Aussie Replica Engines Limited (ABN 12 345 678 910) is registered for GST on an accrual basis. The company has already lodged their BAS for

Aussie Replica Engines Limited (ABN 12 345 678 910) is registered for GST on an accrual basis. The company has already lodged their BAS for the quarter ended 30 September 2021 and paid the outstanding liability of $36,480. The following month an error was discovered in which the following invoice was found to have the wrong tax code used:

15.09.21 Sale to New Zealand Train Tours 1 steam engine $220,000 GST

As this was an export sale there was no GST on this sale and the correct code should have been EXP. GST collected on the invoice was actually nil not $20,000 as recorded in the MYOB reports.

Aussie Replica Engines Limited wishes to lodge an amended BAS immediately to recover the overpaid GST. Listed below are the original values at the various labels on the September BAS.

- Fill up the third column to indicate what the new amended figures should be at each label when the amended BAS is prepared for lodgement.

BAS Label | September BAS lodged | Amended September BAS |

G1 | 1760000 |

|

G2 | 0 |

|

G10 | 55000 |

|

G11 | 1358720 |

|

1A | 160000 |

|

8A | 160000 |

|

1B | 123520 |

|

8B | 123520 |

|

9 | 36480 |

|

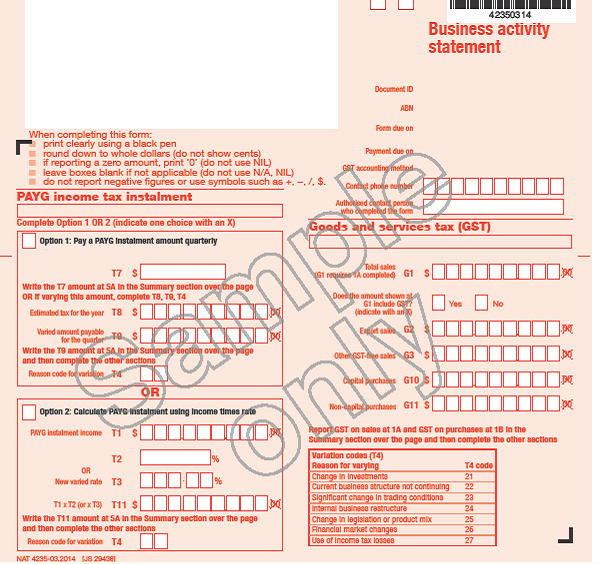

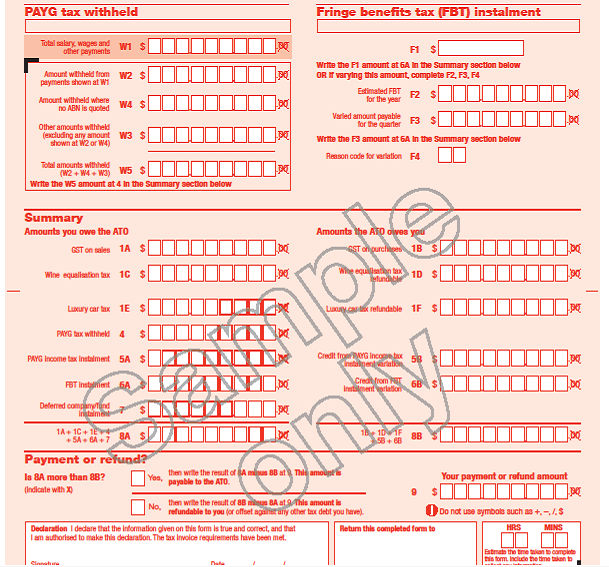

- Complete an amended paper BAS for Aussie Replica Engines Limited for the September 2021 quarter. A blank sample BAS form (C - Quarterly BAS) is attached.

When completing this form: print clearly using a black pen round down to whole dollars (do not show cents) if reporting a zero amount, print '0' (do not use NIL) leave boxes blank if not applicable (do not use N/A, NIL) do not report negative figures or use symbols such as +,-./. $. PAYG income tax instalment Complete Option 1 OR 2 (indicate one choice with an Option 1: Pay a PAYG Instalment amount quarterly T7 $ Write the 17 amount at SA In the Summary section over the page OR If varying this amount, complete T8, TO, T4 Estimated tax for the year T8 $ Varied amount payable TO $2 for the quarter Write the TO amount at SA In the Summary section over the page and then complete the other sections Reason code for varia OR Option 2: Calculate PAYG Instalment using income times rate PAYG instalment income T1 S T2 TNX OR New varied rate T3 % T1 x T2 (orx T3) T11 $ Write the T11 amount at 5A In the Summary section over the page and then complete the other sections Reason code for variation T4 NAT 4235-03.2014 [JS 294381 |DQ| L L Document ID ABN Form due on Payment due on GST accounting method on Conflict phone number Authoped conta person who completed the form Goods and services tax (GST) Total sales G1 requires A completed) G1 Does the amount shown at G1 include G (indicate with an Exet sal G2 42350314 Business activity statement Other GST-fige sales 63 $ Capital Purchaus G10, Non-pit purchases G11 S Yes Report GST on sales at 1A and GST on purchases at 18 In the Summary section over the page and then complete the other sections Variation codes (T4) Reason for varying Change in Investments Current business structure not continuing Significant change in trading conditions Internal business restructure Change in legislation or product mix Anancial market changes Use of income tax losses No T4 code 21 22 23 24 25 26 27 DE 8 JUT 8 8

Step by Step Solution

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To amend the BAS for Aussie Replica Engines Limited for the September 2021 quarter we need to adjust ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started