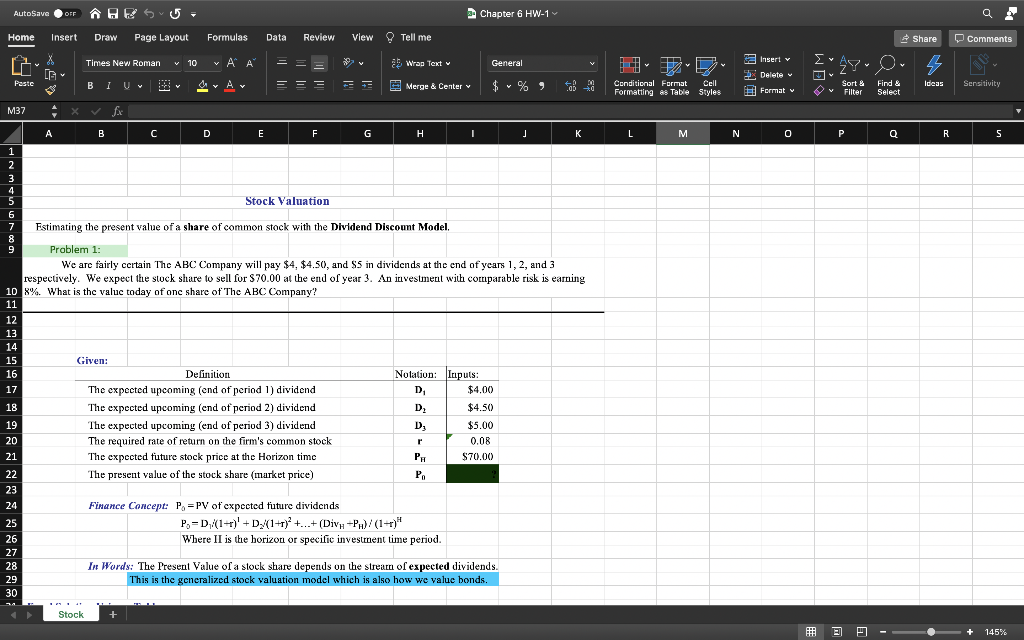

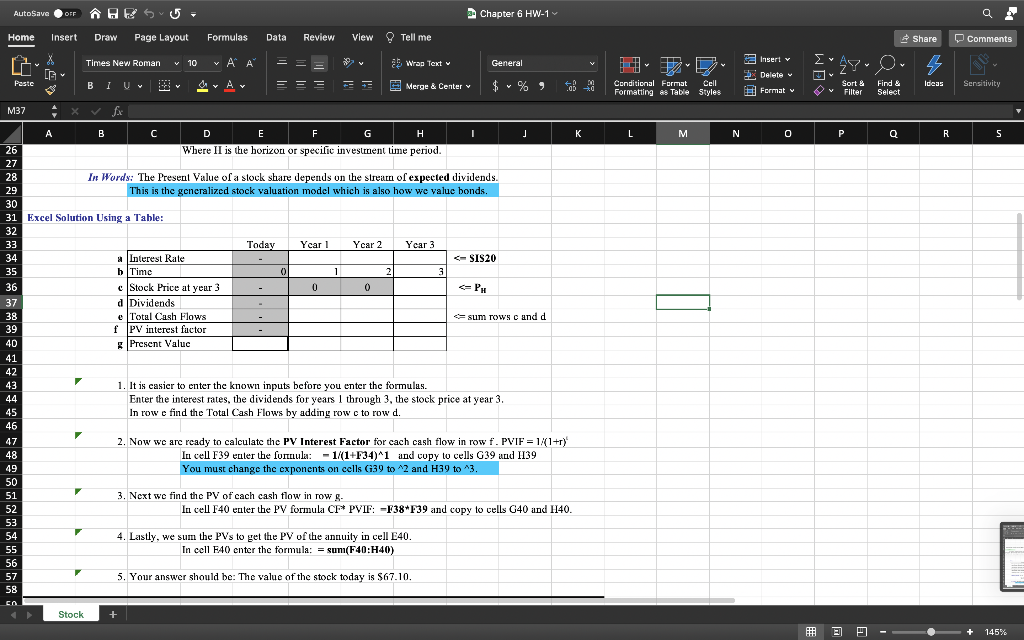

AutoSave IF OFF RESU Chapter 6 HW-1 Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Times New Roman X X G v 10 ~ A ab Wrap Text General Insert v 7 4 Delete Paste BIU Av = = = Merge & Center Ideas Y Conditional Format Cell Formatting es Table Styles Sort & Filter Sensitivity Format v Find & Select V M37 A B C D E F G H T J K L M N 0 Q R S 1 VOUDWNP 2 3 4 5 Stock Valuation 6 7 8 9 Estimating the present value of a share of common stock with the Dividend Discount Model. Problem 1: We are fairly certain The ABC Company will pay $4, $4.50, and $5 in dividends at the end of years 1, 2, and 3 respectively. We expect the stock share to sell for $70.00 at the end of year 3. An investment with comparable risk is earning 10 8%. What is the value today of one share of The ABC Company? 11 12 13 14 15 Given: 16 Definition Notation: Inputs: 17 The expected upcoming (end of period 1) dividend D $4.00 18 The expected upcoming (end of period 2) dividend D $4.50 19 The expected upcoming (end of period 3) dividend Ds $5.00 20 The required rate of return on the firm's common stock 0.08 21 The expected future stock price at the Horizon time P. $70.00 22 The present value of the stock share (market price) PO 23 24 Finance Concept: P = PV of expected future dividends 25 Po=D (1++)' +Dx/(1+1) +...+(Div.-P.)/(1+4)* 26 Where II is the horizon or specific investment time period. 27 28 In Words: The Present Value of a stock share depends on the stream of expected dividends. 29 This is the generalized stock valuation model which is also how we value bonds. 30 r Stock + - + 145% AutoSave OFF OFF RESU Chapter 6 HW-1 Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Times New Roman X G v 10 ~ A ab Wrap Text General Insert v Y , 4 Paste BIU Av = = Merge & Center Delete Format Ideas Conditional Format Cell Formatting es Table Styles Y Sort & Filter Sensitivity v Find & Select V K L M N 0 P Q R S OP - M37 . X fx A B C D E F F G H I J 26 Where II is the horizon or specific investment time period. 27 28 In Words: The Present Value of a stock share depends on the stream of expected dividends. 29 This is the generalized stock valuation model which is also how we value bonds. 30 31 Excel Solution Using a Table: 32 33 Today Year 1 Year 2 Year 3 34 Interest Rate