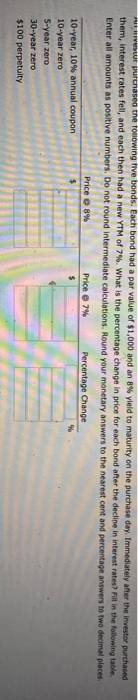

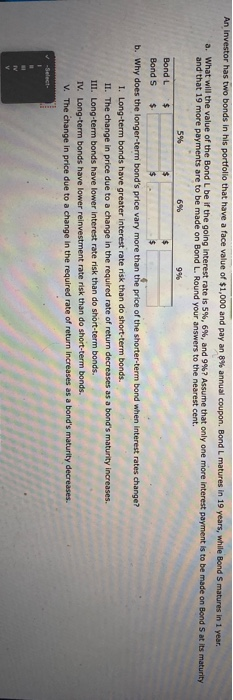

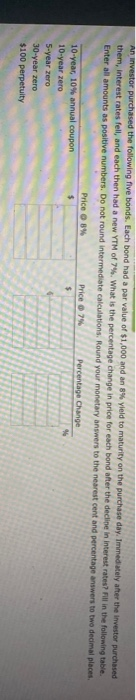

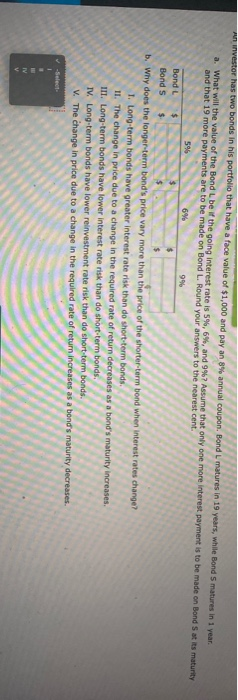

Aur purchased the following live bonds. Each bond had a par value of $1,000 and an 8% yield to maturity on the purchase day. Immediately after the investor purchased them, interest rates fell, and each then had a new YTM of 7%. What is the percentage change in price for each bond after the decline in interest rates? Fill in the following table. Enter all amounts as positive numbers. Do not round intermediate calculations. Round your monetary answers to the nearest cent and percentage answers to two decimal places Price o 8% Price 7% Percentage Change 10-year, 10% annual coupon % 10-year zero 5-year zero 30-year zero $100 perpetuity 99 An Investor has two bonds in his portfolio that have a face value of $1,000 and pay an 8% annual coupon. Bond L matures in 19 years, while Bond S matures in 1 year. a. What will the value of the Bond L be if the going interest rate is 5%, 6%, and 9%? Assume that only one more interest payment is to be made on Bond 5 at its maturity and that 19 more payments are to be made on Bond L. Round your answers to the nearest cent. 5% 6% Bond L $ $ Bond S $ $ b. Why does the longer-term bond's price vary more than the price of the shorter term bond when interest rates change? 1. Long-term bonds have greater interest rate risk than do short-term bonds. II. The change in price due to a change in the required rate of return decreases as a bond's maturity increases. III. Long-term bonds have lower interest rate risk than do short-term bonds. IV. Long-term bonds have lower reinvestment rate risk than do short-term bonds. V. The change in price due to a change in the required rate of return increases as a bond's maturity decreases. Select V An investor purchased the following five bonds. Each bond had a par value of $1,000 and an 8% yield to maturity on the purchase day. Immediately after the investor purchased them, interest rates fell, and each then had a new YTM of 7%. What is the percentage change in price for each bond after the decline in interest rates? Fill in the following table. Enter all amounts as positive numbers. Do not round Intermediate calculations. Round your monetary answers to the nearest cent and percentage answers to two decimal places Price O 8% Price 7 Percentage Change 10-year, 10% annual coupon $ $ 10-year zero 5-year zero 30-year zero $100 perpetuity an investor has two bonds in his portfolio that have a face value of $1,000 and pay an 8% annual coupon Bond L matures in 19 years, while Bond 5 matures in 1 year a. What will the value of the Bond L be if the going interest rate is 5%, 6%, and 9% Assume that only one more interest payment is to be made on Bond Stits maturity and that 19 more payments are to be made on Bond L. Round your answers to the nearest cent. 5% 6% 99 Bond L $ Bonds $ b. Why does the longer-term bond's price vary more than the price of the shorter-term bond when Interest rates change? 1. Long-term bonds have greater interest rate risk than do short-term bonds. II. The change in price due to a change in the required rate of return decreases as a bond's maturity increases III. Long-term bonds have lower interest rate risk than do short-term bonds. IV. Long-term bonds have lower reinvestment rate risk than do short-term bonds. V. The change in price due to a change in the required rate of return increases as a bond's maturity decreases. -Select- TV