Question

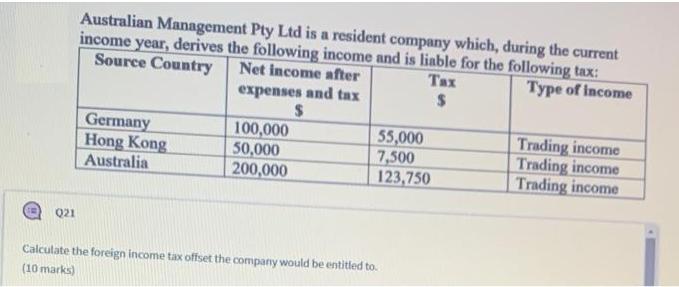

Australian Management Pty Ltd is a resident company which, during the current income year, derives the following income and is liable for the following

Australian Management Pty Ltd is a resident company which, during the current income year, derives the following income and is liable for the following tax: Source Country Net income after Type of income expenses and tax Germany Hong Kong Australia 100,000 50,000 200,000 55,000 7,500 123,750 Trading income Trading income Trading income Q21 Calculate the foreign income tax offset the company would be entitled to. (10 marks)

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Computation of taxable income including foreign sources As per the slab rates for 202122 the tax r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Accounting A Managerial Emphasis

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav

13th Edition

8120335643, 136126634, 978-0136126638

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App