Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Auto Driver Ltd. (ADL) manufactures and sells automotive parts. ADL allocates manufacturing overhead to both of its customers based on machine hours. One of

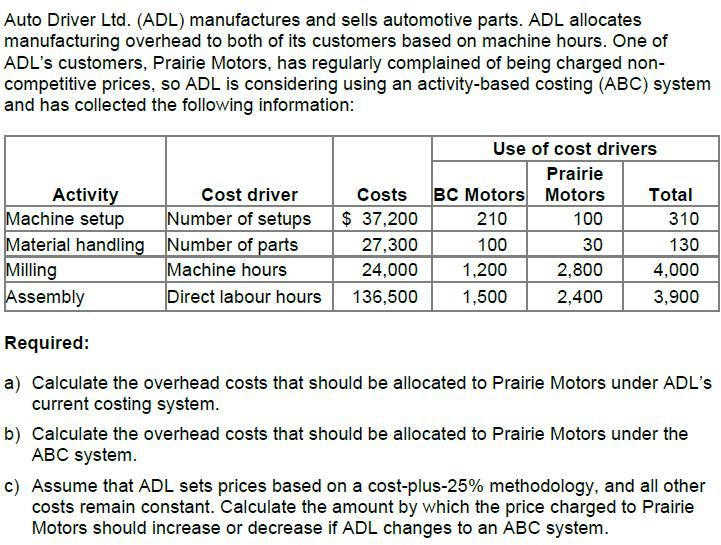

Auto Driver Ltd. (ADL) manufactures and sells automotive parts. ADL allocates manufacturing overhead to both of its customers based on machine hours. One of ADL's customers, Prairie Motors, has regularly complained of being charged non- competitive prices, so ADL is considering using an activity-based costing (ABC) system and has collected the following information: Use of cost drivers Prairie BC Motors Motors Activity Machine setup Material handling Number of parts Milling Assembly Cost driver Costs Total Number of setups $ 37,200 210 100 310 27,300 100 30 130 Machine hours Direct labour hours 24,000 1,200 2,800 4,000 136,500 1,500 2,400 3,900 Required: a) Calculate the overhead costs that should be allocated to Prairie Motors under ADL's current costing system. b) Calculate the overhead costs that should be allocated to Prairie Motors under the ABC system. c) Assume that ADL sets prices based on a cost-plus-25% methodology, and all other costs remain constant. Calculate the amount by which the price charged to Prairie Motors should increase or decrease if ADL changes to an ABC system.

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Page Date Pseiriemotor CoSt Data Presented in Tabular foem BCMotors Cast Ddiveg U...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started