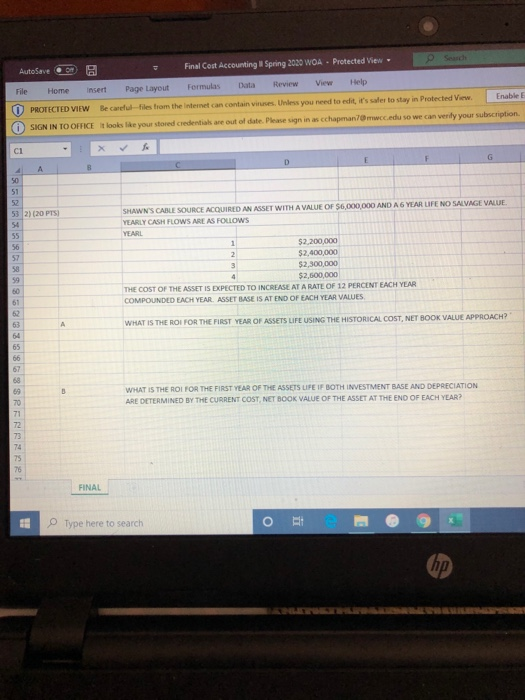

AutoSave B R - Final Cost Accounting Spring 2020 WOA. Protected View Sands File Home Insert Page Layout Formulas Data Review View Help PROTECTED VIEW Be carefules from the Internet can contain vies. Unless you need to edit is water to stay in Protected View Enable SIGN IN TO OFFICE it looks like your stored credentials are out of date. Please sign in as chan c ed so we can verify your subscription SHAWNS CABLE SOURCE ACQUIRED AN ASSET WITH A VALUE OF 56 000 000 AND A 6 VAR LIFE NO SALVAGE VALUE YEARLY CASH FLOWS ARE AS FOLLOWS YEARL 52200 000 $2,400,000 $2.300000 $2.500.000 THE COST OF THE ASSET IS EXPECTED TO INCREASE AT A RATE OF 12 PERCENT EACH YEAR COMPOUNDED EACH YEAR ASSET BASE IS AT END OF EACH YEAR VALUES REIROS 5338 SS3 SREBRER WHAT IS THE ROI FOR THE FIRST YEAR OF ASSETS LIFE USING THE HISTORICAL COST, NET BOOK VALUE APPROACH? WHAT IS THE ROI FOR THE FIRST YEAR OF THE ASSETS UFEIF BOTH INVESTMENT BASE AND DEPRECIATION ARE DETERMINED BY THE CURRENT COST NET SOOK VALUE OF THE ASSET AT THE END OF EACH YEAR? Type here to search AutoSave B R - Final Cost Accounting Spring 2020 WOA. Protected View Sands File Home Insert Page Layout Formulas Data Review View Help PROTECTED VIEW Be carefules from the Internet can contain vies. Unless you need to edit is water to stay in Protected View Enable SIGN IN TO OFFICE it looks like your stored credentials are out of date. Please sign in as chan c ed so we can verify your subscription SHAWNS CABLE SOURCE ACQUIRED AN ASSET WITH A VALUE OF 56 000 000 AND A 6 VAR LIFE NO SALVAGE VALUE YEARLY CASH FLOWS ARE AS FOLLOWS YEARL 52200 000 $2,400,000 $2.300000 $2.500.000 THE COST OF THE ASSET IS EXPECTED TO INCREASE AT A RATE OF 12 PERCENT EACH YEAR COMPOUNDED EACH YEAR ASSET BASE IS AT END OF EACH YEAR VALUES REIROS 5338 SS3 SREBRER WHAT IS THE ROI FOR THE FIRST YEAR OF ASSETS LIFE USING THE HISTORICAL COST, NET BOOK VALUE APPROACH? WHAT IS THE ROI FOR THE FIRST YEAR OF THE ASSETS UFEIF BOTH INVESTMENT BASE AND DEPRECIATION ARE DETERMINED BY THE CURRENT COST NET SOOK VALUE OF THE ASSET AT THE END OF EACH YEAR? Type here to search