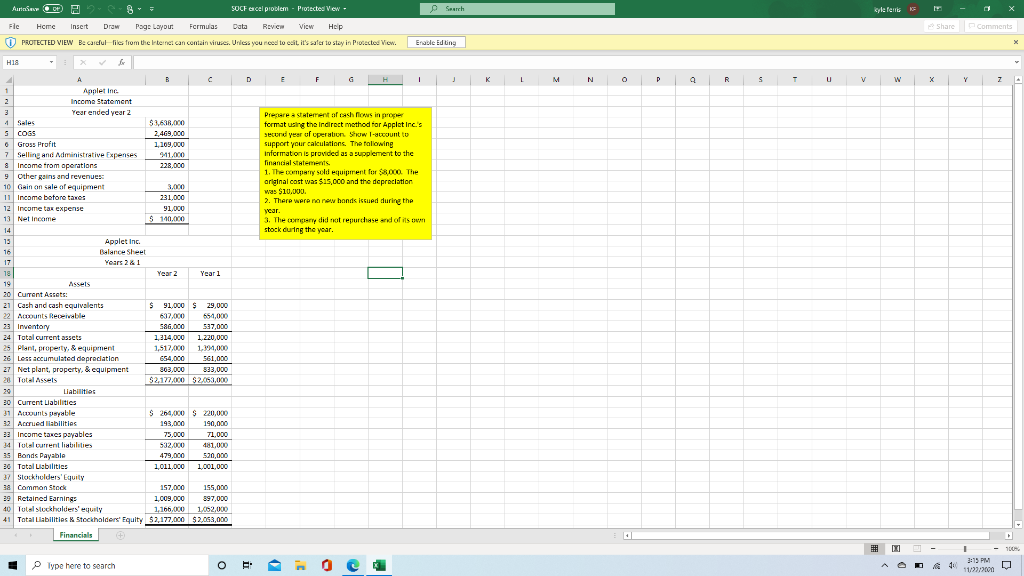

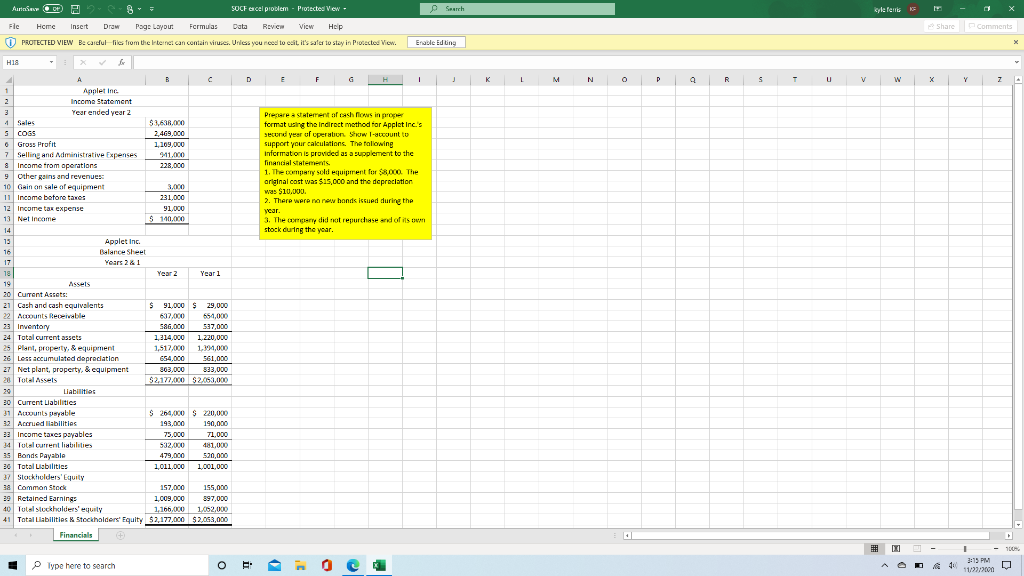

Auri 0 B SOCF cel problem - Protected View - Search Kyle fent Share Comments Fle Home Insert Draw Page Layout Formulas Data Review View Help PROTECTED VIEW Be cardul files from the latenet can contain viruses. Unless you need to ecit, it's safe to stay in Protected View. Ena idling HIS D E F H 1 K 1 M N R S U v W w X Y 7 Prestere a statement of cash flows in propter format using the Indirect method for Apple Inc.'s Second year of operation Show l-account to support your calculations. The following Information is provided as a supplement to the financial statements 1. The company sold equipment for CO. The original cost was $15.000 and the depreciation was $10.000. 2. There were no new honds issued during the year. 3. The company did not repurchase and of its ou stock during the year. | A 1 Apple Inc. 2 Income Statement 3 Year ended year 2 4 Sales COSS 2,469,000 o Gross Profit 1,109,000 7 Selling and Administrative Expenses 91.000 & Income from operations 228.000 9 Other gains and revenues 10 Gain on sale of equipment 3.000 11 Income before taxes 231.000 12 Income tax expense 91,000 13 Net Income S 10.200 14 13 Apple Inc. 16 Balance Sheet 17 Years 2&1 18 Year 2 Year 1 19 20 Current Assets: 21 Cash and cash equivalents $ 91,000 $ 29,000 22 Acounts Receivable 637,000 654,000 23 Inventory 586.000 537,000 24 Total current assets 1,214.000 1.220,000 25 Plant, property, & equipment 1,512200 1,394,000 26 Less accumulated depreciation 654,000 561,000 27 Net plant, property, & equipment 863,000 533,000 28 Total Assets 52,177,000 $2053,000 29 Liabilities 30 Current Liabilities 31 Awounts payable S 264,000 $ 220,000 32 Acued liabilities 193.000 190,000 33 Income taxes payables 75,000 71,000 34 Tollurrent liabilities 532.000 481,000 3s fonds Payable 479.000 520,000 36 Total Lisbilities 1,011.000 1.001,000 37 Stockholders'Equity 39 Comman Stock 157.000 155,000 39 Retained Earnings 1,009,000 597,000 40 Tulal stockholders' equity 1,166.000 1.262,000 41 Total Liabilities Stockholders' Equity $2,177,000 $2,000,000 Financials 100% 1 3:13 PM 11/27/200 Type here to search O Auri 0 B SOCF cel problem - Protected View - Search Kyle fent Share Comments Fle Home Insert Draw Page Layout Formulas Data Review View Help PROTECTED VIEW Be cardul files from the latenet can contain viruses. Unless you need to ecit, it's safe to stay in Protected View. Ena idling HIS D E F H 1 K 1 M N R S U v W w X Y 7 Prestere a statement of cash flows in propter format using the Indirect method for Apple Inc.'s Second year of operation Show l-account to support your calculations. The following Information is provided as a supplement to the financial statements 1. The company sold equipment for CO. The original cost was $15.000 and the depreciation was $10.000. 2. There were no new honds issued during the year. 3. The company did not repurchase and of its ou stock during the year. | A 1 Apple Inc. 2 Income Statement 3 Year ended year 2 4 Sales COSS 2,469,000 o Gross Profit 1,109,000 7 Selling and Administrative Expenses 91.000 & Income from operations 228.000 9 Other gains and revenues 10 Gain on sale of equipment 3.000 11 Income before taxes 231.000 12 Income tax expense 91,000 13 Net Income S 10.200 14 13 Apple Inc. 16 Balance Sheet 17 Years 2&1 18 Year 2 Year 1 19 20 Current Assets: 21 Cash and cash equivalents $ 91,000 $ 29,000 22 Acounts Receivable 637,000 654,000 23 Inventory 586.000 537,000 24 Total current assets 1,214.000 1.220,000 25 Plant, property, & equipment 1,512200 1,394,000 26 Less accumulated depreciation 654,000 561,000 27 Net plant, property, & equipment 863,000 533,000 28 Total Assets 52,177,000 $2053,000 29 Liabilities 30 Current Liabilities 31 Awounts payable S 264,000 $ 220,000 32 Acued liabilities 193.000 190,000 33 Income taxes payables 75,000 71,000 34 Tollurrent liabilities 532.000 481,000 3s fonds Payable 479.000 520,000 36 Total Lisbilities 1,011.000 1.001,000 37 Stockholders'Equity 39 Comman Stock 157.000 155,000 39 Retained Earnings 1,009,000 597,000 40 Tulal stockholders' equity 1,166.000 1.262,000 41 Total Liabilities Stockholders' Equity $2,177,000 $2,000,000 Financials 100% 1 3:13 PM 11/27/200 Type here to search O