Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Authentic Products is a maker of authentic metal toys sold in elite Toy Stores and by catalog in the US and Western Europe. Authentic

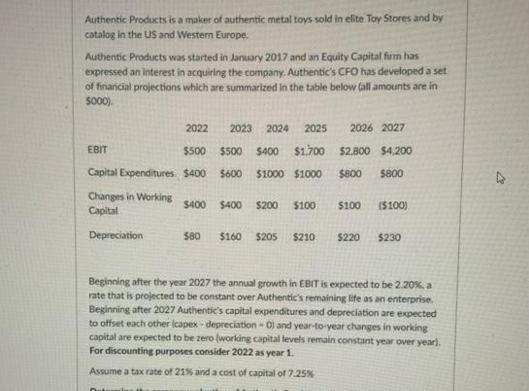

Authentic Products is a maker of authentic metal toys sold in elite Toy Stores and by catalog in the US and Western Europe. Authentic Products was started in January 2017 and an Equity Capital firm has expressed an interest in acquiring the company. Authentic's CFO has developed a set of financial projections which are summarized in the table below (all amounts are in 5000) EBIT Capital Expenditures $400 $600 $1000 $1000 $400 $400 $200 $100 Changes in Working Capital 2022 2023 2024 2025 2026 2027 $500 $500 $400 $1,700 $2,800 $4,200 $800 $800 Depreciation $80 $160 $205 $210 $100 ($100) $220 $230 Beginning after the year 2027 the annual growth in EBIT is expected to be 2.20%, a rate that is projected to be constant over Authentic's remaining life as an enterprise. Beginning after 2027 Authentic's capital expenditures and depreciation are expected to offset each other (capex-depreciation-0) and year-to-year changes in working capital are expected to be zero (working capital levels remain constant year over year). For discounting purposes consider 2022 as year 1. Assume a tax rate of 21% and a cost of capital of 7.25% 27 Determine the company valuation of Authentic Products using the NPV method and the cash flow information provided above.

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

NPV C0 C11r1 C21r2 Cn1rn C0 Initial investment C1 Cash flow in year 1 r Discount rate Year 1 C1 EBIT ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started