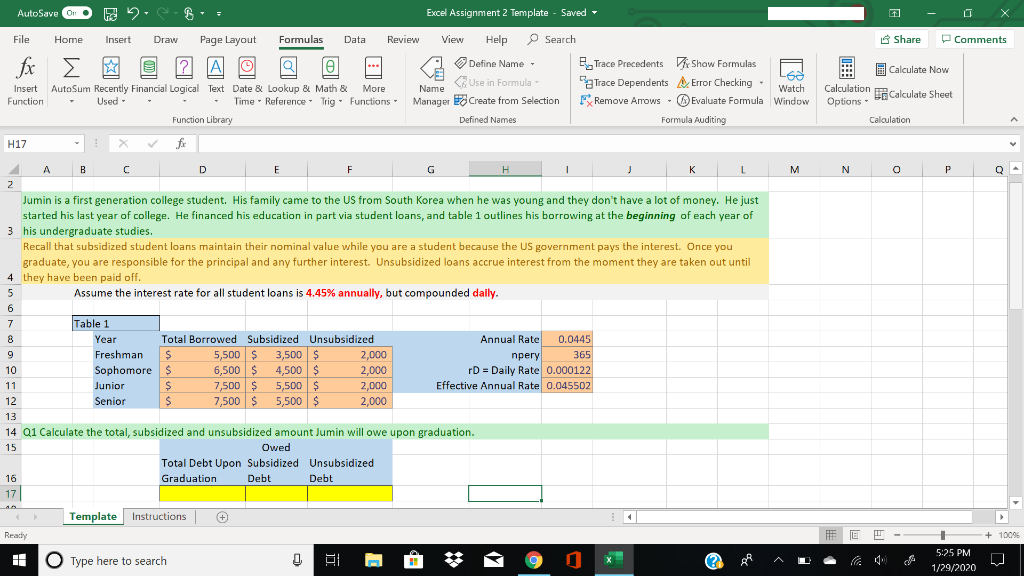

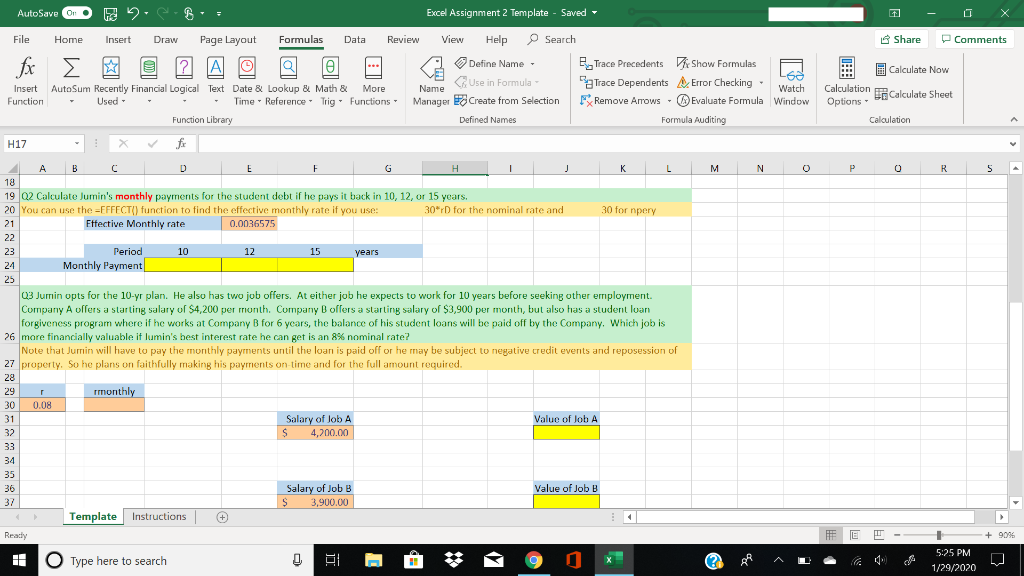

AutoSave C 9 .8.: Excel Assignment 2 Template - Saved @ ? A @ @ @ Share Comments e Calculate Now Calculation calculate Sheet Options Calculation File Home Insert Draw Page Layout Formulas Data Review View Help Search fx 3 Trace Precedents Show Formulas D Use in Formula PaTrace Dependents Insert AutoSum Recently Financial Logical Text Date & Lookup & Math & More Error Checking Name Watch Function - Used . . . . Time Reference Trig functions Manager Create from Selection Remove Arrows - Evaluate Formula Window Function Library Defined Names Formula Auditing H17 : X fire A B C D E F G H I J K L M 2 Jumin is a first generation college student. His family came to the US from South Korea when he was young and they don't have a lot of money. He just started his last year of college. He financed his education in part via student loans, and table 1 outlines his borrowing at the beginning of each year of 3 his undergraduate studies. Recall that subsidized student loans maintain their nominal value while you are a student because the US government pays the interest. Once you graduate, you are responsible for the principal and any further interest. Unsubsidized loans accrue interest from the moment they are taken out until 4 they have been paid off. Assume the interest rate for all student loans is 4.45% annually, but compounded daily. N O P QA Table 1 Year Total Borrowed Subsidized Unsubsidized Freshman $ 5,500 $ 3,500 $ 2,000 Sophomore $ 6,500 $ 4,500 $ 2,000 Junior 7,500 $ 5,500 $ 2,000 Senior 7,500 $ 5,500 $ 2,000 Annual Rate 0.0445 npery 365 rD = Daily Rate 0.000122 Effective Annual Rate 0.045502 11 12 13 14 Q1 Calculate the total, subsidized and unsubsidized amount Jumin will owe upon graduation 15 Owed Total Debt Upon Subsidized Unsubsidized 16 Graduation Debt Debt 17| Template Instructions | Ready # E E - + 100% Type here to search 5:25 PM 1/29/2020 W AutoSave C 9 .8.: Excel Assignment 2 Template - Saved Share Comments File fx Insert Function Home Insert Draw Page Layout Formulas Data Review View Help Search 3 Define Name - Trace Precedents Show Formulas F PaTrace Dependents AutoSum Recently Financial Logical Text Date & Lookup & Math & More Name Use in Formula Error Checking Watch - Used - - - Time - Reference - Trig - Functions Manager Create from Selection Remove Arrows - Evaluate Formula Window Function Library Defined Names Formula Auditing @ ? A @ @ @ Calculate Now Calculation calculate Sheet Options Calculation K L M N O P R S H17 A B C D J 18 19 Q2 Calculate Jumin's monthly payments for the student debt if he pays it back in 10, 12, or 15 years. 20 You can use the =EFFECT() function to find the effective monthly rate if you use: 30*r for the nominal rate and Effective Monthly rate 0.0036575 30 for pery 10 - 12 15 years Period Monthly Payment 03 Jumin opts for the 10-yr plan. He also has two job offers. At either job he expects to work for 10 years before seeking other employment. Company A offers a starting salary of $4,200 per month. Company B offers a starting salary of $3,900 per month, but also has a student loan forgiveness program where if he works at Company B for 6 years, the balance of his student loans will be paid off by the Company. Which job is 26 mare financially valuable it lumin's best interest rate he can get is an 8% nominal rate? Note that Jurrin will have to pay the monthly payments until the loan is paid off or he may be subject to negative credit events and reposession of 27 property. So he plans on faithfully making his payments on time and for the full amount required. 28 monthly 30 0.08 Salary of Job Value of lobA $ 4,700.00 Value of Job B Salary of Job B $ 3,900.00 Template Instructions Ready F E -_ + 90% 5:25 PM O Type here to search 1/29/2020 0 W