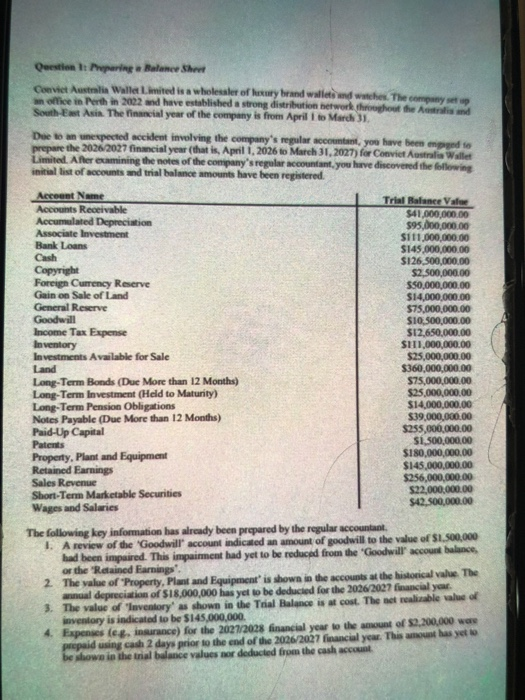

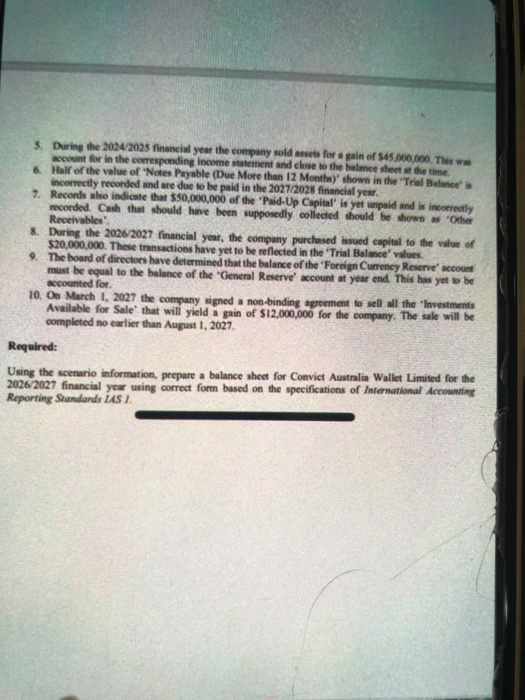

Australin Wallet imited is a wholessler of hexury brand walleto and watches. The company set op an office in Perth in 2022 and have established a strong distribution network throoghout the stralis and South-East Asia The financial year of the company is from April o March 31, Dee to an unexpected accident involving the company's regular accountant, you have beem prepare the 2026/2027 financial year (that is, April 1, 2026 to March 31,2027) for Convict Australia Wallet Limited. After examining the notes of the company'sregular accountant,you have discovered the initial list of accounts and trial balance amounts have been registered mpged to Acceent Name Accounts Receivable Trial Balance Vale $41,000,000.00 $95,000,000.00 111,000,000.00 $145,000,000.00 $126 500,000.00 $2,500,000.00 $50,000,000.00 $14,000,000.00 $75,000,000.00 $10.500,000.00 $12,650,000.00 $111,000,000.00 $25,000,000.00 $360,000,000.00 $75,000,000.00 $25,000,000.00 $14,000,000.00 $39000,000.00 $255,000,000.00 $1,500,000.00 $180,000,000.00 $145,000,000.00 $256,000,000.00 $22,000,000.00 Associate Investment Bank Loans Cash Foreign Currency Reserve Gain on Sale of Land General Reserve Income Tax Expense Inventory In vestments Available for Sale Land Long-Term Bonds (Due More than 12 Months) Long-Term Investment (Held to Maturity) Long-Term Pension Obligations Notes Payable (Due More than 12 Months Paid-Up Capital Patents Property, Plant and Equipment Retained Earnings Sales Revenue Short-Term Marketable Securities Wages and Salaries The following key information has already been propared by the regular accountaot. I. A review of the Goodwill account indicated an amount of goodwill to the value of $1.500,000 This impairment had yet to be reduced from the Goodwill account balance, 2. The value of Property, Plant and Equipment is showa in the accounts at the historical value The 3. The value of Iaventory' as shown in the Trial Balance is at cost. The act realizable valus of 4. Expenses (eg, insurance) for the 202028 financial year to the amount of $2.200000 was had been impaired. or the "Retained Earnings annual depreciation of S18,000,000 has yet to be deducied for the 2026/2027 financial yar inventory is indicatod to be $145,000,000 using cash 2 days prior to the end of the 2026/2027 financial year. This amount has yet e shown in the trial balance values nor deducted from the cash accot Australin Wallet imited is a wholessler of hexury brand walleto and watches. The company set op an office in Perth in 2022 and have established a strong distribution network throoghout the stralis and South-East Asia The financial year of the company is from April o March 31, Dee to an unexpected accident involving the company's regular accountant, you have beem prepare the 2026/2027 financial year (that is, April 1, 2026 to March 31,2027) for Convict Australia Wallet Limited. After examining the notes of the company'sregular accountant,you have discovered the initial list of accounts and trial balance amounts have been registered mpged to Acceent Name Accounts Receivable Trial Balance Vale $41,000,000.00 $95,000,000.00 111,000,000.00 $145,000,000.00 $126 500,000.00 $2,500,000.00 $50,000,000.00 $14,000,000.00 $75,000,000.00 $10.500,000.00 $12,650,000.00 $111,000,000.00 $25,000,000.00 $360,000,000.00 $75,000,000.00 $25,000,000.00 $14,000,000.00 $39000,000.00 $255,000,000.00 $1,500,000.00 $180,000,000.00 $145,000,000.00 $256,000,000.00 $22,000,000.00 Associate Investment Bank Loans Cash Foreign Currency Reserve Gain on Sale of Land General Reserve Income Tax Expense Inventory In vestments Available for Sale Land Long-Term Bonds (Due More than 12 Months) Long-Term Investment (Held to Maturity) Long-Term Pension Obligations Notes Payable (Due More than 12 Months Paid-Up Capital Patents Property, Plant and Equipment Retained Earnings Sales Revenue Short-Term Marketable Securities Wages and Salaries The following key information has already been propared by the regular accountaot. I. A review of the Goodwill account indicated an amount of goodwill to the value of $1.500,000 This impairment had yet to be reduced from the Goodwill account balance, 2. The value of Property, Plant and Equipment is showa in the accounts at the historical value The 3. The value of Iaventory' as shown in the Trial Balance is at cost. The act realizable valus of 4. Expenses (eg, insurance) for the 202028 financial year to the amount of $2.200000 was had been impaired. or the "Retained Earnings annual depreciation of S18,000,000 has yet to be deducied for the 2026/2027 financial yar inventory is indicatod to be $145,000,000 using cash 2 days prior to the end of the 2026/2027 financial year. This amount has yet e shown in the trial balance values nor deducted from the cash accot