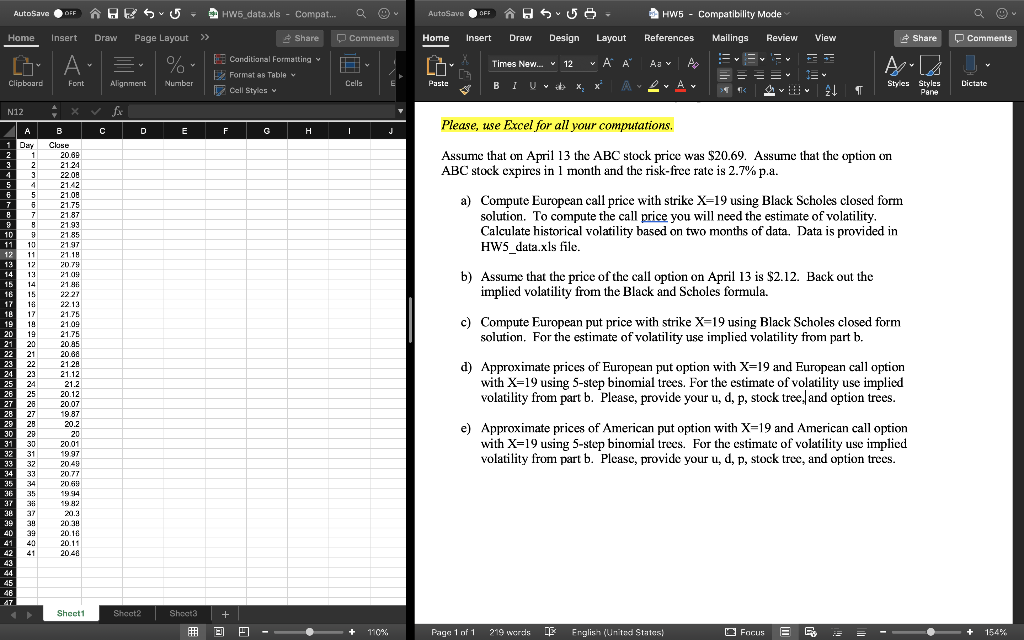

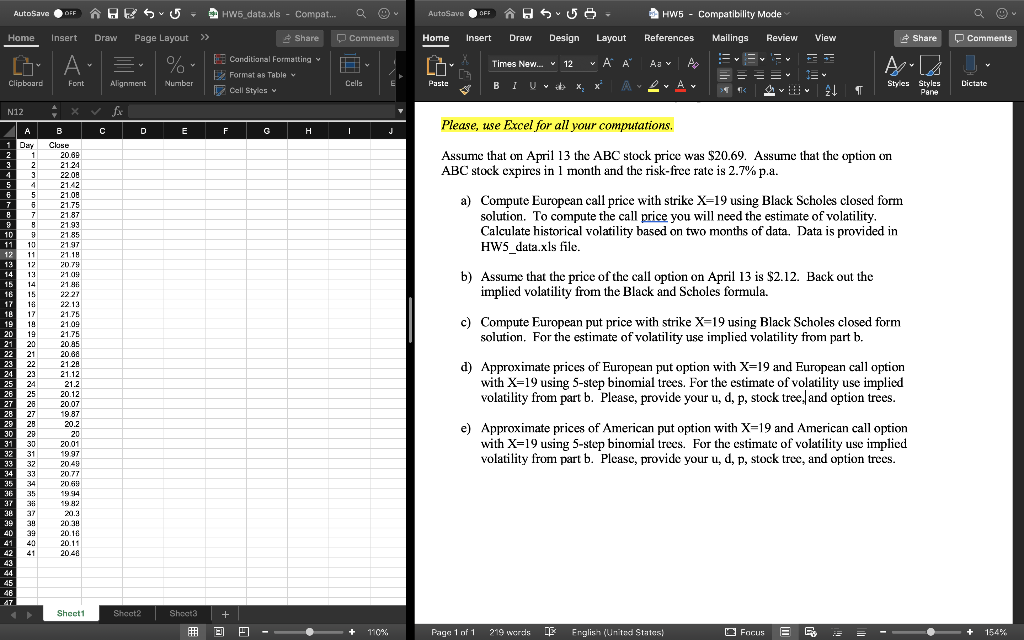

AutoSave A - Q OY Home Comments Share Comments Insert A Font HW5_data.xls - Compat... Share E Conditional Formatting E Format as Table Cell Styles Draw Page Layout >> % Alignment Number AutoSave $ 5 HW5 - Compatibility Mode Home Insert Draw Design Layout References Mailings Review View Times New... 12 AA AB AE F Paste B1 Vit X, X A A AB ALT L Clipboard L3 By Cells Styles Styles Pane Dictate N12 x fe Please, use Excel for all your computations, Close 1 Day 2 1 32 20.89 21 24 22.01 Assume that on April 13 the ABC stock price was $20.69. Assume that the option on ABC stock expires in 1 month and the risk-free rate is 2.7% p.a. 54 a) Compute European call price with strike X=19 using Black Scholes closed form solution. To compute the call price you will need the estimate of volatility, Calculate historical volatility based on two months of data. Data is provided in HW5_data.xls file. 11 10 13 12 15 14 21.08 21.75 21.87 2193 21 85 2197 2118 20.78 21.018 21.48 22 27 22.12 21.75 21.09 21.75 20 85 20.88 2126 21.12 21.2 b) Assume that the price of the call option on April 13 is $2.12. Back out the implied volatility from the Black and Scholes formula. **** 10 20 19 c) Compute European put price with strike X=19 using Black Scholes closed form solution. For the estimate of volatility use implied volatility from part b. 22 23 NNNNNNNNN d) Approximate prices of European put option with X=19 and European call option with X=19 using 5-step binomial trees. For the estimate of volatility use implied volatility from part b. Please, provide your u, d, p, stock tree and option trees. 20.12 20.07 1987 27 28 202 e) Approximate prices of American put option with X=19 and American call option with X=19 using 5-step binomial trees. For the estimate of volatility use implied volatility from part b. Please, provide your u, d, p, stock tree, and option trees. 31 32 33 34 35 365 37 39 31 32 33 35 38 2001 1997 2048 20.77 20.69 1914 1982 20.3 2034 20.16 20.11 2048 39 40 *** 39 39 42 41 46 47 Sheet1 Sheet2 + Shocta I! 2 2 - + 110% Page 1 of 1 219 wurde E English (United States Focus E E E - + 154% AutoSave A - Q OY Home Comments Share Comments Insert A Font HW5_data.xls - Compat... Share E Conditional Formatting E Format as Table Cell Styles Draw Page Layout >> % Alignment Number AutoSave $ 5 HW5 - Compatibility Mode Home Insert Draw Design Layout References Mailings Review View Times New... 12 AA AB AE F Paste B1 Vit X, X A A AB ALT L Clipboard L3 By Cells Styles Styles Pane Dictate N12 x fe Please, use Excel for all your computations, Close 1 Day 2 1 32 20.89 21 24 22.01 Assume that on April 13 the ABC stock price was $20.69. Assume that the option on ABC stock expires in 1 month and the risk-free rate is 2.7% p.a. 54 a) Compute European call price with strike X=19 using Black Scholes closed form solution. To compute the call price you will need the estimate of volatility, Calculate historical volatility based on two months of data. Data is provided in HW5_data.xls file. 11 10 13 12 15 14 21.08 21.75 21.87 2193 21 85 2197 2118 20.78 21.018 21.48 22 27 22.12 21.75 21.09 21.75 20 85 20.88 2126 21.12 21.2 b) Assume that the price of the call option on April 13 is $2.12. Back out the implied volatility from the Black and Scholes formula. **** 10 20 19 c) Compute European put price with strike X=19 using Black Scholes closed form solution. For the estimate of volatility use implied volatility from part b. 22 23 NNNNNNNNN d) Approximate prices of European put option with X=19 and European call option with X=19 using 5-step binomial trees. For the estimate of volatility use implied volatility from part b. Please, provide your u, d, p, stock tree and option trees. 20.12 20.07 1987 27 28 202 e) Approximate prices of American put option with X=19 and American call option with X=19 using 5-step binomial trees. For the estimate of volatility use implied volatility from part b. Please, provide your u, d, p, stock tree, and option trees. 31 32 33 34 35 365 37 39 31 32 33 35 38 2001 1997 2048 20.77 20.69 1914 1982 20.3 2034 20.16 20.11 2048 39 40 *** 39 39 42 41 46 47 Sheet1 Sheet2 + Shocta I! 2 2 - + 110% Page 1 of 1 219 wurde E English (United States Focus E E E - + 154%