Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Auditing homework, please help sertion being tested. the materials 3-12 (3-31 Required: For audit procedures 1-4, identify the primary assertion beind For each of the

Auditing homework, please help

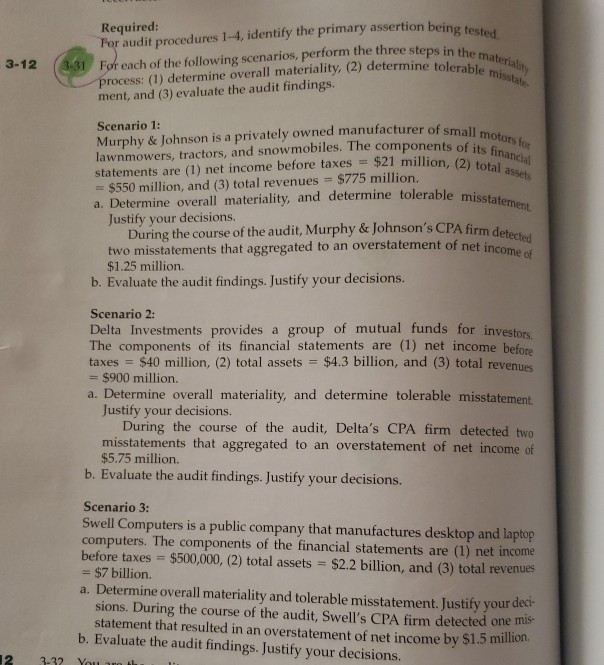

sertion being tested. the materials 3-12 (3-31 Required: For audit procedures 1-4, identify the primary assertion beind For each of the following scenarios, perform the three steps in process: (1) determine overall materiality, (2) determine tolera ment, and (3) evaluate the audit findings. tolerable misstate small motors for of its financial on (2) total assets able misstatement Scenario 1: Murphy & Johnson is a privately owned manufacturer of small lawnmowers, tractors, and snowmobiles. The components of statements are (1) net income before taxes = $21 million (2) = $550 million, and (3) total revenues = $775 million. a. Determine overall materiality, and determine tolerable mis Justify your decisions. During the course of the audit, Murphy & Johnson's CPA fi two misstatements that aggregated to an overstatement of net in $1.25 million. b. Evaluate the audit findings. Justify your decisions. PA firm detected Scenario 2: Delta Investments provides a group of mutual funds for investors The components of its financial statements are (1) net income before taxes - $40 million, (2) total assets = $4.3 billion, and (3) total revenue = $900 million. a. Determine overall materiality, and determine tolerable misstatement, Justify your decisions. During the course of the audit, Delta's CPA firm detected two misstatements that aggregated to an overstatement of net income of $5.75 million. b. Evaluate the audit findings. Justify your decisions. Scenario 3: Swell Computers is a public company that manufactures desktop and laptop computers. The components of the financial statements are (1) net income before taxes = $500,000, (2) total assets = $2.2 billion, and (3) total revenues = $7 billion. a. Determine overall materiality and tolerable misstatement. Justify your dech sions. During the course of the audit, Swell's CPA firm detected one statement that resulted in an overstatement of net income by $1.5 mm b. Evaluate the audit findings. Justify your decisions. 3-32 Your 12 sertion being tested. the materials 3-12 (3-31 Required: For audit procedures 1-4, identify the primary assertion beind For each of the following scenarios, perform the three steps in process: (1) determine overall materiality, (2) determine tolera ment, and (3) evaluate the audit findings. tolerable misstate small motors for of its financial on (2) total assets able misstatement Scenario 1: Murphy & Johnson is a privately owned manufacturer of small lawnmowers, tractors, and snowmobiles. The components of statements are (1) net income before taxes = $21 million (2) = $550 million, and (3) total revenues = $775 million. a. Determine overall materiality, and determine tolerable mis Justify your decisions. During the course of the audit, Murphy & Johnson's CPA fi two misstatements that aggregated to an overstatement of net in $1.25 million. b. Evaluate the audit findings. Justify your decisions. PA firm detected Scenario 2: Delta Investments provides a group of mutual funds for investors The components of its financial statements are (1) net income before taxes - $40 million, (2) total assets = $4.3 billion, and (3) total revenue = $900 million. a. Determine overall materiality, and determine tolerable misstatement, Justify your decisions. During the course of the audit, Delta's CPA firm detected two misstatements that aggregated to an overstatement of net income of $5.75 million. b. Evaluate the audit findings. Justify your decisions. Scenario 3: Swell Computers is a public company that manufactures desktop and laptop computers. The components of the financial statements are (1) net income before taxes = $500,000, (2) total assets = $2.2 billion, and (3) total revenues = $7 billion. a. Determine overall materiality and tolerable misstatement. Justify your dech sions. During the course of the audit, Swell's CPA firm detected one statement that resulted in an overstatement of net income by $1.5 mm b. Evaluate the audit findings. Justify your decisions. 3-32 Your 12Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started