its understanding of the nature of the board of directors. In a memorandum to the audit team explain your view on the likely effectiveness of the board of directors as an oversight mechanism for TSO Remember: Your response will be graded for both technical relevance and writing skills. For writing skills you should demon strate an ability to develop your ideas, organize them and express them clearly. Do not convey information in the form of a ta ble, bullet point list, or other abbreviated presentation To: Audit Team From: CPA Candidate Re: TSO Audit Committee You have now completed the fieldwork for the TSQ audit and find that due to a change in accounting principle mandated by the Financial Accounting Standards Board, you will need to add an explanatory paragraph for a lack of consistency for the year 20X6. Using the Professional Standards, find an example of an appropriate explanatory paragraph for a lack of consis tency. Do this by copying and pasting the report to a workspace. You should not edit the report in any way. in the above exercise, please draft the entire auditor's report, including the explanatory paragraph. You will find sufficient guidance and example language in Chapter 17 of your textbook