Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Aussie Yarn Co. is a U.S. producer of woolen yarn made from wool imported from Australia. Raw wool is processed, spun, and finished before

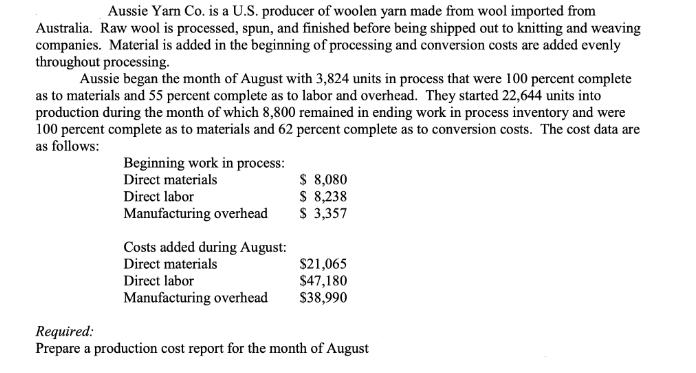

Aussie Yarn Co. is a U.S. producer of woolen yarn made from wool imported from Australia. Raw wool is processed, spun, and finished before being shipped out to knitting and weaving companies. Material is added in the beginning of processing and conversion costs are added evenly throughout processing. Aussie began the month of August with 3,824 units in process that were 100 percent complete as to materials and 55 percent complete as to labor and overhead. They started 22,644 units into production during the month of which 8,800 remained in ending work in process inventory and were 100 percent complete as to materials and 62 percent complete as to conversion costs. The cost data are as follows: Beginning work in process: Direct materials Direct labor Manufacturing overhead Costs added during August: Direct materials Direct labor Manufacturing overhead $ 8,080 $ 8,238 $ 3,357 $21,065 $47,180 $38,990 Required: Prepare a production cost report for the month of August

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare a production cost report for Aussie Yarn Co for the month of August youll need to calculate the equivalent units of production and the costs incurred Heres the production cost report Aussie Yarn Co Production Cost Report For the Month of August Equivalent Units of Production 1 Direct Materials Beginning Work in Process 100 complete 3824 units Started and Completed 22644 units Ending Work in Process 100 complete 8800 units Total Equivalent Units of Direct Materials 3824 22644 8800 35268 units 2 Direct Labor and Manufacturing Overhead Conversion Costs Beginning Work in Process 55 complete 3824 units 55 21032 equivalent units Started and Completed 22644 units Ending Work in Process 62 complete 8800 units 62 5456 equivalent units Total Equivalent Units of Conversion Costs 21032 22644 5456 302032 units Total Costs 1 Beginning Work in Process Direct Materials 8080 Direct Labor 8238 Manufacturing Overhead 3357 Total Beginning Work in Process Costs 8080 8238 3357 19675 2 Costs Added During August Direct Materials 21065 Direct Labor 47180 Manufacturing Overhead 38990 Total Costs Added During August 21065 47180 38990 107235 Costs Per Equivalent Unit Direct Materials Cost Per Equivalent Unit 107235 35268 304 per unit Conversion Costs Direct Labor and Manufacturing Overhead Cost Per Equivalent Unit 107235 302032 355 per unit Cost Assignment to Units 1 Beginning Work in Process Direct Materials 3824 units 304 1162896 Direct Labor 3824 units 355 1356020 Manufacturing Overhead 3824 units 355 1356020 Total Cost for Beginning Work in Process 1162896 Direct Materials 1356020 Direct Labor 1356020 Manufacturing Overhead 3874936 2 Started and Completed Direct Materials 22644 units 304 6882336 Direct Labor 22644 units 355 8027920 Manufacturing Overhead 22644 units 355 8027920 Total Cost for Started and Completed 6882336 Direct Materials 8027920 Direct Labor 8027920 Manufacturing Overhead 22938176 3 Ending Work in Process Direct Materials 8800 units 304 26752 Direct Labor 8800 units 355 31240 Manufacturing Overhead 8800 units 355 31240 Total Cost for Ending Work in Process 26752 Direct Materials 31240 Direct Labor 31240 Manufacturing Overhead 89232 Total Costs Accounted For Beginning Work in Process 3874936 Started and Completed 22938176 Ending Work in Process 89232 Total Costs Accounted For 3874936 22938176 89232 35736312 Reconciliation of Costs Total Costs Added During August 107235 Total Costs Accounted For 35736312 Overhead Overapplied 35736312 107235 25012812 This production cost report summarizes the equivalent units cost per equivalent unit and the cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started