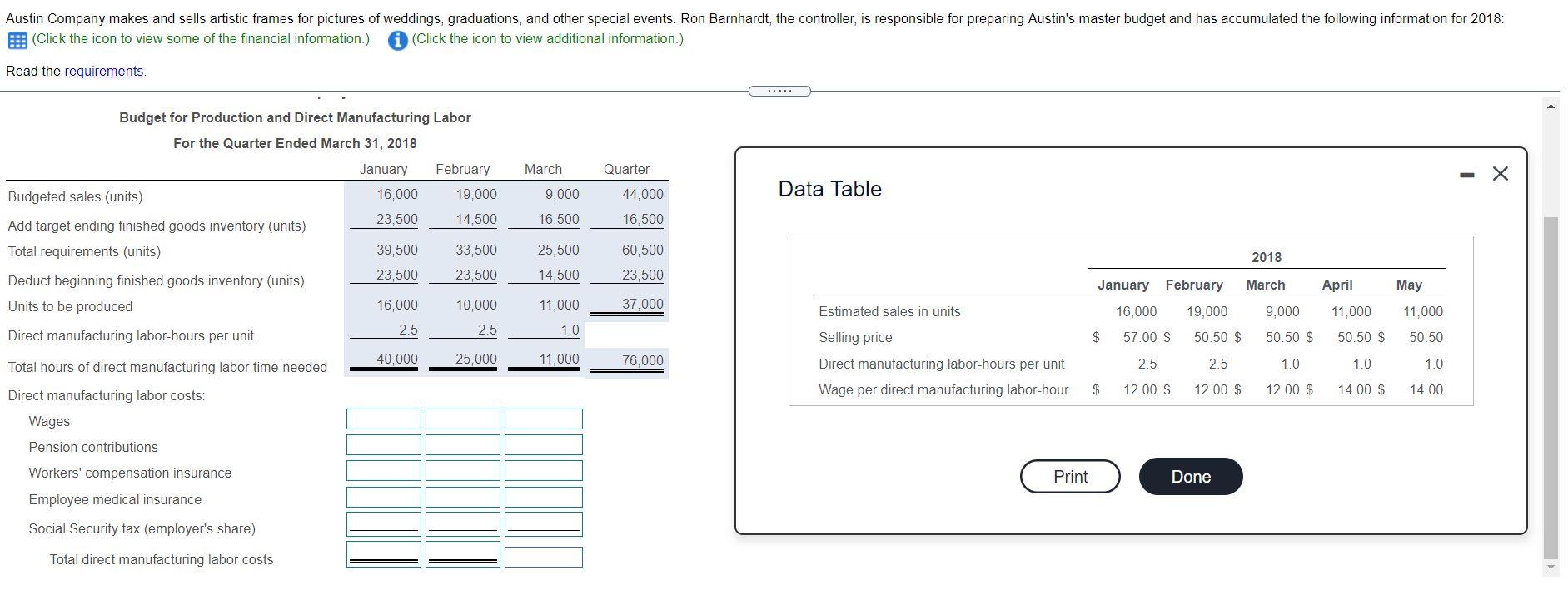

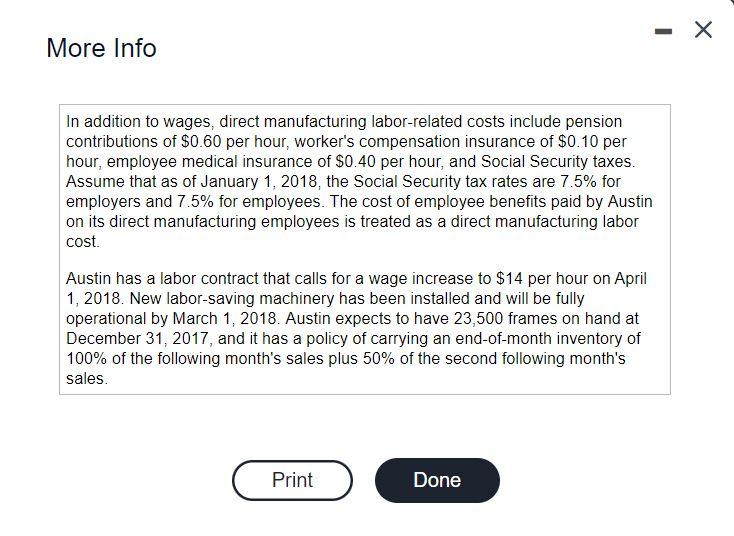

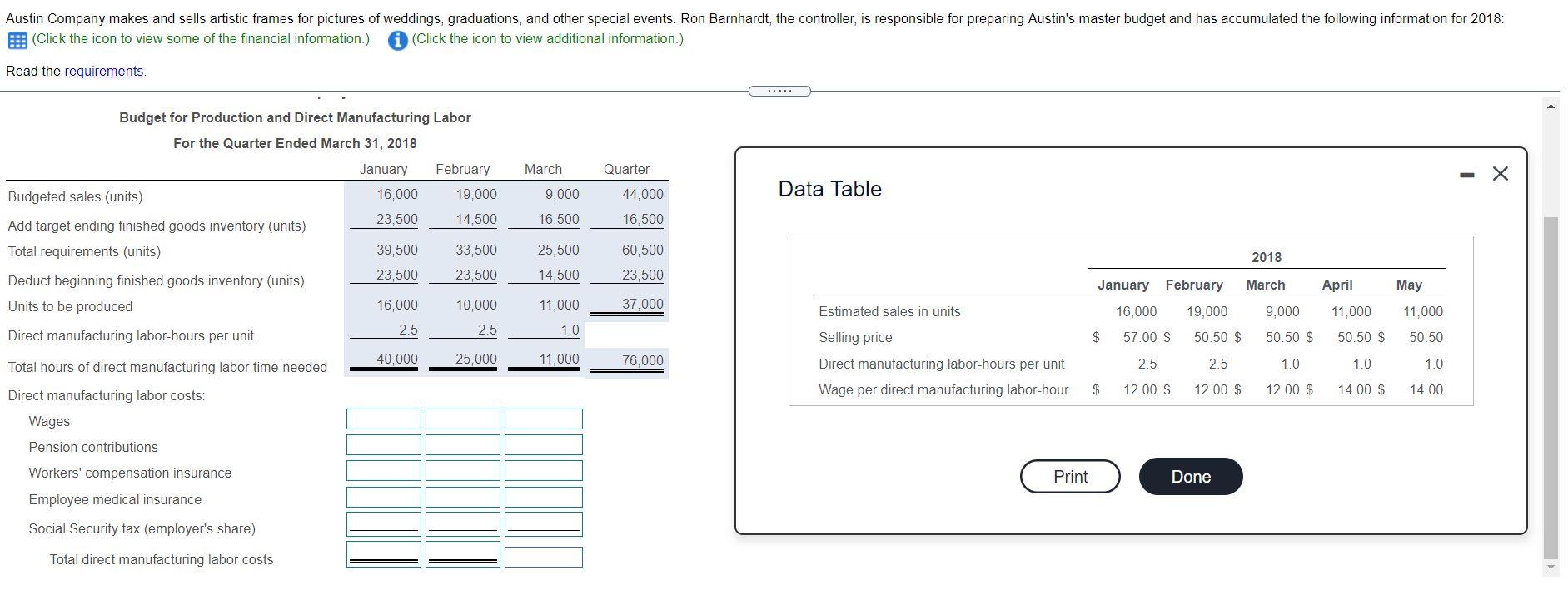

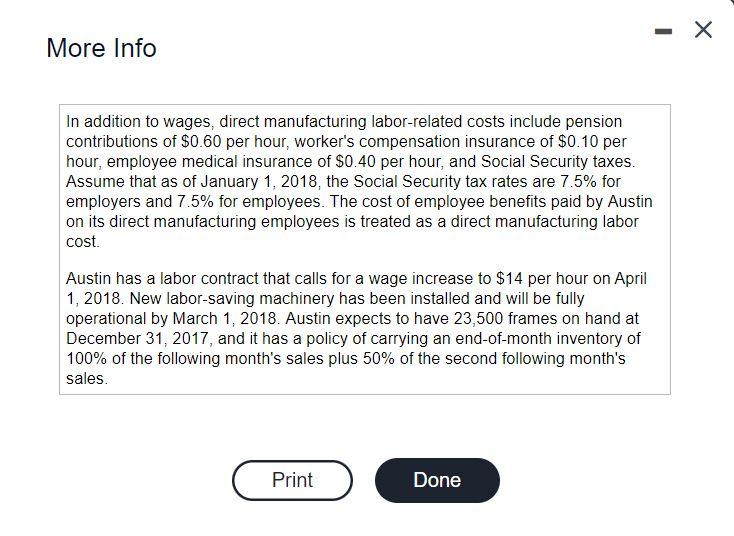

Austin Company makes and sells artistic frames for pictures of weddings, graduations, and other special events. Ron Barnhardt, the controller, is responsible for preparing Austin's master budget and has accumulated the following information for 2018: B (Click the icon to view some of the financial information.) (Click the icon to view additional information.) Read the requirements March Quarter - X 9,000 Data Table 44,000 16,500 16,500 Budget for Production and Direct Manufacturing Labor For the Quarter Ended March 31, 2018 January February Budgeted sales (units) 16,000 19,000 23,500 14,500 Add target ending finished goods inventory (units) Total requirements (units) 39,500 33,500 Deduct beginning finished goods inventory (units) 23,500 23,500 Units to be produced 16,000 10,000 2.5 2.5 Direct manufacturing labor-hours per unit 40.000 25,000 Total hours of direct manufacturing labor time needed Direct manufacturing labor costs: 25,500 60,500 2018 14,500 23,500 April May 11.000 37,000 Estimated sales in units January February March 16,000 19,000 9,000 $ 57.00 $ 50.50 $ 50.50 $ 11,000 11,000 1.0 50.50 $ 50.50 11,000 76,000 Selling price Direct manufacturing labor-hours per unit Wage per direct manufacturing labor-hour 2.5 2.5 1.0 1.0 1.0 $ 12.00 $ 12.00 $ 12.00 $ 14.00 $ 14.00 Wages Pension contributions Print Done Workers' compensation insurance Employee medical insurance Social Security tax (employer's share) Total direct manufacturing labor costs - More Info In addition to wages, direct manufacturing labor-related costs include pension contributions of $0.60 per hour, worker's compensation insurance of $0.10 per hour, employee medical insurance of $0.40 per hour, and Social Security taxes. Assume that as of January 1, 2018, the Social Security tax rates are 7.5% for employers and 7.5% for employees. The cost of employee benefits paid by Austin on its direct manufacturing employees is treated as a direct manufacturing labor cost. Austin has a labor contract that calls for a wage increase to $14 per hour on April 1, 2018. New labor-saving machinery has been installed and will be fully operational by March 1, 2018. Austin expects to have 23,500 frames on hand at December 31, 2017, and it has a policy of carrying an end-of-month inventory of 100% of the following month's sales plus 50% of the second following month's sales. Print Done