Answered step by step

Verified Expert Solution

Question

1 Approved Answer

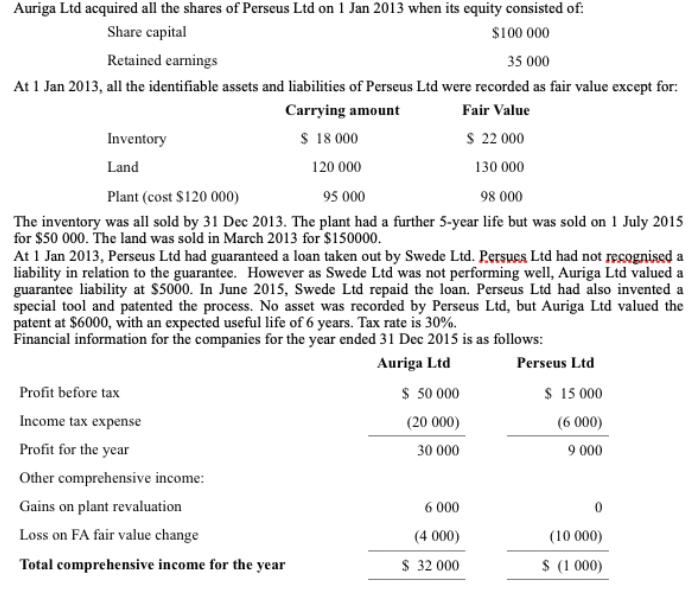

Auriga Ltd acquired all the shares of Perseus Ltd on 1 Jan 2013 when its equity consisted of: Share capital $100 000 Retained earnings

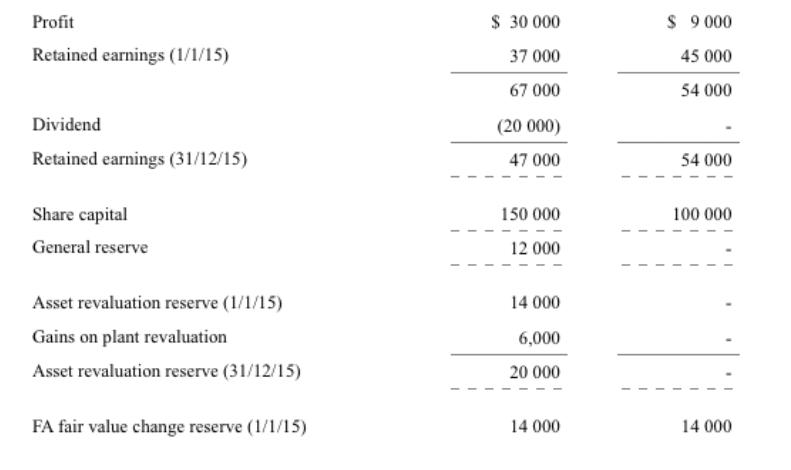

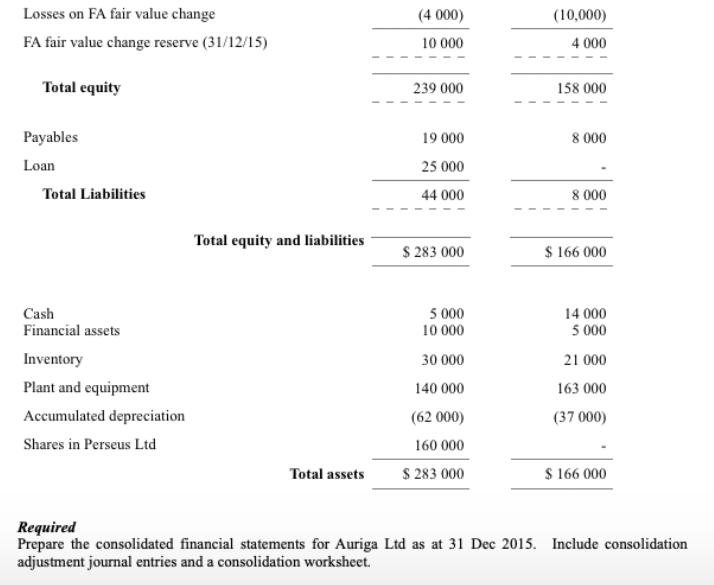

Auriga Ltd acquired all the shares of Perseus Ltd on 1 Jan 2013 when its equity consisted of: Share capital $100 000 Retained earnings 35 000 At 1 Jan 2013, all the identifiable assets and liabilities of Perseus Ltd were recorded as fair value except for: Carrying amount Fair Value Inventory $ 18.000 $ 22 000 Land 120 000 130 000 Plant (cost $120 000) 95 000 98 000 The inventory was all sold by 31 Dec 2013. The plant had a further 5-year life but was sold on 1 July 2015 for $50 000. The land was sold in March 2013 for $150000. At 1 Jan 2013, Perseus Ltd had guaranteed a loan taken out by Swede Ltd. Persues Ltd had not recognised a liability in relation to the guarantee. However as Swede Ltd was not performing well, Auriga Ltd valued a guarantee liability at $5000. In June 2015, Swede Ltd repaid the loan. Perseus Ltd had also invented a special tool and patented the process. No asset was recorded by Perseus Ltd, but Auriga Ltd valued the patent at $6000, with an expected useful life of 6 years. Tax rate is 30%. Financial information for the companies for the year ended 31 Dec 2015 is as follows: Auriga Ltd Perseus Ltd $ 15.000 (6 000) 9 000 Profit before tax Income tax expense Profit for the year Other comprehensive income: Gains on plant revaluation Loss on FA fair value change Total comprehensive income for the year $ 50 000 (20 000) 30 000 6.000 (4 000) $ 32 000 (10 000) $ (1.000) Profit Retained earnings (1/1/15) Dividend Retained earnings (31/12/15) Share capital General reserve Asset revaluation reserve (1/1/15) Gains on plant revaluation Asset revaluation reserve (31/12/15) FA fair value change reserve (1/1/15) $ 30 000 37 000 67 000 (20 000) 47 000 150 000 12 000 14 000 6,000 20 000 14 000 $ 9.000 45 000 54 000 54 000 100 000 14 000 Losses on FA fair value change FA fair value change reserve (31/12/15) Total equity Payables Loan Total Liabilities Cash Financial assets Inventory Plant and equipment Accumulated depreciation Shares in Perseus Ltd Total equity and liabilities Total assets (4 000) 10 000 239 000 19 000 25 000 44 000 $ 283 000 5.000 10 000 30 000 140 000 (62 000) 160 000 $ 283 000 (10,000) 4000 158 000 8.000 8.000 $ 166 000 14 000 5 000 21 000 163 000 (37 000) $ 166 000 Required Prepare the consolidated financial statements for Auriga Ltd as at 31 Dec 2015. Include consolidation adjustment journal entries and a consolidation worksheet.

Step by Step Solution

★★★★★

3.40 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

Auriga Ltd Consolidated balance sheet As at 31 December 2015 Assets Cash 140 000 Financial assets 62 000 Inventory 160 000 Plant and equipment 21 000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started