Answered step by step

Verified Expert Solution

Question

1 Approved Answer

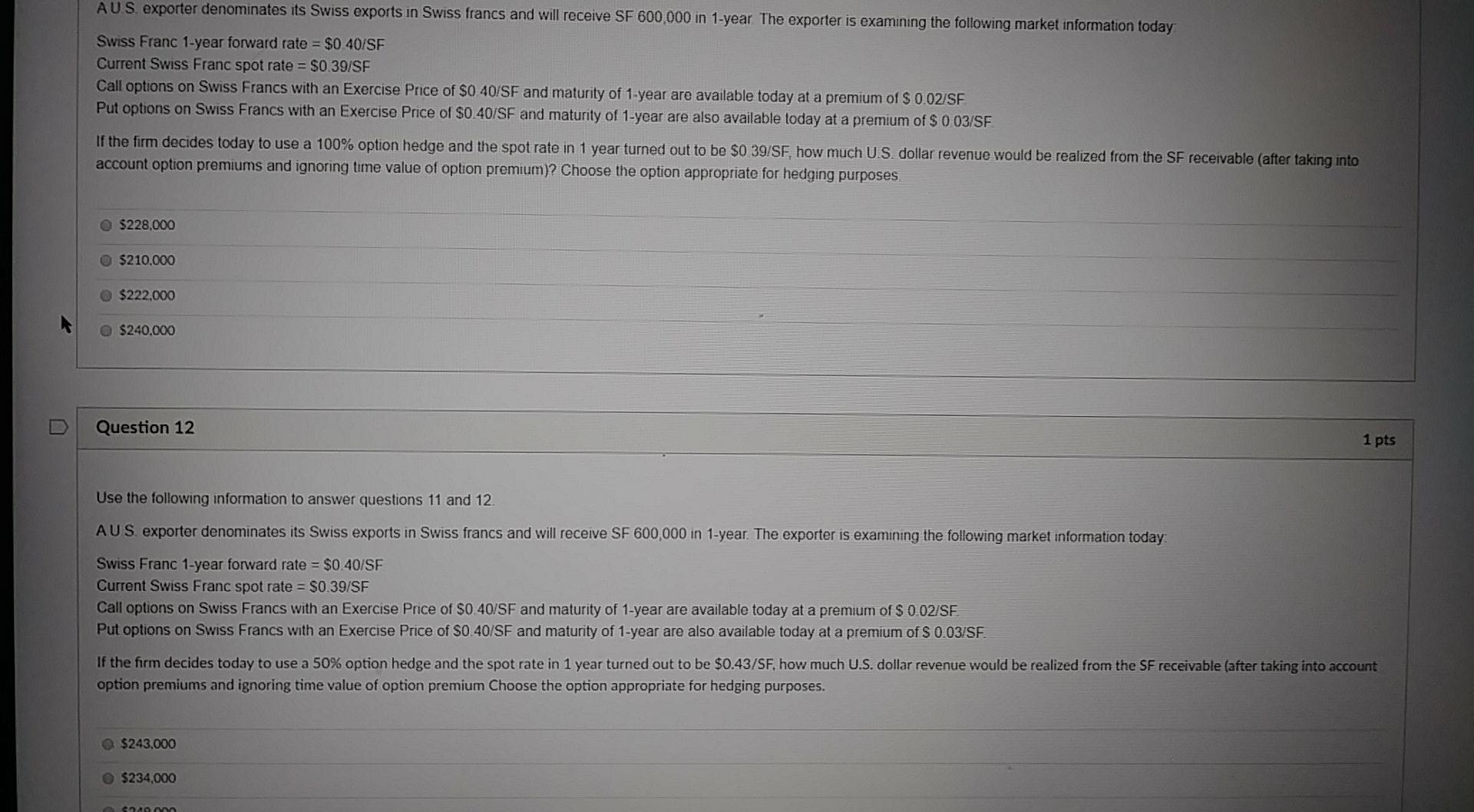

AUS exporter denominates its Swiss exports in Swiss francs and will receive SF 600,000 in 1-year The exporter is examining the following market information today

AUS exporter denominates its Swiss exports in Swiss francs and will receive SF 600,000 in 1-year The exporter is examining the following market information today Swiss Franc 1-year forward rate = $0.40/SF Current Swiss Franc spot rate = $0.39/SF Call options on Swiss Francs with an Exercise Price of $0 40/SF and maturity of 1 year are available today at a premium of $ 0.02/SF Put options on Swiss Francs with an Exercise Price of $0 40/SF and maturity of 1-year are also available today at a premium of $ 0 03/SF If the firm decides today to use a 100% option hedge and the spot rate in 1 year turned out to be $0 39/SF, how much U.S. dollar revenue would be realized from the SF receivable (after taking into account option premiums and ignoring time value of option premium)? Choose the option appropriate for hedging purposes O $228.000 O $210.000 $222.000 $240,000 Question 12 1 pts Use the following information to answer questions 11 and 12 AUS exporter denominates its Swiss exports in Swiss francs and will receive SF 600,000 in 1-year. The exporter is examining the following market information today Swiss Franc 1-year forward rate = $0.40/SF Current Swiss Franc spot rate = $0.39/SF Call options on Swiss Francs with an Exercise Price of $0.40/SF and maturity of 1-year are available today at a premium of $ 0.02/SF. Put options on Swiss Francs with an Exercise Price of SO 40/SF and maturity of 1-year are also available today at a premium of S 0.03/SF. If the firm decides today to use a 50% option hedge and the spot rate in 1 year turned out to be $0.43/SF. how much U.S. dollar revenue would be realized from the SF receivable (after taking into account option premiums and ignoring time value of option premium Choose the option appropriate for hedging purposes. $243,000 $234.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started