Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Auron Inc, a US car manufacturing firm, expects to have cash inflow of 1 million in one year from exporting its products to the

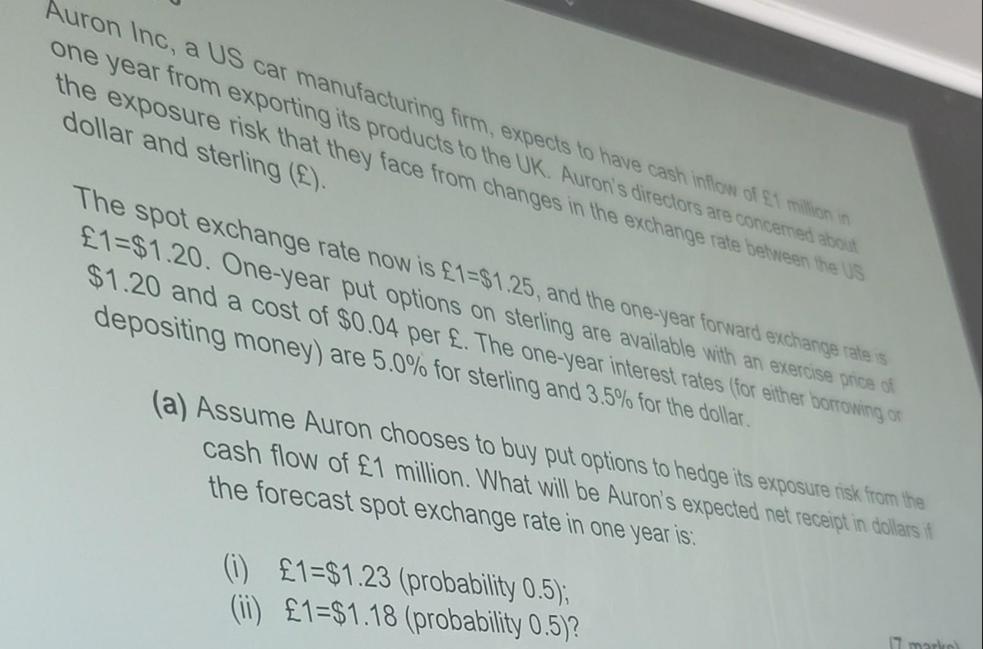

Auron Inc, a US car manufacturing firm, expects to have cash inflow of 1 million in one year from exporting its products to the UK. Auron's directors are concerned about the exposure risk that they face from changes in the exchange rate between the US dollar and sterling (). The spot exchange rate now is 1-$1.25, and the one-year forward exchange rate is 1-$1.20. One-year put options on sterling are available with an exercise price of $1.20 and a cost of $0.04 per . The one-year interest rates (for either borrowing or depositing money) are 5.0% for sterling and 3.5% for the dollar. (a) Assume Auron chooses to buy put options to hedge its exposure risk from the cash flow of 1 million. What will be Auron's expected net receipt in dollars if the forecast spot exchange rate in one year is: (1) 1=$1.23 (probability 0.5); (ii) 1-$1.18 (probability 0.5)? 17 marke)

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Aurons expected net receipt in dollars we need to consider the two scenarios provided a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started