Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Auditing Questions Auditing choose a audit stragedy then justify your answer for each question Based on the facts in each scenario, recommend the most appropriate

Auditing Questions

Auditing

choose a audit stragedy then justify your answer for each question

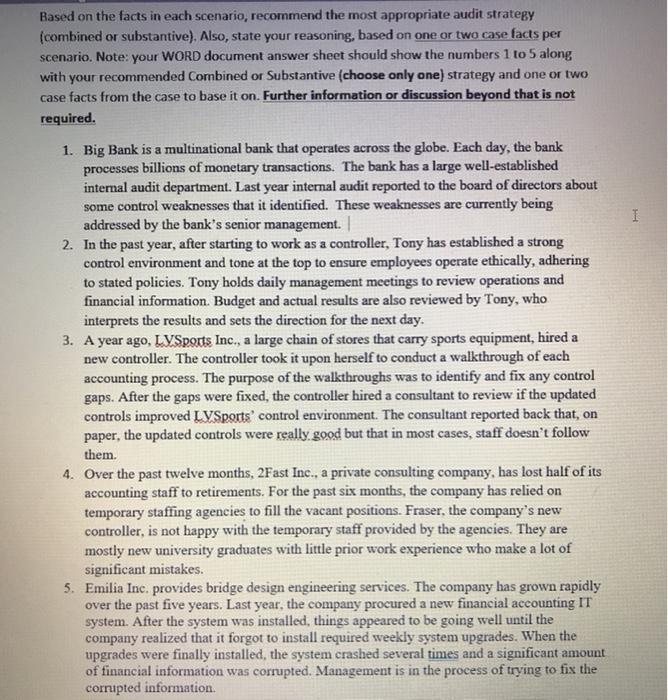

Based on the facts in each scenario, recommend the most appropriate audit strategy (combined or substantive). Also, state your reasoning, based on one or two case facts per scenario. Note: your WORD document answer sheet should show the numbers 1 to 5 along with your recommended Combined or Substantive (choose only one) strategy and one or two case facts from the case to base it on. Further information or discussion beyond that is not required. 1. Big Bank is a multinational bank that operates across the globe. Each day, the bank processes billions of monetary transactions. The bank has a large well-established internal audit department. Last year internal audit reported to the board of directors about some control weaknesses that it identified. These weaknesses are currently being addressed by the bank's senior management. 2. In the past year, after starting to work as a controller, Tony has established a strong control environment and tone at the top to ensure employees operate ethically, adhering to stated policies. Tony holds daily management meetings to review operations and financial information. Budget and actual results are also reviewed by Tony, who interprets the results and sets the direction for the next day. 3. A year ago, LVSports Inc., a large chain of stores that carry sports equipment, hired a new controller. The controller took it upon herself to conduct a walkthrough of each accounting process. The purpose of the walkthroughs was to identify and fix any control gaps. After the gaps were fixed, the controller hired a consultant to review if the updated controls improved LVSports' control environment. The consultant reported back that, on paper, the updated controls were really good but that in most cases, staff doesn't follow them. 4. Over the past twelve months, 2Fast Inc., a private consulting company, has lost half of its accounting staff to retirements. For the past six months, the company has relied on temporary staffing agencies to fill the vacant positions. Fraser, the company's new controller, is not happy with the temporary staff provided by the agencies. They are mostly new university graduates with little prior work experience who make a lot of significant mistakes. 5. Emilia Inc. provides bridge design engineering services. The company has grown rapidly over the past five years. Last year, the company procured a new financial accounting IT system. After the system was installed, things appeared to be going well until the company realized that it forgot to install required weekly system upgrades. When the upgrades were finally installed, the system crashed several times and a significant amount of financial information was corrupted. Management is in the process of trying to fix the corrupted information.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Combined bank processes very high Big Bank is a multinational bank that operates across the gl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started