Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Auditing Individual Assignment 1 Part 1 ( 8 0 % ) For the following independent situations, assume that you are the audit partner on the

Auditing

Individual Assignment

Part

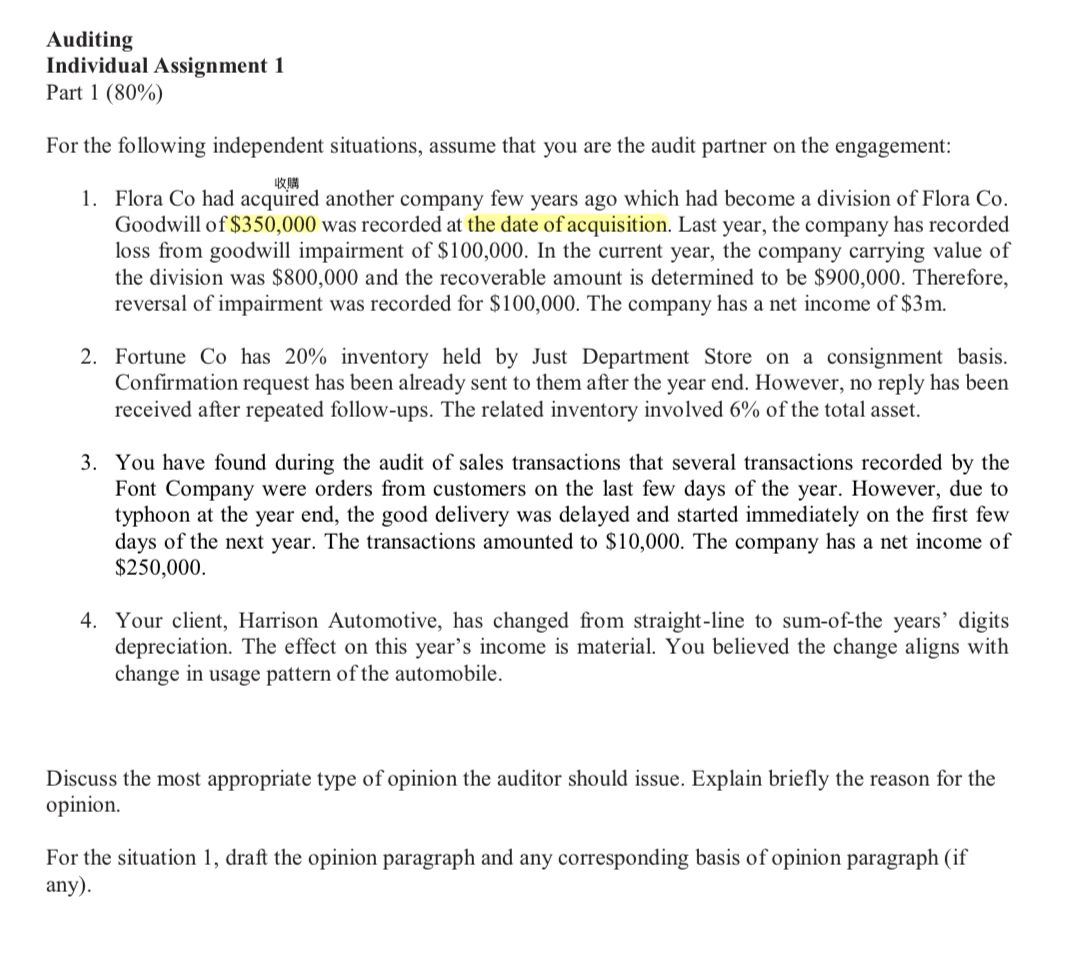

For the following independent situations, assume that you are the audit partner on the engagement:

Flora Co had acquired another company few years ago which had become a division of Flora Co Goodwill of $ was recorded at the date of acquisition. Last year, the company has recorded loss from goodwill impairment of $ In the current year, the company carrying value of the division was $ and the recoverable amount is determined to be $ Therefore, reversal of impairment was recorded for $ The company has a net income of $

Fortune Co has inventory held by Just Department Store on a consignment basis. Confirmation request has been already sent to them after the year end. However, no reply has been received after repeated followups. The related inventory involved of the total asset.

You have found during the audit of sales transactions that several transactions recorded by the Font Company were orders from customers on the last few days of the year. However, due to typhoon at the year end, the good delivery was delayed and started immediately on the first few days of the next year. The transactions amounted to $ The company has a net income of $

Your client, Harrison Automotive, has changed from straightline to sumofthe years' digits depreciation. The effect on this year's income is material. You believed the change aligns with change in usage pattern of the automobile.

Discuss the most appropriate type of opinion the auditor should issue. Explain briefly the reason for the opinion.

For the situation draft the opinion paragraph and any corresponding basis of opinion paragraph if any

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started