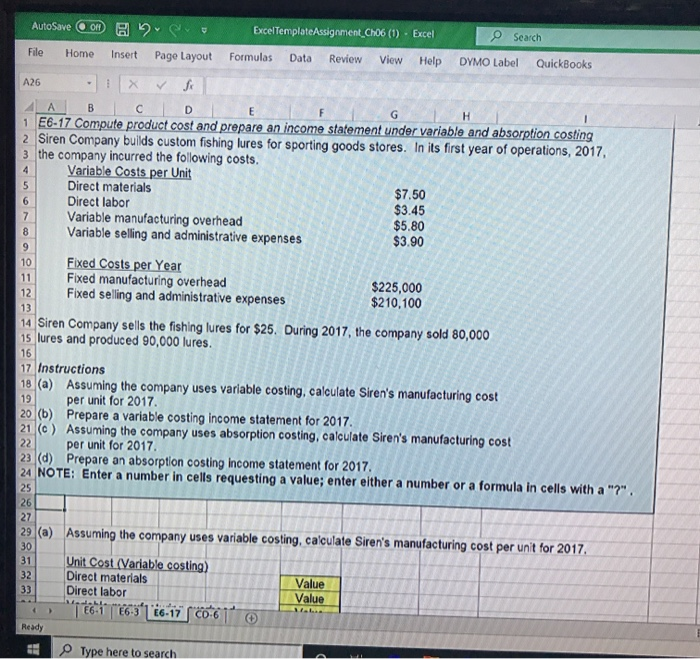

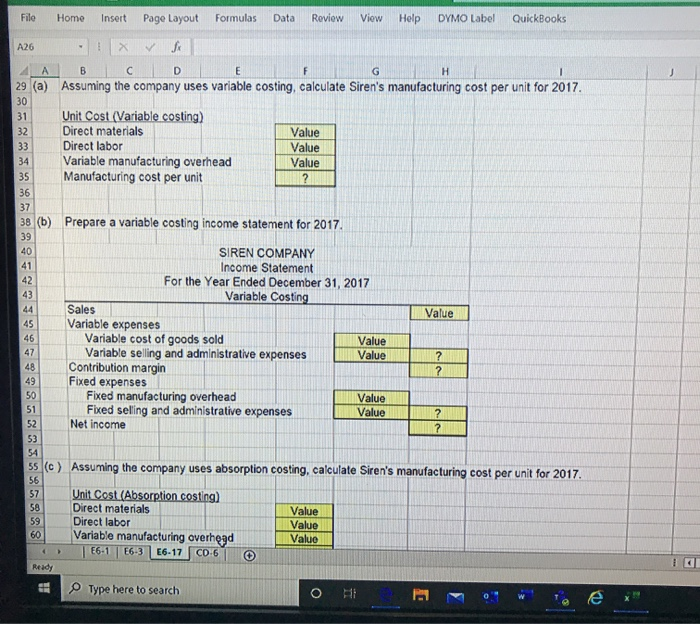

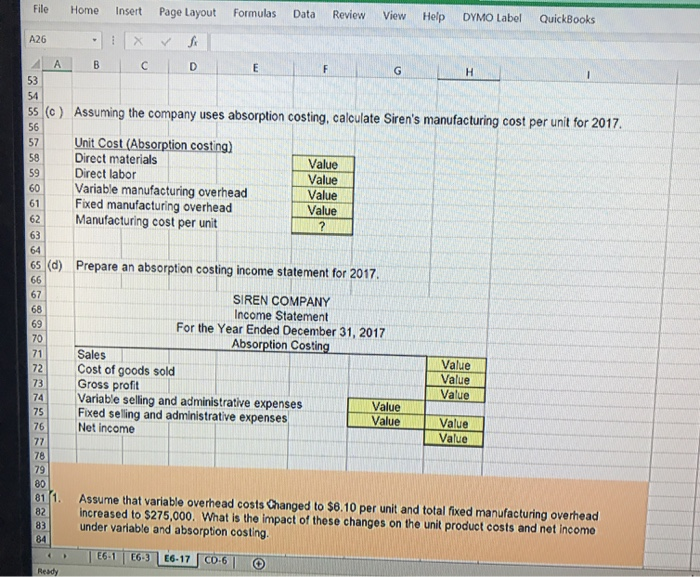

AutoSave File Home Insert Page Layout Excel Template Assignment ChO6 (1) Excel Formulas Data Review View Help Search DYMO Label QuickBooks A26 4ABCD. 1 E6-17 Compute product cost and prepare an income statement under variable and absorption costing 2 Siren Company builds custom fishing lures for sporting goods stores. In its first year of operations, 2017, 3 the company incurred the following costs. Variable Costs per Unit Direct materials $7.50 Direct labor $3.45 Variable manufacturing overhead $5.80 Variable selling and administrative expenses $3.90 Fixed Costs per Year Fixed manufacturing overhead Fixed selling and administrative expenses $225,000 $210,100 12 13 14 Siren Company sells the fishing lures for $25. During 2017, the company sold 80,000 15 lures and produced 90,000 lures. 17 Instructions 18 (a) Assuming the company uses variable costing, calculate Siren's manufacturing cost 19 per unit for 2017. 20 (b) Prepare a variable costing income statement for 2017 21 (0) Assuming the company uses absorption costing, calculate Siren's manufacturing cost 22 per unit for 2017. 23 (d) Prepare an absorption costing Income statement for 2017 24 NOTE: Enter a number in cells requesting a value; enter either a number or a formula in cells with a "?". 29 (a) 30 Assuming the company uses variable costing, calculate Siren's manufacturing cost per unit for 2017 32 Unit Cost (Variable costing) Direct materials Direct labor | E61 E6:31 E6-17 C 6 | Value Value + Ready File Home Insert Page Layout Formulas Data Review View HelpDYMO Label QuickBooks A26 .! Xx 4 29 (a) Assuming the company uses variable costing, calculate Siren's manufacturing cost per unit for 2017. Unit Cost (Variable costing) Direct materials Value Direct labor Value Variable manufacturing overhead Value Manufacturing cost per unit 38 (b) Prepare a variable costing income statement for 2017. SIREN COMPANY Income Statement For the Year Ended December 31, 2017 Variable Costing Sales Value Value Value Variable expenses Variable cost of goods sold | Variable selling and administrative expenses Contribution margin Fixed expenses Fixed manufacturing overhead Fixed selling and administrative expenses Net income Value Value 55 (c) Assuming the company uses absorption costing, calculate Siren's manufacturing cost per unit for 2017. 58 59 Unit Cost(Absorption costing) Direct materials Direct labor Variable manufacturing overhegd | E6-1 6-3 E6-17 CD-6 Value Value Value Ready 10 Type here to search File Home Insert Page Layout Formulas Data Review View Help DYMO Label QuickBooks A26 A B C D 55 (0) Assuming the company uses absorption costing, calculate Siren's manufacturing cost per unit for 2017 Unit Cost (Absorption costing) Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Manufacturing cost per unit Value Value Value Value Prepare an absorption costing income statement for 2017 SIREN COMPANY Income Statement For the Year Ended December 31, 2017 Absorption Costing Sales Cost of goods sold Gross profit Variable selling and administrative expenses Value Fixed seling and administrative expenses Value Net income Value Value Value Value Value 811. Assume that variable overhead costs Changed to $6.10 per unit and total fixed manufacturing overhead increased to $275,000. What is the impact of these changes on the unit product costs and net incomo under variable and absorption costing. BA 156- 1 6 -3 E6-1700-6