Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Australasian Ltd. produces two types of desks that are classified into two types as in-door and Out- door. The company uses a simple job-costing

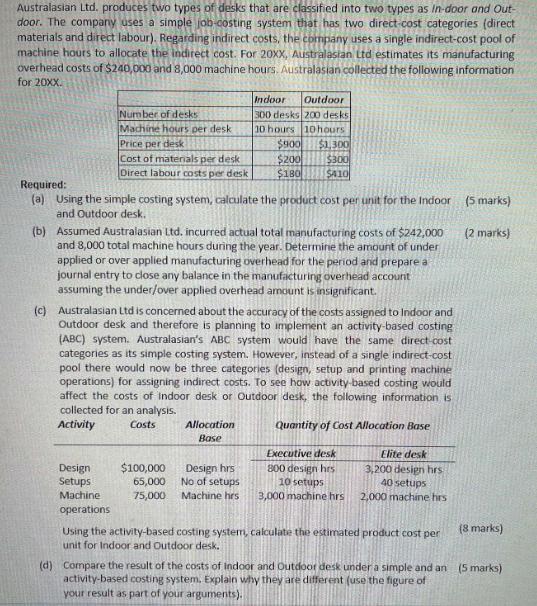

Australasian Ltd. produces two types of desks that are classified into two types as in-door and Out- door. The company uses a simple job-costing system that has two direct cost categories (direct materials and direct labour). Regarding indirect costs, the company uses a single indirect-cost pool of machine hours to allocate the indirect cost. For 20XX, Australasian Ltd estimates its manufacturing overhead costs of $240,000 and 8,000 machine hours. Australasian collected the following information for 20XX. Number of desks Machine hours per desk Price per desk Cost of materials per desk Direct labour costs per desk Required: (a) Using the simple costing system, calculate the product cost per unit for the Indoor and Outdoor desk. (b) Assumed Australasian Ltd. incurred actual total manufacturing costs of $242,000 and 8,000 total machine hours during the year. Determine the amount of under applied or over applied manufacturing overhead for the period and prepare a journal entry to close any balance in the manufacturing overhead account assuming the under/over applied overhead amount is insignificant. Design Setups Machine operations (c) Australasian Ltd is concerned about the accuracy of the costs assigned to Indoor and Outdoor desk and therefore is planning to implement an activity-based costing (ABC) system. Australasian's ABC system would have the same direct cost categories as its simple costing system. However, instead of a single indirect-cost pool there would now be three categories (design, setup and printing machine operations) for assigning indirect costs. To see how activity-based costing would affect the costs of Indoor desk or Outdoor desk, the following information is collected for an analysis. Activity Costs Quantity of Cost Allocation Base Executive desk 800 design hrs Elite desk 3,200 design hrs 40 setups 10 setups 3,000 machine hrs 2,000 machine hrs Indoor Outdoor 300 desks 200 desks 10 hours 10 hours $900 $1,300 $200 $300 $180 $410 $100,000 65,000 75,000 Allocation Base Design hrs No of setups Machine hrs Using the activity-based costing system, calculate the estimated product cost per unit for Indoor and Outdoor desk. (5 marks) (2 marks) (8 marks) (d) Compare the result of the costs of Indoor and Outdoor desk under a simple and an (5 marks) activity-based costing system. Explain why they are different (use the figure of your result as part of your arguments).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Product cost per unit for the Indoor desk using the simple costing system Total Direct Cost Cost of materials per desk Direct labour costs per desk Total Direct Cost 1300 180 1480 Manufacturing over...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started