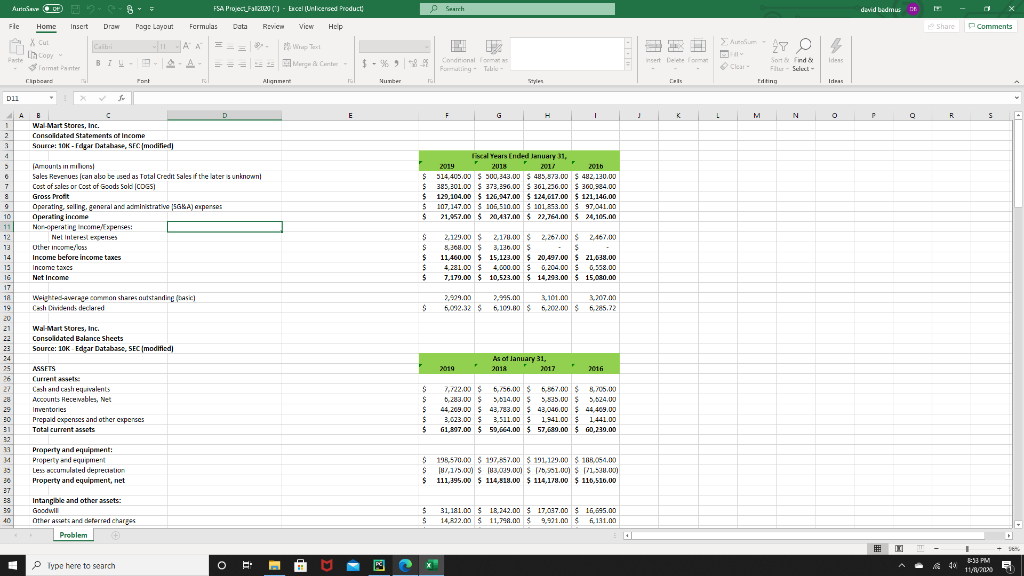

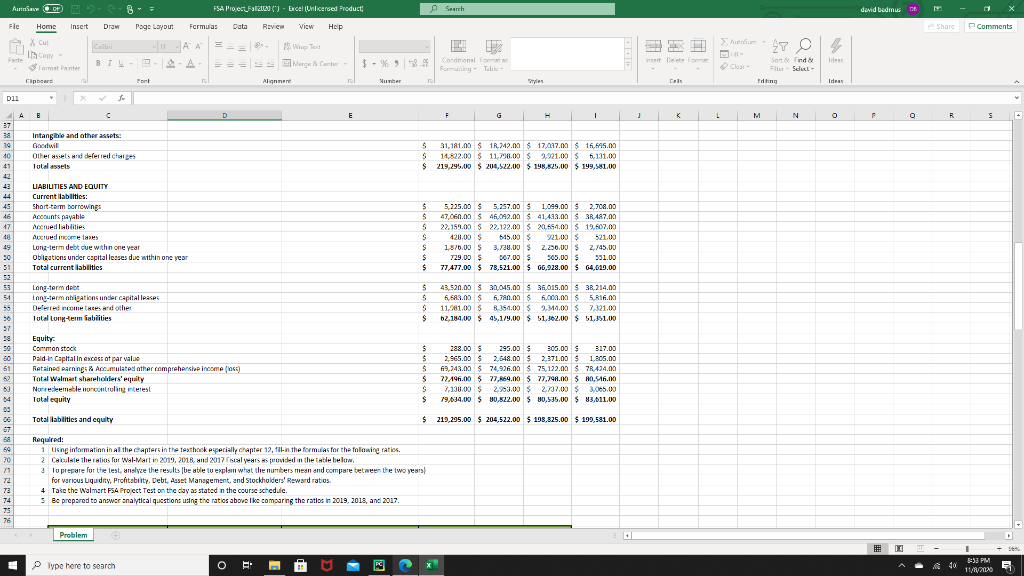

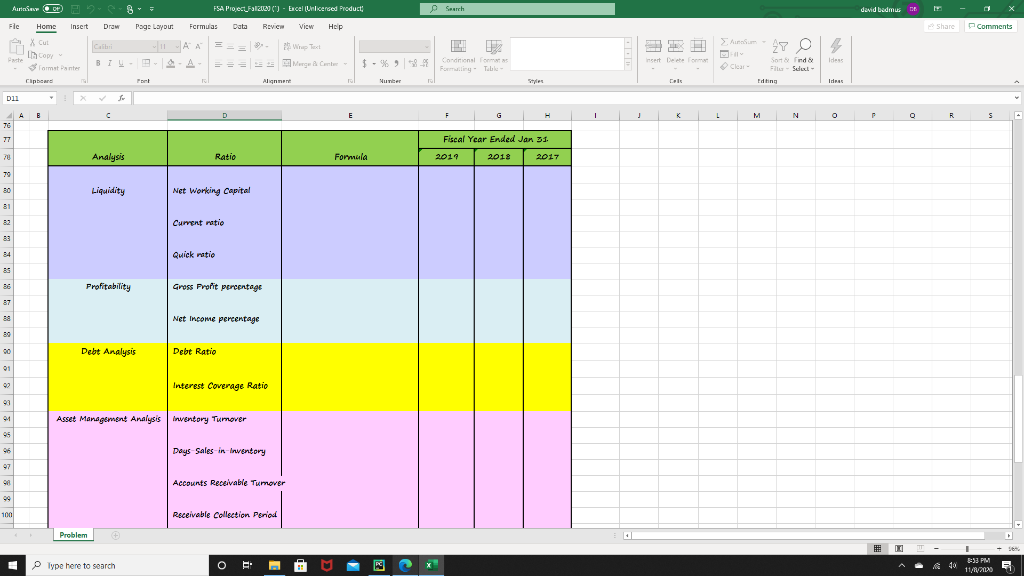

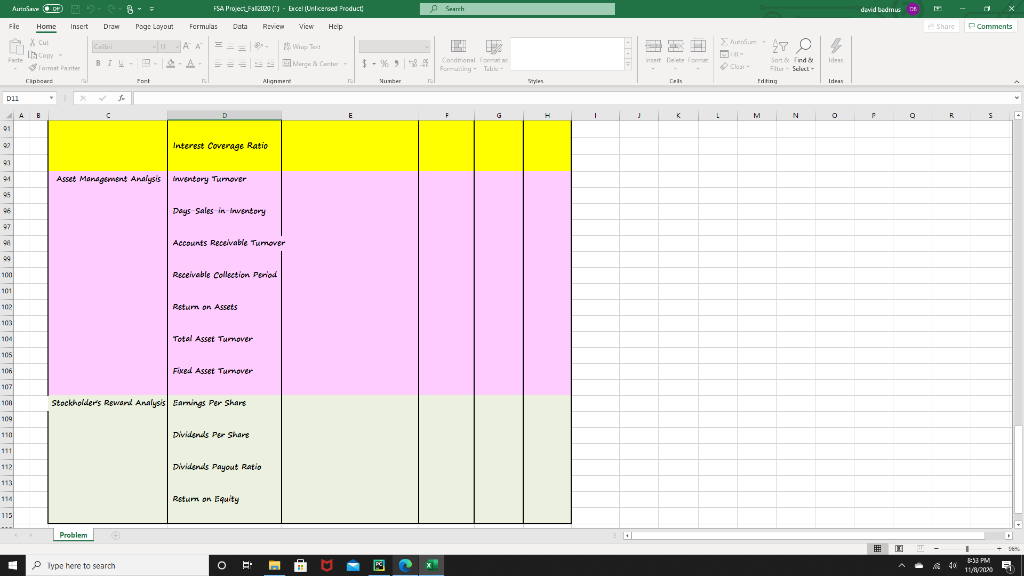

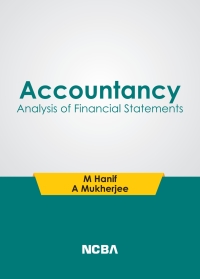

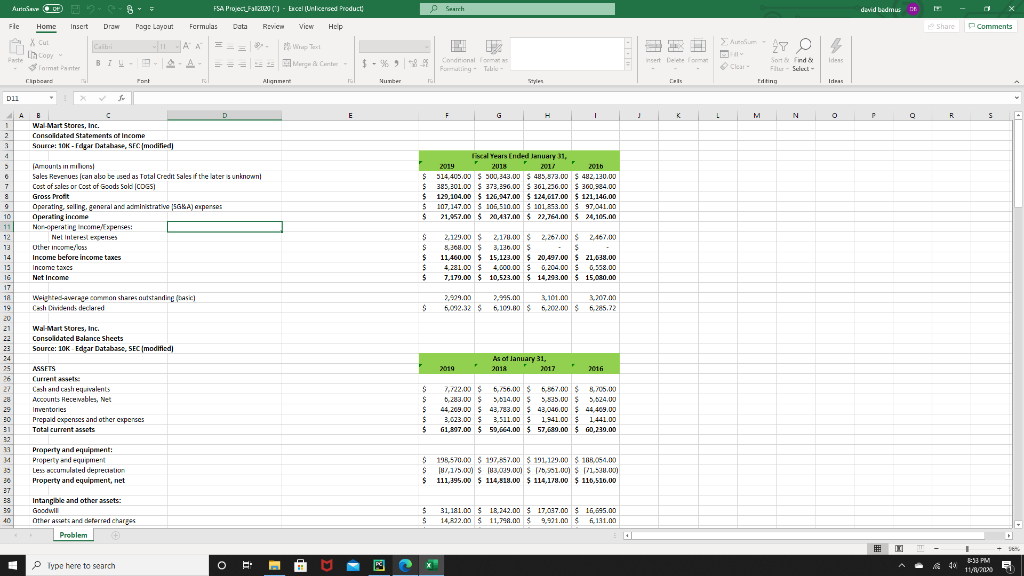

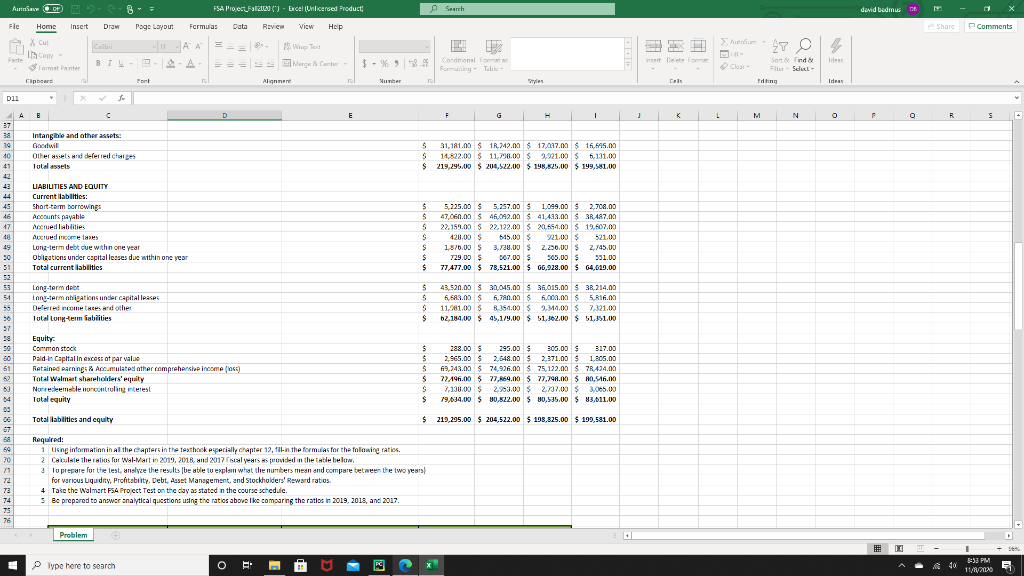

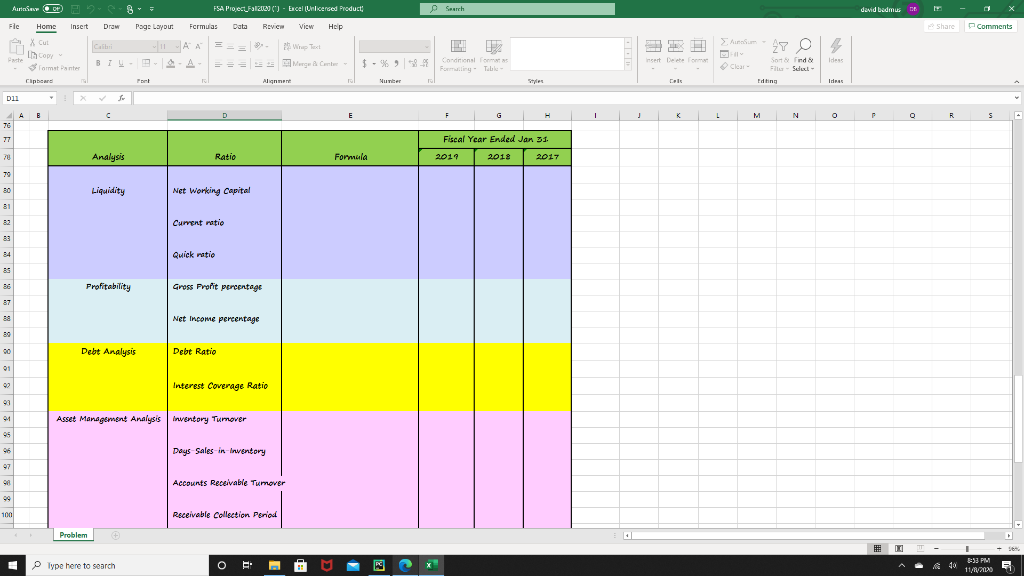

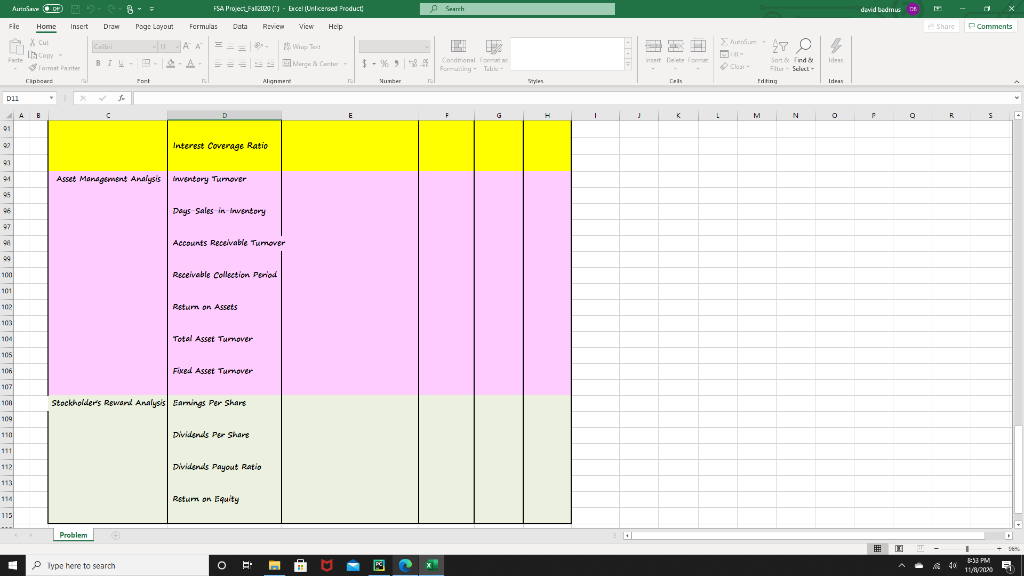

Aurinn DP FSA Procta 2020 () - Excel (Unlicensed Product Search david badmus De Fle Home Insert Draw Page Layout Formulas Data Review View Share Comments AS- A 27 0 % the X Cut Copy Format Panter == === Wrap Text 3 Merge Can Idees A ncert De Conditional Formwiling Table Sortid F-Set Editing Clipboard Fort Alignment Ideas D11 Se E F G M N P o R s s 1 2 3 4 B Wal-Mart Stores, Inc. Consolidated Statements of income Source: 10K - Fdgar Database, SE modified) 7 8 Amounts in milions! Sales Revenues can also be used as Total Credit Sales if the later is unknown Cost of sales or Cost of Goods Sold COSS Gross Pront Operating sailing, general and ministrative SGKA) expenses Operating income Non operating income penes Nel interest Other incore/loss Income before income taxes Income taxes Net Income Fiscal Years Ended Lanuary 31, 2019 2018 2017 " 2015 $ 514,405.00 $ 300,343.00 $ 485,573.00 $ 482,130.00 $ 385,301.00 $ 373,396.00 $ 361,236.00 $ 360,984.00 $ 129,104.00 $ 126,947.00 $ 124,617.00 $ 121,146.00 $ 107,147.00 $ 106,510.00 $ 101,853.00 $ 97,041.00 $ 21,457.00 $ 20,4:17.00 $ 27,764.00 $ 24,105.00 10 11 12 13 14 13 16 17 18 19 S S $ S $ 2,129.00 $ 2170.00 $2,267.00 $ 2,467.00 3,200.00 $3,130.00 $ $ 11,460.00 $ 15,123.00 $ 20,497.00 $ 21,638.00 4,281.00 $ 4.000.00 $ 6,204.00 $ 0,558.00 7,179.00 $ 10,523.00 $14,293.00 $ 15.080.00 Weighted average common shares outstanding frasci Cach Dividends declared S 2,995.00 3.101.00 3.207.00 5,092.32 $ 6.109.00 $ 5.200.00 $ 6.285.72 21 Wal- Mart Stores, Inc. Consoldated Balance Sheets Source: 1OK Edgar Database, SEC modified 24 As of lanuary 31, 2019 2018 2017 2016 ASSETS Current ANIS Cool and casheqvalents Accounts Heceivables, Net Inventores Prepaid expenses and other expenses Total current assets $ S S S $ 7.722.00 $ 6,756.00 $ 5,867.00 $ 5.705.00 0,293.00 $ 5,614.00 $ 5,505.00 $ 5,624.00 44,269.00 $ 43,783.00 $ 43,046.00 $ 44,409.00 3,623.00 $3,511.00 $ 1.11.00 $ 1.441.00 61,397.00 $ 59,664.00 $ 57,680.00 $ 60,239.00 30 31 32 33 35 30 Property and equipment: Property and equpment Less accumulated depreciation Property and equipment, net $ 196,570.00 $ 197,867.00 $ 191,129.00 $ 188,054.00 S (U/,175.00) $ 193,009.00) $ 75,901.00) $ 171,599.00) $ 111,395.00 $ 114,518.00 $ 114,178.00 $ 116,510.00 37 39 40 Intangible and other assets: Goodwil Other Acces and deterred charges Problem $ $ 31,181.00 $ 18,242.00 $ 17.037.00 $ 16,695.00 14,812.00 $ 11,799.00 $ 9,921.00 $ 6,191.00 Type here to search O E- M RC 10 8:53 PM 11/10723 Aurinn Op FSA Procta 2020 () - Excel (Unlicensed Product p Search david badmus De Fle Home Insert Draw Page Layout Formulas Data Review View HSB Share Comments AS- A == 27 0 % X Cut Un Byte Copy Format Dan Clipboard Idees - A Wrap Text 3 Merge Can Alignment Conditional Formwiling Table Sortid F-Set Editing Fort Nunc Ideas D11 4 E F G G H 1 1 M N P o R s 37 38 39 Intangible and other assets: Goodwil Other assets and theferred charges Tutal assets S S $ 40 41 42 43 31,181.00 $ 1,2M2.00 $ 17,047.00 $ 16,695.00 14,822,00 $ 11,798.00 $ 9,921,00 $ 6.131.00 219,295,00 $ 204,522.00 $ 198,625,00 $ 199,501.00 45 46 47 LIABILITIES AND EQUITY Current abilities: Short-torm borrowings Accounts payable Accrued liabilities Auxud noorele Long-term debt clue within one year Obligations under capital lesses due within one year Total current abilities 48 49 $ $ S S S $ $ 5.225.00 $ 5.257.00 $ 1,099.00 $ 2,708.00 47,060.00 $ 46,042.00 $ 41,433.00 $ 3.487.00 22,159.00 $ 22,122.00 $ 20,554.00 $ 19,507.00 4201.00 S 545.00 921.00 $ 521.00 1.570.00 3.730.00 $ 2.230.00 $ 2,745.00 729.00 $ 607.00 $ 505.00 $ 351.00 77,477.00 $ 78,521.00 $ 66,928.00 $ 64,619.00 51 885## ### F B H 3 B ****85228868 53 54 Long-term debe long-term nigations under capitales Deleted income tes and other Total long-term abilities $ 43,520.00 $ 30,045.00 $ 36,015.00 $ 38,214.00 S 5,693.00 $ 6,780.00 $ f.003.09 $ 5.R16.00 S 11.081.00 $ 8.364.00 $9.344.00 $ 7,321.00 $ 62,184.00 $ 45,179.00 $ 51,362,00 $ 51,351.00 57 80 61 62 Equity Common stock Paid In Capital in excess of par value Retained Parnings & Accumulated other comprehensive income foss) Total Walmart shareholders' equity Norresteemeklemtonterest Tutal equity $ $ $ $ S 288.00 $ 293.00 $ 305.00 $ 317.00 2,965.00 $ 2,548.00 $ 2,371.00 $ 1,305.00 69,243.00 $ 74,976.00 $ 75,132.00 $ 7R.434.00 72.496.00 $ 77,864.00 $ 77,798.00 $ 10,916.00 7,130.00 $ 2,993.00 $ 2,737.00 $ 3,065.00 79,634,00 $ 20,522,00 $ 20,595.00 $ 83,611.00 $ Totallablities and equity $ $ 219,295.00 $ 204,522.00 $ 198,825.00 $ 199,581.00 37 69 69 70 Required: 1 Using information in Althe chapters in the textbook especially chapter 12, fil-in the formulas for the following raties 2. Calculate the ratios for Wal-1/artin 2019, 2018 and 2017 Fiscal years as provided in the table below 2 To prepare for the test, analyze the results (be able to explain what the numbers mean and compare between the two years) for various Liquidity, Profitability, Debt, Asset Management, and Stockholders' Reward ratios. 4 Take the Walmart FS4 Project Test on the day as stated in the course schedule. 3 Be prepared to answer analytical questions using the ratios above the comparing the ratlos in 2019, 2013, and 2017. TE 74 76 Problem Type here to search O E- R 10 3:53 PM 11/12) Aurinn FSA Procta 2020 () - Excel (Unlicensed Product Search david badmus De Fle Home Insert Draw Page Layout Formulas Data Review View Share Comments AS- A == 27 0 % X Cut Incom Format Panter Wrap Text 3 Merge Carles Idees - A Conditional Formwiling Table Sortid Slut Editing Clipboard Fort Alignment Number Dil 4 B C D E F H 1 J I M N P P o R s s 76 77 Fiscal Year Ended Jan 31. 2019 2018 2017 Analysis Ratio Formula 30 Liquidity Net Working Capital 81 82 Current ratio 34 Quick ratio Profitability Gross Prolit porcentage Net Income percentage 90 Debt Analysis Debt Ratio 91 92 Interest Coverage Ratio 93 94 Asset Management Analysis inventory Tumover 95 96 Days Sales in Inwentory 97 90 Accounts Receivable Tumover 99 100 Receivable Collection Period Problem Type here to search M RC 3:53 PM 11/8/2020 Aurinn FSA Procta 2020 () - Excel (Unlicensed Product Search david badmus Fle Home Insert Draw Page Layout Formulas Data Review View Hop Share Comments AS- A 27 O Pache X Cut Incom Format anter Clipboard Idees == Wrap Text === Morge Carte Aline A Conditional Formiling Tobie Sortid Fiscal Editing Fort Numer Ideas Dil B C D E F H 1 L M N P O R s s 01 92 Interest Coverage Ratio 93 94 Asset Management Analysis inventory Tumover 95 96 Days Sales-in-Inventory 97 94 Accounts Receivable Turnover 94 100 Receivable Collection Period 101 102 Rsturn on Assets 103 104 Total Asset Tumover 105 106 Fixed Asset Tumover 102 100 Stockholder's Reward Analysis Earnings Per Share 109 110 Dividends Per Share 111 112 Dividends Payout Ratio 113 114 Return on Equity 115 Problem Type here to search O M FC 10 3:53 PM 11/12 11/8/2020 Aurinn DP FSA Procta 2020 () - Excel (Unlicensed Product Search david badmus De Fle Home Insert Draw Page Layout Formulas Data Review View Share Comments AS- A 27 0 % the X Cut Copy Format Panter == === Wrap Text 3 Merge Can Idees A ncert De Conditional Formwiling Table Sortid F-Set Editing Clipboard Fort Alignment Ideas D11 Se E F G M N P o R s s 1 2 3 4 B Wal-Mart Stores, Inc. Consolidated Statements of income Source: 10K - Fdgar Database, SE modified) 7 8 Amounts in milions! Sales Revenues can also be used as Total Credit Sales if the later is unknown Cost of sales or Cost of Goods Sold COSS Gross Pront Operating sailing, general and ministrative SGKA) expenses Operating income Non operating income penes Nel interest Other incore/loss Income before income taxes Income taxes Net Income Fiscal Years Ended Lanuary 31, 2019 2018 2017 " 2015 $ 514,405.00 $ 300,343.00 $ 485,573.00 $ 482,130.00 $ 385,301.00 $ 373,396.00 $ 361,236.00 $ 360,984.00 $ 129,104.00 $ 126,947.00 $ 124,617.00 $ 121,146.00 $ 107,147.00 $ 106,510.00 $ 101,853.00 $ 97,041.00 $ 21,457.00 $ 20,4:17.00 $ 27,764.00 $ 24,105.00 10 11 12 13 14 13 16 17 18 19 S S $ S $ 2,129.00 $ 2170.00 $2,267.00 $ 2,467.00 3,200.00 $3,130.00 $ $ 11,460.00 $ 15,123.00 $ 20,497.00 $ 21,638.00 4,281.00 $ 4.000.00 $ 6,204.00 $ 0,558.00 7,179.00 $ 10,523.00 $14,293.00 $ 15.080.00 Weighted average common shares outstanding frasci Cach Dividends declared S 2,995.00 3.101.00 3.207.00 5,092.32 $ 6.109.00 $ 5.200.00 $ 6.285.72 21 Wal- Mart Stores, Inc. Consoldated Balance Sheets Source: 1OK Edgar Database, SEC modified 24 As of lanuary 31, 2019 2018 2017 2016 ASSETS Current ANIS Cool and casheqvalents Accounts Heceivables, Net Inventores Prepaid expenses and other expenses Total current assets $ S S S $ 7.722.00 $ 6,756.00 $ 5,867.00 $ 5.705.00 0,293.00 $ 5,614.00 $ 5,505.00 $ 5,624.00 44,269.00 $ 43,783.00 $ 43,046.00 $ 44,409.00 3,623.00 $3,511.00 $ 1.11.00 $ 1.441.00 61,397.00 $ 59,664.00 $ 57,680.00 $ 60,239.00 30 31 32 33 35 30 Property and equipment: Property and equpment Less accumulated depreciation Property and equipment, net $ 196,570.00 $ 197,867.00 $ 191,129.00 $ 188,054.00 S (U/,175.00) $ 193,009.00) $ 75,901.00) $ 171,599.00) $ 111,395.00 $ 114,518.00 $ 114,178.00 $ 116,510.00 37 39 40 Intangible and other assets: Goodwil Other Acces and deterred charges Problem $ $ 31,181.00 $ 18,242.00 $ 17.037.00 $ 16,695.00 14,812.00 $ 11,799.00 $ 9,921.00 $ 6,191.00 Type here to search O E- M RC 10 8:53 PM 11/10723 Aurinn Op FSA Procta 2020 () - Excel (Unlicensed Product p Search david badmus De Fle Home Insert Draw Page Layout Formulas Data Review View HSB Share Comments AS- A == 27 0 % X Cut Un Byte Copy Format Dan Clipboard Idees - A Wrap Text 3 Merge Can Alignment Conditional Formwiling Table Sortid F-Set Editing Fort Nunc Ideas D11 4 E F G G H 1 1 M N P o R s 37 38 39 Intangible and other assets: Goodwil Other assets and theferred charges Tutal assets S S $ 40 41 42 43 31,181.00 $ 1,2M2.00 $ 17,047.00 $ 16,695.00 14,822,00 $ 11,798.00 $ 9,921,00 $ 6.131.00 219,295,00 $ 204,522.00 $ 198,625,00 $ 199,501.00 45 46 47 LIABILITIES AND EQUITY Current abilities: Short-torm borrowings Accounts payable Accrued liabilities Auxud noorele Long-term debt clue within one year Obligations under capital lesses due within one year Total current abilities 48 49 $ $ S S S $ $ 5.225.00 $ 5.257.00 $ 1,099.00 $ 2,708.00 47,060.00 $ 46,042.00 $ 41,433.00 $ 3.487.00 22,159.00 $ 22,122.00 $ 20,554.00 $ 19,507.00 4201.00 S 545.00 921.00 $ 521.00 1.570.00 3.730.00 $ 2.230.00 $ 2,745.00 729.00 $ 607.00 $ 505.00 $ 351.00 77,477.00 $ 78,521.00 $ 66,928.00 $ 64,619.00 51 885## ### F B H 3 B ****85228868 53 54 Long-term debe long-term nigations under capitales Deleted income tes and other Total long-term abilities $ 43,520.00 $ 30,045.00 $ 36,015.00 $ 38,214.00 S 5,693.00 $ 6,780.00 $ f.003.09 $ 5.R16.00 S 11.081.00 $ 8.364.00 $9.344.00 $ 7,321.00 $ 62,184.00 $ 45,179.00 $ 51,362,00 $ 51,351.00 57 80 61 62 Equity Common stock Paid In Capital in excess of par value Retained Parnings & Accumulated other comprehensive income foss) Total Walmart shareholders' equity Norresteemeklemtonterest Tutal equity $ $ $ $ S 288.00 $ 293.00 $ 305.00 $ 317.00 2,965.00 $ 2,548.00 $ 2,371.00 $ 1,305.00 69,243.00 $ 74,976.00 $ 75,132.00 $ 7R.434.00 72.496.00 $ 77,864.00 $ 77,798.00 $ 10,916.00 7,130.00 $ 2,993.00 $ 2,737.00 $ 3,065.00 79,634,00 $ 20,522,00 $ 20,595.00 $ 83,611.00 $ Totallablities and equity $ $ 219,295.00 $ 204,522.00 $ 198,825.00 $ 199,581.00 37 69 69 70 Required: 1 Using information in Althe chapters in the textbook especially chapter 12, fil-in the formulas for the following raties 2. Calculate the ratios for Wal-1/artin 2019, 2018 and 2017 Fiscal years as provided in the table below 2 To prepare for the test, analyze the results (be able to explain what the numbers mean and compare between the two years) for various Liquidity, Profitability, Debt, Asset Management, and Stockholders' Reward ratios. 4 Take the Walmart FS4 Project Test on the day as stated in the course schedule. 3 Be prepared to answer analytical questions using the ratios above the comparing the ratlos in 2019, 2013, and 2017. TE 74 76 Problem Type here to search O E- R 10 3:53 PM 11/12) Aurinn FSA Procta 2020 () - Excel (Unlicensed Product Search david badmus De Fle Home Insert Draw Page Layout Formulas Data Review View Share Comments AS- A == 27 0 % X Cut Incom Format Panter Wrap Text 3 Merge Carles Idees - A Conditional Formwiling Table Sortid Slut Editing Clipboard Fort Alignment Number Dil 4 B C D E F H 1 J I M N P P o R s s 76 77 Fiscal Year Ended Jan 31. 2019 2018 2017 Analysis Ratio Formula 30 Liquidity Net Working Capital 81 82 Current ratio 34 Quick ratio Profitability Gross Prolit porcentage Net Income percentage 90 Debt Analysis Debt Ratio 91 92 Interest Coverage Ratio 93 94 Asset Management Analysis inventory Tumover 95 96 Days Sales in Inwentory 97 90 Accounts Receivable Tumover 99 100 Receivable Collection Period Problem Type here to search M RC 3:53 PM 11/8/2020 Aurinn FSA Procta 2020 () - Excel (Unlicensed Product Search david badmus Fle Home Insert Draw Page Layout Formulas Data Review View Hop Share Comments AS- A 27 O Pache X Cut Incom Format anter Clipboard Idees == Wrap Text === Morge Carte Aline A Conditional Formiling Tobie Sortid Fiscal Editing Fort Numer Ideas Dil B C D E F H 1 L M N P O R s s 01 92 Interest Coverage Ratio 93 94 Asset Management Analysis inventory Tumover 95 96 Days Sales-in-Inventory 97 94 Accounts Receivable Turnover 94 100 Receivable Collection Period 101 102 Rsturn on Assets 103 104 Total Asset Tumover 105 106 Fixed Asset Tumover 102 100 Stockholder's Reward Analysis Earnings Per Share 109 110 Dividends Per Share 111 112 Dividends Payout Ratio 113 114 Return on Equity 115 Problem Type here to search O M FC 10 3:53 PM 11/12 11/8/2020