Answered step by step

Verified Expert Solution

Question

1 Approved Answer

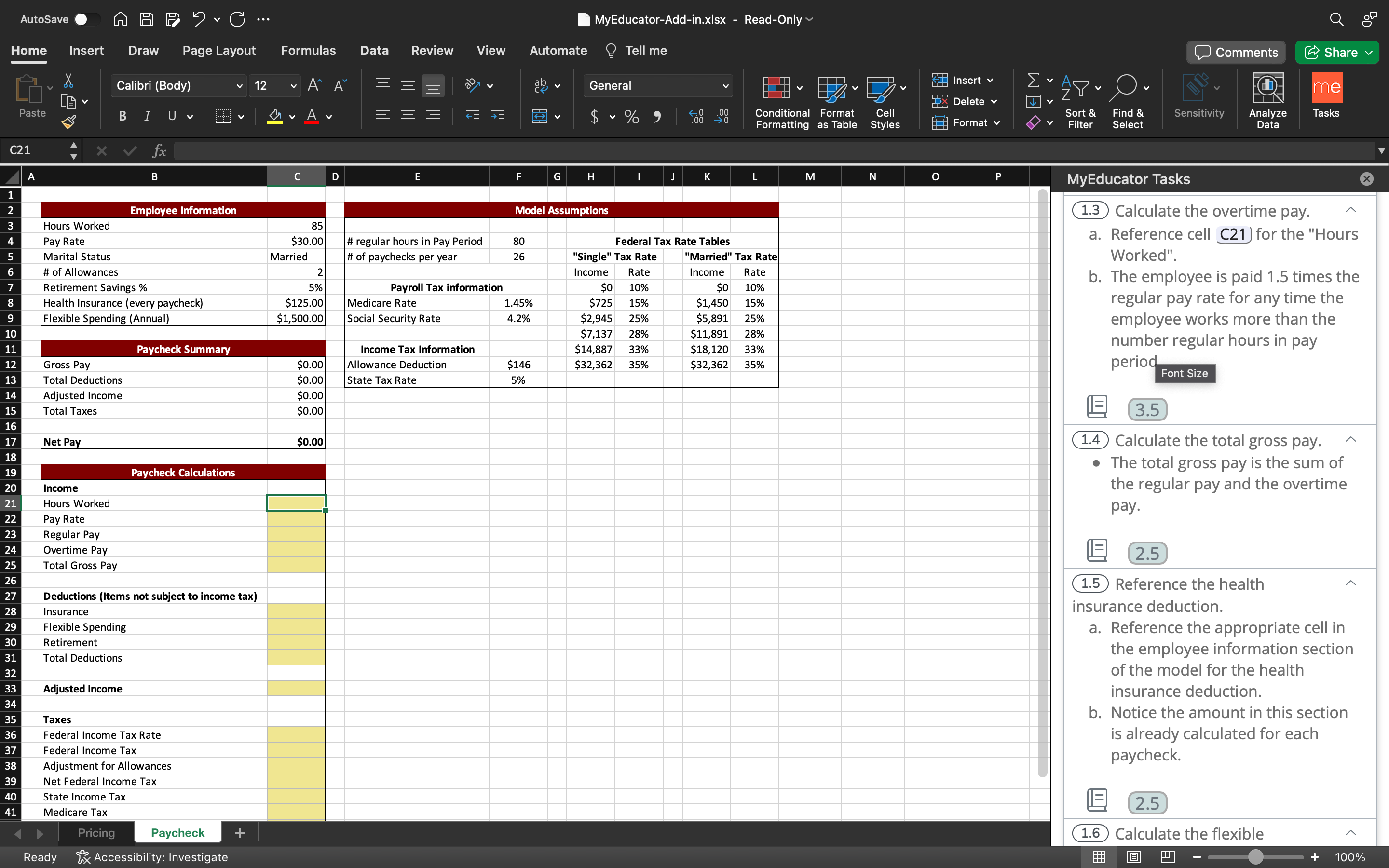

AutoSave C Home Insert Draw Page Layout Formulas G X Calibri (Body) 12 Paste B I U A C21 fx B Data Review View

AutoSave C Home Insert Draw Page Layout Formulas G X Calibri (Body) 12 Paste B I U A C21 fx B Data Review View Automate MyEducator-Add-in.xlsx - Read-Only Tell me General $ % 9 0 .00 0 .00 Conditional Format Formatting as Table Styles Cell O M 1 Comments Share Insert me Delete Format Sort & Filter Find & Select Sensitivity Analyze Data Tasks A D E F G H | J K L M N O P 1 2 Employee Information Model Assumptions 3 Hours Worked 4 Pay Rate 85 $30.00 # regular hours in Pay Period 80 5 Marital Status Married # of paychecks per year 26 6 # of Allowances 2 Rate Federal Tax Rate Tables "Single" Tax Rate Income "Married" Tax Rate Income Rate 7 Retirement Savings % 5% 8 Health Insurance (every paycheck) $125.00 Payroll Tax information Medicare Rate $0 10% $0 10% 1.45% $725 15% $1,450 15% 9 Flexible Spending (Annual) $1,500.00 Social Security Rate 4.2% $2,945 25% $5,891 25% 10 11 Paycheck Summary Income Tax Information 12 Gross Pay $0.00 Allowance Deduction $146 $7,137 28% $14,887 33% $32,362 35% $11,891 28% $18,120 33% $32,362 35% 13 Total Deductions $0.00 State Tax Rate 5% 14 Adjusted Income $0.00 15 Total Taxes $0.00 16 17 Net Pay $0.00 18 19 Paycheck Calculations 20 Income 21 Hours Worked 22 Pay Rate 23 Regular Pay 24 Overtime Pay 25 Total Gross Pay 26 27 28 Deductions (Items not subject to income tax) Insurance 29 Flexible Spending 30 Retirement 31 Total Deductions 32 33 Adjusted Income 34 35 Taxes 36 Federal Income Tax Rate 37 Federal Income Tax 38 Adjustment for Allowances 39 Net Federal Income Tax 40 State Income Tax 41 Medicare Tax Ready Pricing Paycheck Accessibility: Investigate + MyEducator Tasks 1.3 Calculate the overtime pay. a. Reference cell C21 for the "Hours Worked". b. The employee is paid 1.5 times the regular pay rate for any time the employee works more than the number regular hours in pay period 3.5 Font Size 1.4 Calculate the total gross pay. The total gross pay is the sum of the regular pay and the overtime pay. 2.5 1.5 Reference the health insurance deduction. a. Reference the appropriate cell in the employee information section of the model for the health insurance deduction. b. Notice the amount in this section is already calculated for each paycheck. 2.5 1.6 Calculate the flexible + 100% 0%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started