auditing

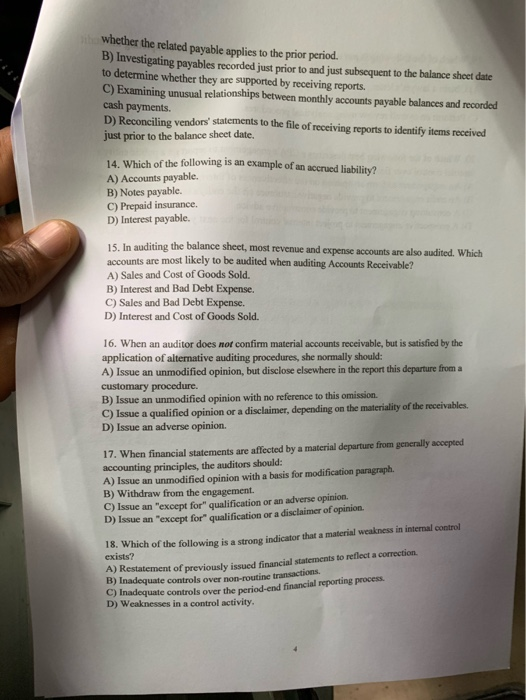

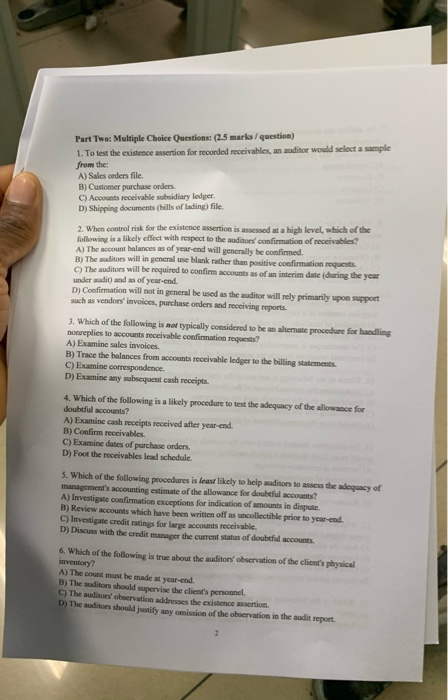

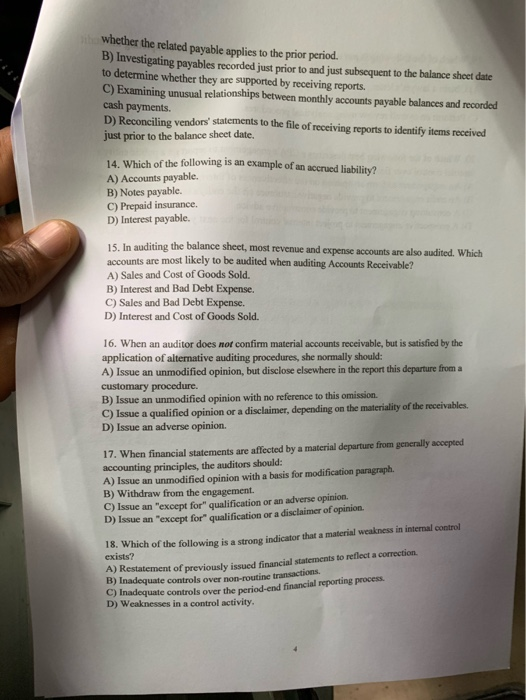

Part Two: Multiple Choice Questions: (2.5 marks/ question) 1. To test the existence assertion for recorded receivables, an auditor would select a sample from the A) Sales orders file. B) Customer purchase orders C) Accounts receivable subsidiary ledger D) Shipping documents (bill of lading) file. 2. When control risk for the existence assertion is assessed at a high level, which of the Gallerine is a likely effect with respect to the auditors' confirmation of receivables? A) The account balances as of year-end will generally be confirmed. Bo The ditors will in general use blank rather than positive confirmation requests c) The auditors will be required to confirm accounts as of an interim date during the year under wait) and as of year-end. D) Confirmation will not in general be used as the auditor will rely primarily upon support such as vendors invoices, purchase orders and receiving reports. 3. Which of the following is mor typically considered to be an alternate procedure forhandling noreplies to accounts receivable confirmation requests? A) Examine sales invoices B) Trace the balances from accounts receivable leder to the billing statements C) Examine correspondence. D) Examinc any subsequent cash receipts. 4. Which of the following is a likely procedure to test the adequacy of the allowance for doubtful account? A) Examine cash receipts received after year-end. B) Confirm receivables. C) Excamine dates of purchase orders. D) Foot the receivables lead schedule. 5. Which of the following procedures is least likely to help witors to assess the adequacy of management's accounting estimate of the allowance for doubtful account? A) Investigate confirmation exceptions for indication of amounts in dispute B) Review accounts which have been written off as collectible prior to year-end C) Investigate credit ratings for large accounts receivable D) Discuss with the credit manager the current status of doubtful account 6. Which of the following is true about the auditors'observation of the client's physical inventory? A) The count must be made wyear-end. B) The does should supervise the client's personne C) The auditors'observation addresses the existence assertion D) The Radio should justify any of the heation in the audit report whether the related payable applies to the prior period. B) Investigating payables recorded just prior to and just subsequent to the balance sheet date to determine whether they are supported by receiving reports. C) Examining unusual relationships between monthly accounts payable balances and recorded cash payments. D) Reconciling vendors' statements to the file of receiving reports to identify items received just prior to the balance sheet date. 14. Which of the following is an example of an accrued liability? A) Accounts payable. B) Notes payable. C) Prepaid insurance. D) Interest payable. 15. In auditing the balance sheet, most revenue and expense accounts are also audited. Which accounts are most likely to be audited when auditing Accounts Receivable? A) Sales and Cost of Goods Sold. B) Interest and Bad Debt Expense. C) Sales and Bad Debt Expense. D) Interest and Cost of Goods Sold. 16. When an auditor does nor confirm material accounts receivable, but is satisfied by the application of alternative auditing procedures, she normally should: A) Issue an unmodified opinion, but disclose elsewhere in the report this departure from a customary procedure. B) Issue an unmodified opinion with no reference to this omission C) Issue a qualified opinion or a disclaimer, depending on the materiality of the receivables. D) Issue an adverse opinion. 17. When financial statements are affected by a material departure from generally accepted accounting principles, the auditors should: A) Issue an unmodified opinion with a basis for modification paragraph. B) Withdraw from the engagement. C) Issue an "except for" qualification or an adverse opinion. D) Issue an except for qualification or a disclaimer of opinion. 18. Which of the following is a strong indicator that a material weakness in internal control exists? A) Restatement of previously issued financial statements to reflect a correction B) Inadequate controls over non-routine transactions. inadequate controls over the period-end financial reporting process. D) Weaknesses in a control activity

auditing

auditing