Question

Austin Boston Corporation's Balance sheet for last year is presented below: Cash $400,000 Accounts recievable 2,000,000 Inventory 3,000,000 Fixed assets 3,600,000 Total assets $9,000,000 Accounts

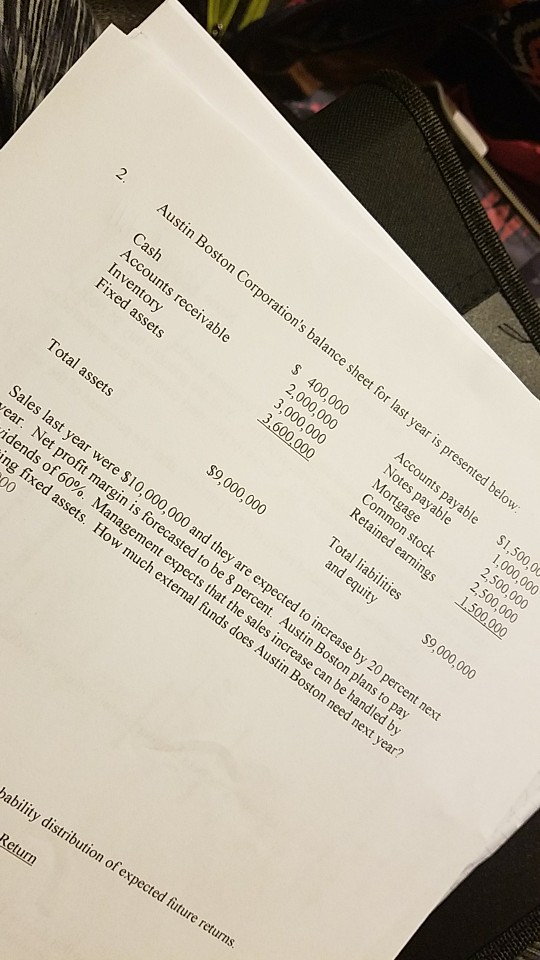

Austin Boston Corporation's Balance sheet for last year is presented below:

Cash $400,000

Accounts recievable 2,000,000

Inventory 3,000,000

Fixed assets 3,600,000

Total assets $9,000,000

Accounts payable $1,500,000

Notes payable 1,000,000

Mortgage 2,500,000

Common stock 2,500,000

Reatined Earnings 1,500,000

Total liabilities and equity $9,000,000

Sales last year were $10,000,000 and they are expected to increase by 20 percent next year. Net profit margin is forcasted to be 8%. Austin Boston plans to pay dividends of 60%. Management expects that the sales increase can be handled by exisisting fixed assets. How much external funds does Austin Boston need next year?

Austin B 0 gage assets year ng fix pects thatt Ston t year? ility distribut f expected futurStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started