Answered step by step

Verified Expert Solution

Question

1 Approved Answer

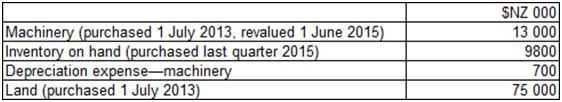

Aus Co Ltd has a foreign operation based in New Zealand. The following information was extracted from the foreign operation's accounts for the period ended

Aus Co Ltd has a foreign operation based in New Zealand. The following information was extracted from the foreign operation's accounts for the period ended 30 June 2015:

Exchange rate information is:

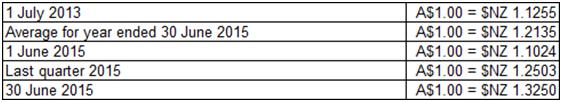

What is the amount at which each item will be translated (rounded to the nearest A$)?

2.

3.

4.

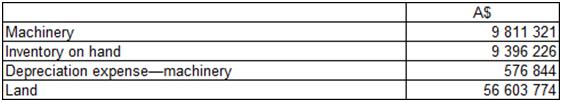

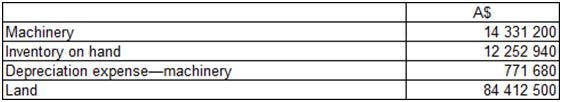

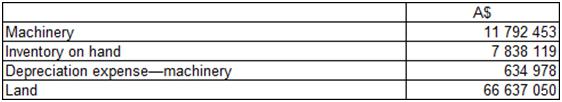

\begin{tabular}{|l|r|} \hline & SNZ 000 \\ \hline Machinery (purchased 1 July 2013, revalued 1 June 2015) & 13000 \\ \hline Inventory on hand (purchased last quarter 2015) & 9800 \\ \hline Depreciation expense-machinery & 700 \\ \hline Land (purchased 1 July 2013) & 75000 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline 1 July 2013 & AS1.00= SNZ 1.1255 \\ \hline Average for year ended 30 June 2015 & AS1.00=$N NZ 1.2135 \\ \hline 1 June 2015 & AS1.00= \$NZ 1.1024 \\ \hline Last quarter 2015 & AS1.00= \$NZ 1.2503 \\ \hline 30 June 2015 & AS1.00= SNZ 1.3250 \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline & AS \\ \hline Machinery & 17225000 \\ \hline Inventory on hand & 12985000 \\ \hline Depreciation expense-machinery & 849450 \\ \hline Land & 99375000 \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline & \multicolumn{1}{|c|}{ AS } \\ \hline Machinery & 9811321 \\ \hline Inventory on hand & 9396226 \\ \hline Depreciation expense-machinery & 576844 \\ \hline Land & 56603774 \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline & AS \\ \hline Machinery & 14331200 \\ \hline Inventory on hand & 12252940 \\ \hline Depreciation expense-machinery & 771680 \\ \hline Land & 84412500 \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline & AS \\ \hline Machinery & 11792453 \\ \hline Inventory on hand & 7838119 \\ \hline Depreciation expense-machinery & 634978 \\ \hline Land & 66637050 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started