Answered step by step

Verified Expert Solution

Question

1 Approved Answer

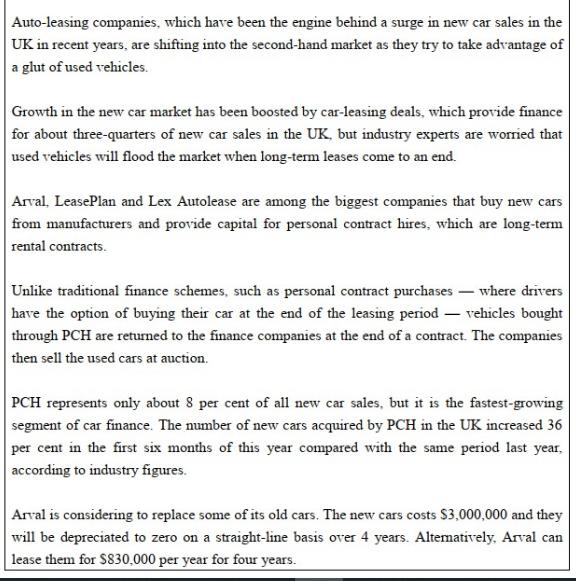

Auto-leasing companies, which have been the engine behind a surge in new car sales in the UK in recent years, are shifting into the

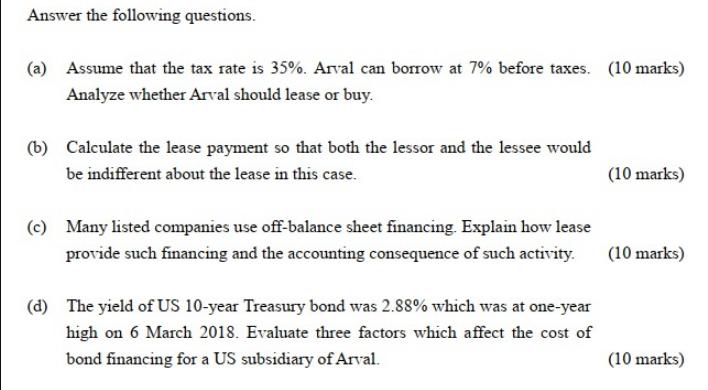

Auto-leasing companies, which have been the engine behind a surge in new car sales in the UK in recent years, are shifting into the second-hand market as they try to take advantage of a glut of used vehicles. Growth in the new car market has been boosted by car-leasing deals, which provide finance for about three-quarters of new car sales in the UK, but industry experts are worried that used vehicles will flood the market when long-term leases come to an end. Arval, LeasePlan and Lex Autolease are among the biggest companies that buy new cars from manufacturers and provide capital for personal contract hires, which are long-term rental contracts. Unlike traditional finance schemes, such as personal contract purchases where drivers have the option of buying their car at the end of the leasing period vehicles bought through PCH are returned to the finance companies at the end of a contract. The companies then sell the used cars at auction. PCH represents only about 8 per cent of all new car sales, but it is the fastest-growing segment of car finance. The number of new cars acquired by PCH in the UK increased 36 per cent in the first six months of this year compared with the same period last year, according to industry figures. Arval is considering to replace some of its old cars. The new cars costs $3,000,000 and they will be depreciated to zero on a straight-line basis over 4 years. Alternatively, Arval can lease them for $830,000 per year for four years. Answer the following questions. (a) Assume that the tax rate is 35%. Arval can borrow at 7% before taxes. (10 marks) Analyze whether Arval should lease or buy. (b) Calculate the lease payment so that both the lessor and the lessee would be indifferent about the lease in this case. (c) Many listed companies use off-balance sheet financing. Explain how lease provide such financing and the accounting consequence of such activity. (d) The yield of US 10-year Treasury bond was 2.88% which was at one-year high on 6 March 2018. Evaluate three factors which affect the cost of bond financing for a US subsidiary of Arval. (10 marks) (10 marks) (10 marks)

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Option 1 Purchase Cost 3000000 upfront investment Depreciation 750000 per year 3000000 4 years Resid...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started