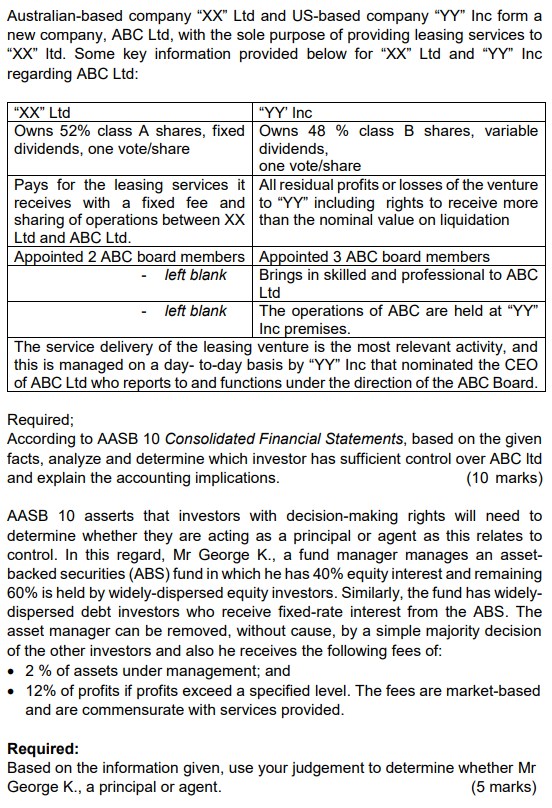

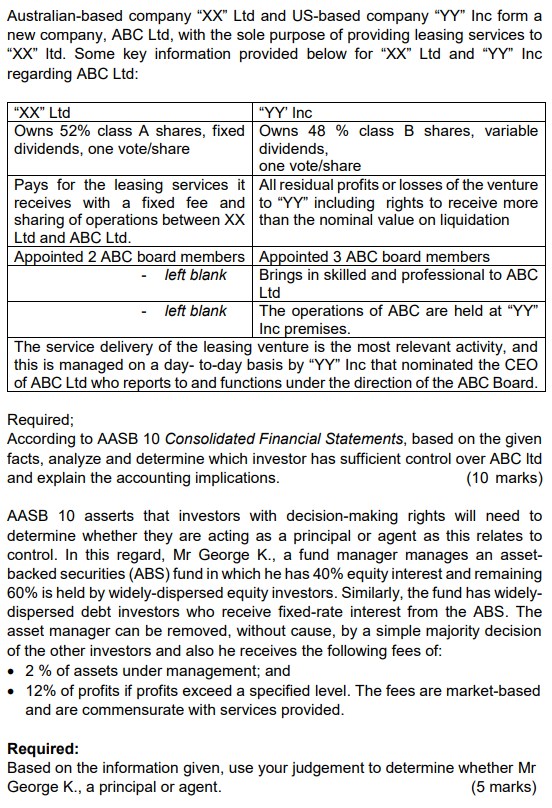

Australian-based company XX Ltd and US-based company YY" Inc form a new company, ABC Ltd, with the sole purpose of providing leasing services to "XX" Itd. Some key information provided below for "XX" Ltd and "YY" Inc regarding ABC Ltd: "XX" Ltd "YY' Inc Owns 52% class A shares, fixed Owns 48 % class B shares, variable dividends, one vote/share dividends, one vote/share Pays for the leasing services it All residual profits or losses of the venture receives with a fixed fee and to "YY" including rights to receive more sharing of operations between XX than the nominal value on liquidation Ltd and ABC Ltd. Appointed 2 ABC board members Appointed 3 ABC board members left blank Brings in skilled and professional to ABC Ltd left blank The operations of ABC are held at YY" Inc premises. The service delivery of the leasing venture is the most relevant activity, and this is managed on a day-to-day basis by YY" Inc that nominated the CEO of ABC Ltd who reports to and functions under the direction of the ABC Board. Required; According to AASB 10 Consolidated Financial Statements, based on the given facts, analyze and determine which investor has sufficient control over ABC Itd and explain the accounting implications. (10 marks) AASB 10 asserts that investors with decision-making rights will need to determine whether they are acting as a principal or agent as this relates to control. In this regard, Mr George K., a fund manager manages an asset- backed securities (ABS) fund in which he has 40% equity interest and remaining 60% is held by widely-dispersed equity investors. Similarly, the fund has widely- dispersed debt investors who receive fixed-rate interest from the ABS. The asset manager can be removed, without cause, by a simple majority decision of the other investors and also he receives the following fees of: 2% of assets under management; and 12% of profits if profits exceed a specified level. The fees are market-based and are commensurate with services provided. Required: Based on the information given, use your judgement to determine whether Mr George K., a principal or agent