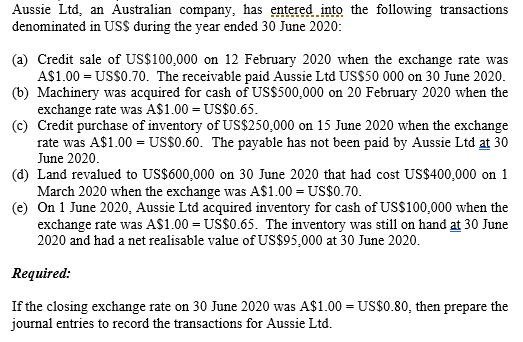

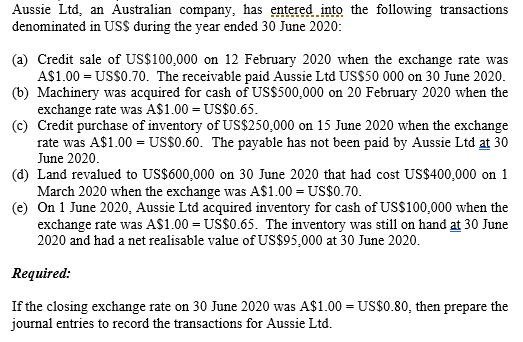

Aussie Ltd, an Australian company, has entered into the following transactions denominated in US$ during the year ended 30 June 2020: (a) Credit sale of US$100,000 on 12 February 2020 when the exchange rate was A$1.00 = US$0.70. The receivable paid Aussie Ltd US$50 000 on 30 June 2020. (b) Machinery was acquired for cash of US$500,000 on 20 February 2020 when the exchange rate was A$1.00 = US$0.65. ) Credit purchase of inventory of US$250,000 on 15 June 2020 when the exchange rate was A$1.00 = US$0.60. The payable has not been paid by Aussie Ltd at 30 June 2020. (d) Land revalued to US$600,000 on 30 June 2020 that had cost US$400,000 on 1 March 2020 when the exchange was A$1.00 = US$0.70. (e) On 1 June 2020. Aussie Ltd acquired inventory for cash of US$100,000 when the exchange rate was A$1.00 = US$0.65. The inventory was still on hand at 30 June 2020 and had a net realisable value of US$95,000 at 30 June 2020. Required: If the closing exchange rate on 30 June 2020 was A$1.00 = US$0.80, then prepare the journal entries to record the transactions for Aussie Ltd. Aussie Ltd, an Australian company, has entered into the following transactions denominated in US$ during the year ended 30 June 2020: (a) Credit sale of US$100,000 on 12 February 2020 when the exchange rate was A$1.00 = US$0.70. The receivable paid Aussie Ltd US$50 000 on 30 June 2020. (b) Machinery was acquired for cash of US$500,000 on 20 February 2020 when the exchange rate was A$1.00 = US$0.65. ) Credit purchase of inventory of US$250,000 on 15 June 2020 when the exchange rate was A$1.00 = US$0.60. The payable has not been paid by Aussie Ltd at 30 June 2020. (d) Land revalued to US$600,000 on 30 June 2020 that had cost US$400,000 on 1 March 2020 when the exchange was A$1.00 = US$0.70. (e) On 1 June 2020. Aussie Ltd acquired inventory for cash of US$100,000 when the exchange rate was A$1.00 = US$0.65. The inventory was still on hand at 30 June 2020 and had a net realisable value of US$95,000 at 30 June 2020. Required: If the closing exchange rate on 30 June 2020 was A$1.00 = US$0.80, then prepare the journal entries to record the transactions for Aussie Ltd