Question

******AUSTRALIAN TAX LAW***** Required: Determine Lans taxable income, basic tax payable and liability to both the Medicare Levy and Medicare Levy surcharge by completing the

******AUSTRALIAN TAX LAW*****

Required:

Required:

Determine Lans taxable income, basic tax payable and liability to both the Medicare Levy and Medicare Levy surcharge by completing the following question set.

Complete Lans tax return using the following tax return extract.

1 Salary or wages

| PAYERs Australian Business Number | Tax Withheld $ | Income C $ |

| [input] | [input] | [input] |

2 Allowances, earnings tips, directors fees etc

| Tax Withheld $ | Income K $ |

| [input] | [input] |

5 Australian Government allowances and payments like Newstart, Youth Allowance, JobSeeker and Austudy payments

| Tax Withheld $ | Income A $ |

| [input] | [input] |

TOTAL TAX WITHHELD

| $[input] |

10 Gross interest

| Tax file number amounts withheld from gross interest M $ | Income L $ |

| [input] | [input] |

18 Capital gains

Did you have a capital gains tax event during the year?

| G | No | [input] | Yes | [input] |

Total current year capital gains

| H | $[input] |

Net capital losses carried forward to later income years

| V | $[input] |

Net capital gain

| A | $[input] |

TAXABLE INCOME OR LOSS

| $[input] |

Q6.Calculate Lans basic tax payable

Q7.Determine Lans liability for both the Medicare Levy and Medicare Levy surcharge

Q8.Reflect on the impact of the crypto-related activities on Lans tax payable

******AUSTRALIAN TAX LAW*****

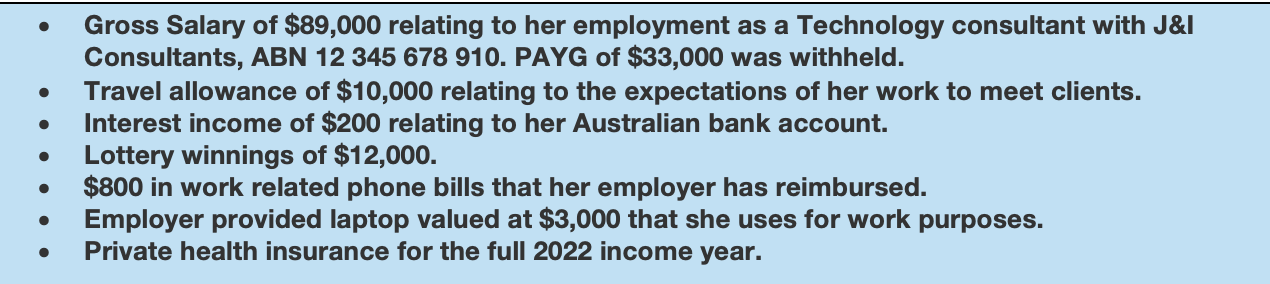

. . Gross Salary of $89,000 relating to her employment as a Technology consultant with J&I Consultants, ABN 12 345 678 910. PAYG of $33,000 was withheld. Travel allowance of $10,000 relating to the expectations of her work to meet clients. Interest income of $200 relating to her Australian bank account. Lottery winnings of $12,000. $800 in work related phone bills that her employer has reimbursed. Employer provided laptop valued at $3,000 that she uses for work purposes. Private health insurance for the full 2022 income year. . . . O . . Gross Salary of $89,000 relating to her employment as a Technology consultant with J&I Consultants, ABN 12 345 678 910. PAYG of $33,000 was withheld. Travel allowance of $10,000 relating to the expectations of her work to meet clients. Interest income of $200 relating to her Australian bank account. Lottery winnings of $12,000. $800 in work related phone bills that her employer has reimbursed. Employer provided laptop valued at $3,000 that she uses for work purposes. Private health insurance for the full 2022 income year. . . . OStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started