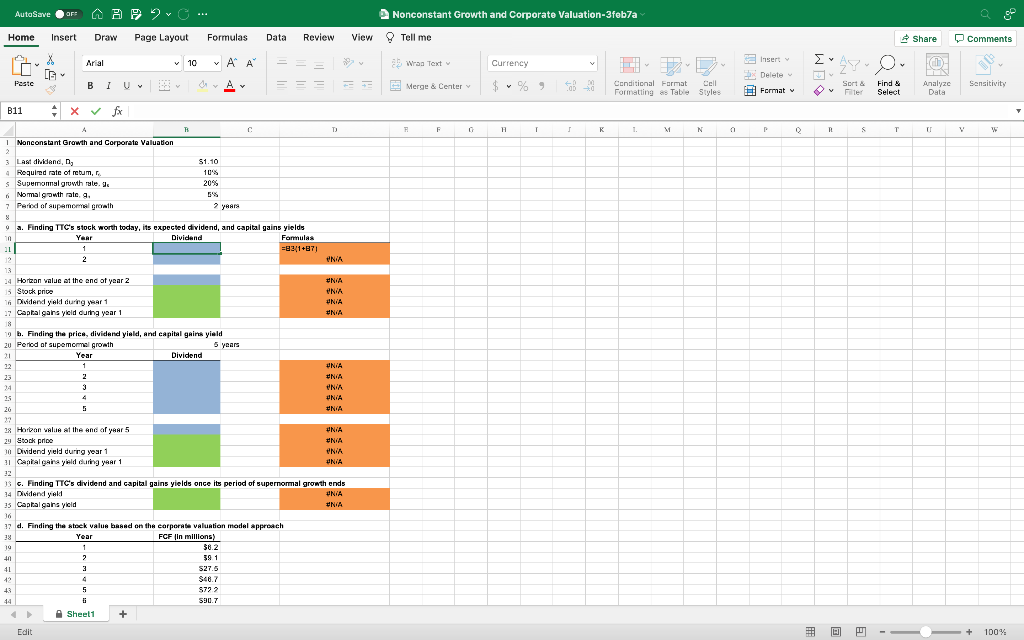

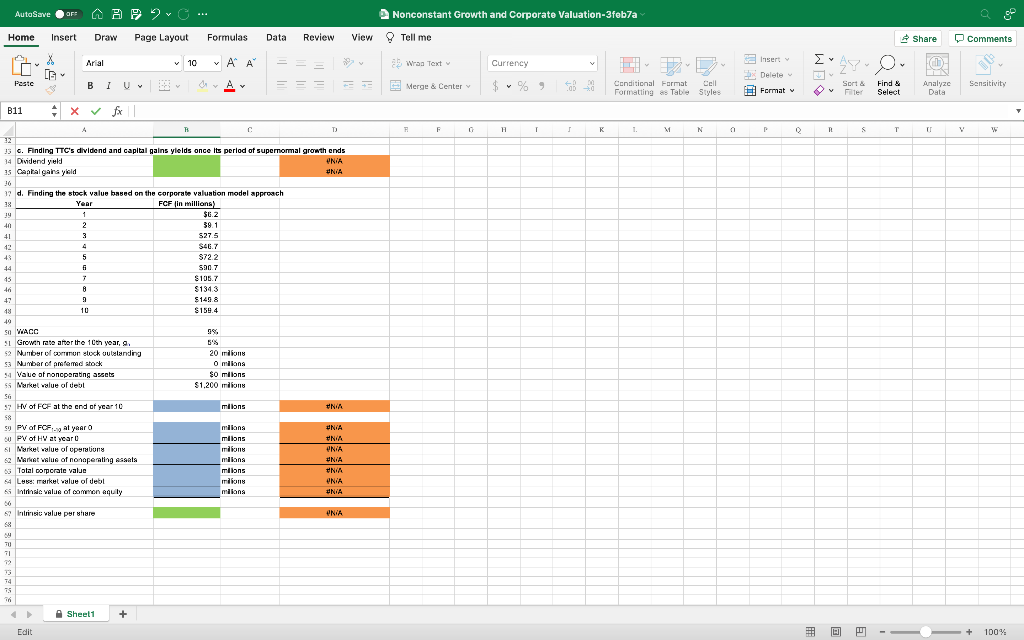

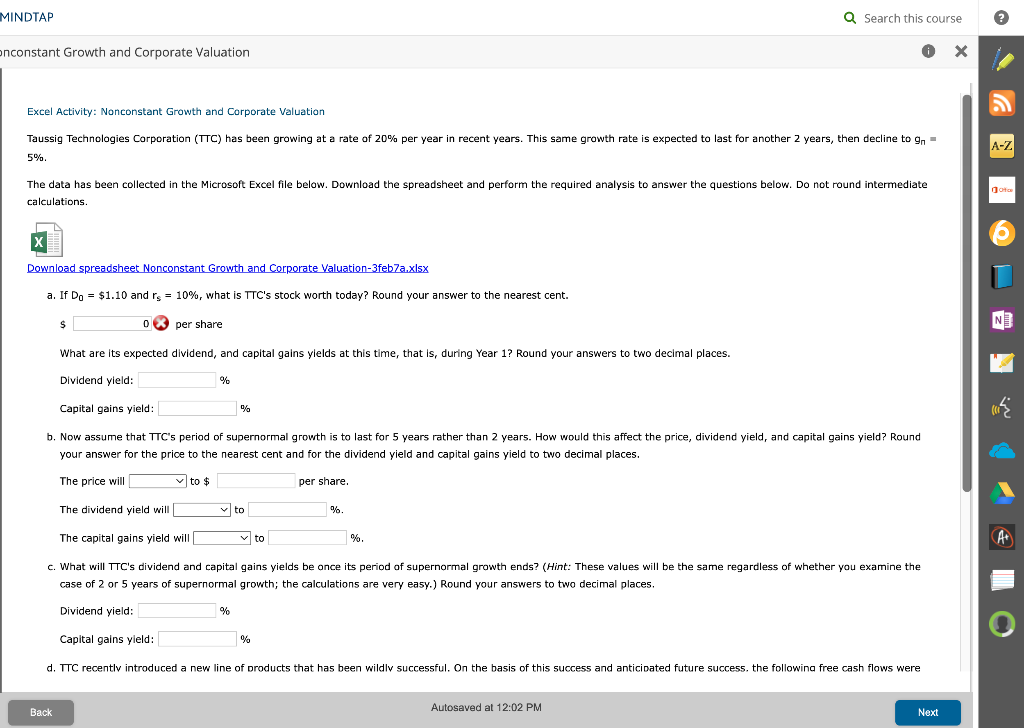

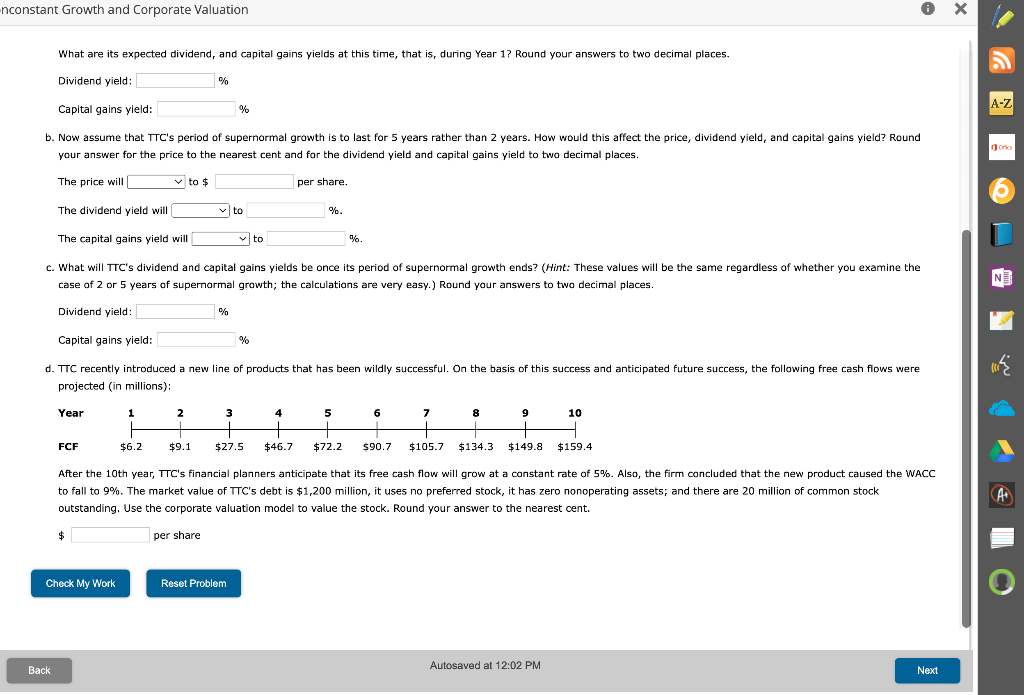

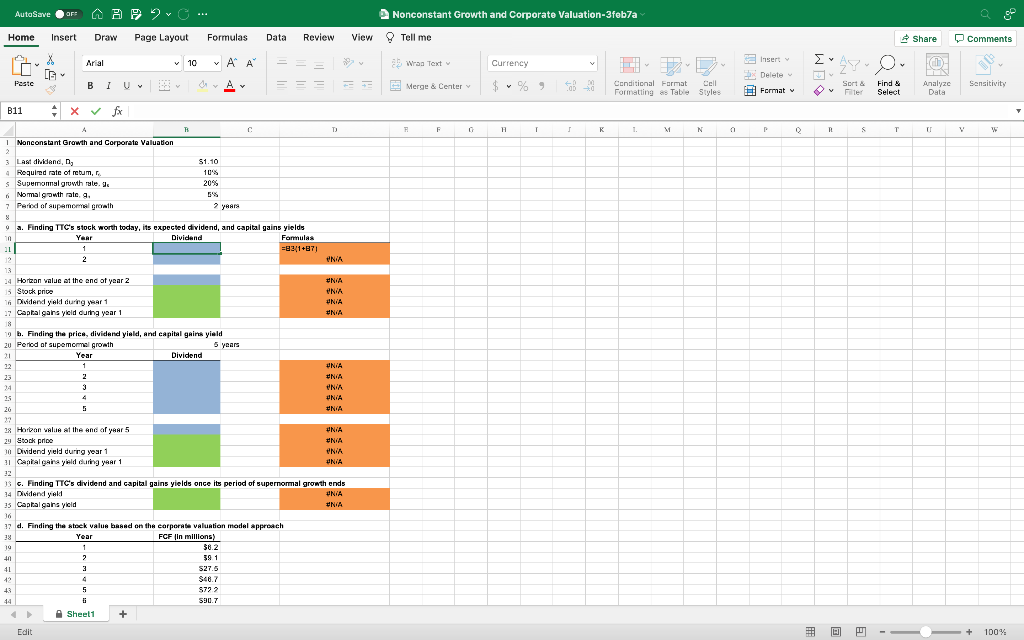

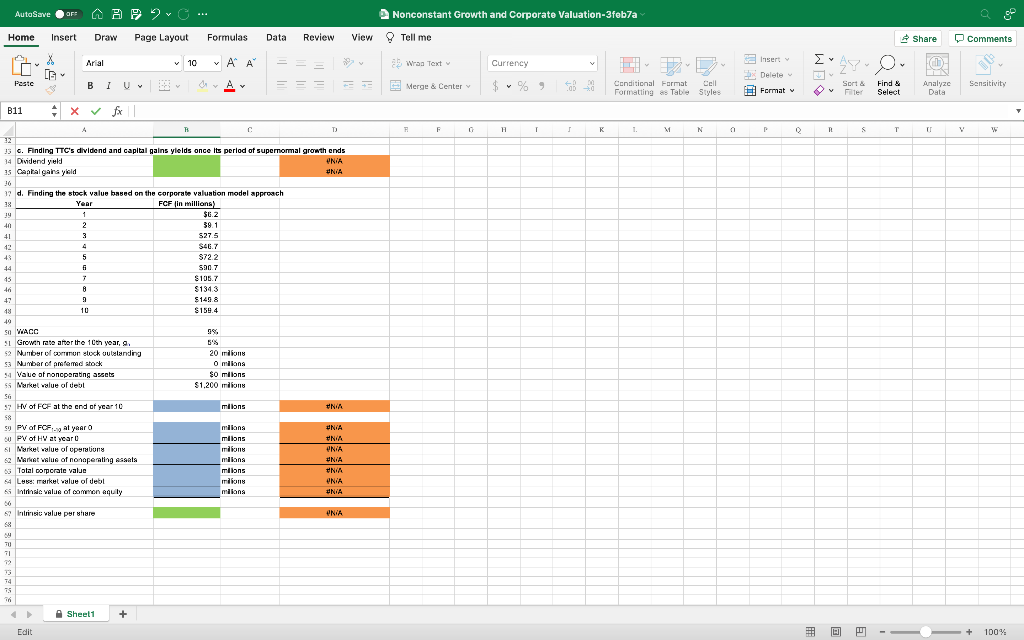

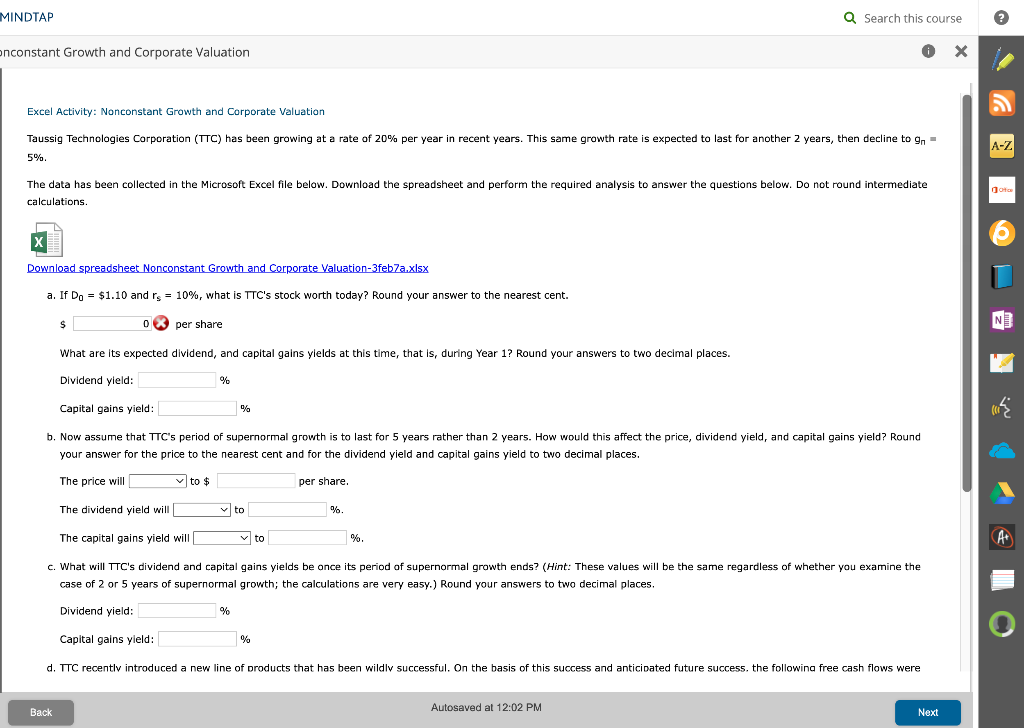

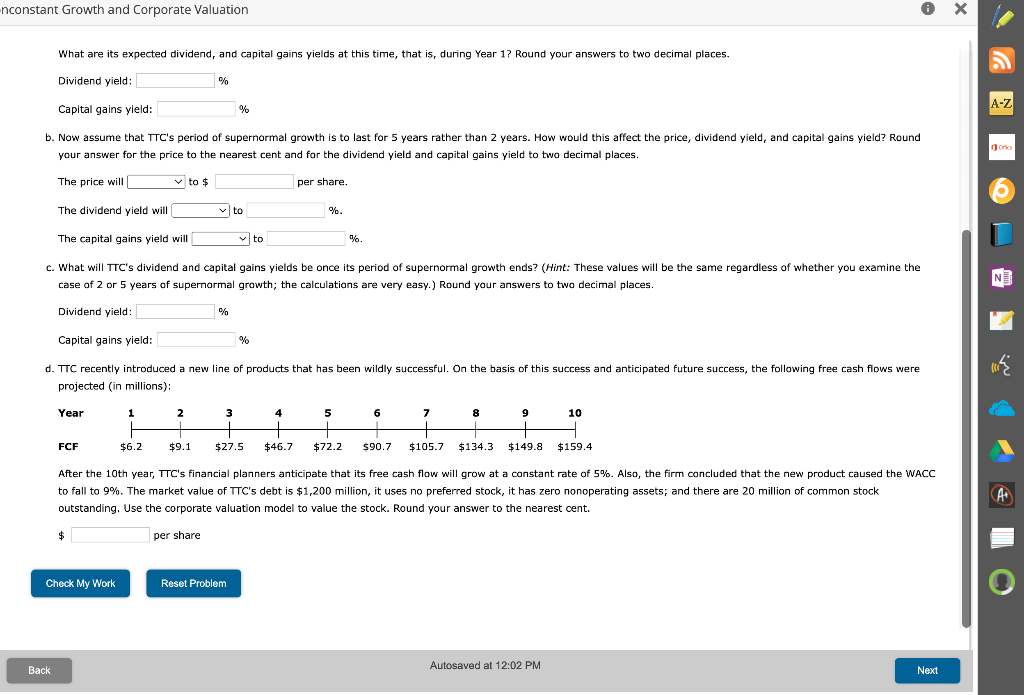

AutoSave OF APvc ... Nonconstant Growth and Corporate Valuation-3feb7a Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Insert Arial v 10 X G ~ Al A Wran Text , Currency DE 23-0 Paste BIU 1 - Merge & Center $ % Conditional Format Cell Formatting as Table Styles Delete Format Sensitivity v Sort & Filter Analyze Data y Find & Select B11 + X FX T D ) F 0 1 s K 1. M N R S T IT V C 1 1 Nonconstant Growth and Corporate Valuation 2 3 Last Midland, n, S1.10 4 Required rate of rebum, 10% s Superonal growth rule 9 20% 6 Nomal growth rate, a. 5% 7 Parod of supamamagrath 2 years 8 a. Finding TTC's stock worth today, its expected dividend, and capital gains yields Year Dividend Formulas 21 1 =83/1+B71 2 TO EN #NA NA UNIA #N/A 5 years 24 Horitzon value at the end of year 2 15 Stock price 16 Dividend yeld during year 1 27 Capital gains yield during year 1 18 19 . Finding the price, dividend yield, and capital gaink yield 20 Period of supo mermal growth 5 21 Year Dividend 12 1 23 34 3 25 4 20 5 22 28 Harbon value at the end of years 29 stock price 30 Dividend yeld during year 1 11 Cantal gaire yield during year 1 UNIE #N/A NA UNIA NA UNIA #NA NA UNIA 15 c. Finding TTC's dividend and capital gains yields once its period of supernormal growth ends 14 Dividendyol #NIA 35 Captal gains yold #NA 16 11 d. Finding the stock value based on the corporate valuation model approach 28 Year FCF in millions) 19 1 $0.2 20 40 2 39 1 41 3 $27.5 42 $48.7 5 +3 5722 44 590.7 Sheet1 + 4 Edit 3 + 100% AutoSave OF APvc ... Nonconstant Growth and Corporate Valuation-3feb7a Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Aral v 10 ~ A A Wran Text Currency DE Insert Delete Format 23-0 G Paste BIU 1 Merge & Center GB Conditional Format Cell Formatting as Table Styles Sensitivity v Sort & Filter Analyze Data y Find & Select T F 0 1 K 1. M N RE S S IT B11 + x fx 4 12 33 c. Finding TTC's dividend and capital gains yields once its period of supernormal growth ends 14 Dividend yuld ONIA 15 Cantal gara yold UNIA 36 17 d. Finding the stock value based on the corporate valuation model approach 28 Year FCF in millions) 39 1 $6.2 40 2 39.1 +1 3 $27.5 42 $46.7 43 5 $72.2 44 fi S907 45 7 $105.7 46 B S134.3 47 9 $1498 48 10 $159.4 49 50 WACC 99. 31 Growth rate after the 10th year, a 52 Number of women slock outstanding 20 milions 53 Number of arfemd stock O milana 54 Vaue of noncporating assets $0 milions 55 ss Market value of deal $1.200 milions SG 57 HV of FCF at the end of year 10 #NIA 98 sy PV of FCSat year milana #NIA BU PV of HV at year NIA 61 Market value of operation milions UNA 2 Market value of nonaperating ASAR miliona UNA A 85 Total corporate value ilons UNIA 54 Les market value of debl milion ONIA 65 Inte value of common equily milana #NA ONIA 6 Inic value per here 5 70 11 72 74 75 Sheet1 + Edit + 100% MINDTAP Q Search this course onconstant Growth and Corporate Valuation Excel Activity: Nonconstant Growth and Corporate Valuation years, then decline to on Taussig Technologies Corporation (TTC) has been growing at a rate of 20% per year in recent years. This same growth rate is expected to last for another 5%. A-Z The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. oto Download spreadsheet Nonconstant Growth and Corporate Valuation-3feb7a.xlsx a. If Do = $1.10 and rs = 10%, what is TTC's stock worth today? Round your answer to the nearest cent. S 0X per share What are its expected dividend, and capital gains yields at this time, that is, during Year 1? Round your answers to two decimal places. Dividend yield: Capital gains yield: % b. Now assume that TTC's period of supernormal growth is to last for 5 years rather than 2 years. How would this affect the price, dividend yield, and capital gains yield? Round your answer for the price to the nearest cent and for the dividend yield and capital gains yield to two decimal places. The price will wto & per share. The dividend yield will to The capital gains yield will to %. A+ c. What will TTC's dividend and capital gains yields be once its period of supernormal growth ends? (Hint: These values will be the same regardless of whether you examine the case of 2 or 5 years of supernormal growth; the calculations are very easy.) Round your answers to two decimal places, Dividend yield: % Capital gains yield: % d. TTC recently introduced a new line of products that has been wildly successful. On the basis of this success and anticipated future success, the followina free cash flows were Autosaved at 12:02 PM Back Next nconstant Growth and Corporate Valuation X What are its expected dividend, and capital gains yields at this time, that is, during Year 1? Round your answers to two decimal places. Dividend yield: % A-Z Capital gains yield: % b. Now assume that TTC's period of supernormal growth is to last for 5 years rather than 2 years. How would this affect the price, dividend yield, and capital gains yield? Round your answer for the price to the nearest cent and for the dividend yield and capital gains yield to two decimal places. ok The price will to $ per share The dividend yield will to %. The capital gains yield will to %. % c. What will TTC's dividend and capital gains yields be once its period of supernormal growth ends? (Hint: These values will be the same regardless of whether you examine the : case of 2 or 5 years of supernormal growth; the calculations are very easy.) Round your answers to two decimal places. . NE Dividend yield: % Capital gains yield: % li d. TTC recently introduced a new line of products that has been wildly successful. On the basis of this success and anticipated future success, the following free cash flows were projected (in millions): Year 1 4 5 6 8 9 9 10 2 + $9.1 3 + $27.5 7 + $105.7 FCF $6.2 $46.7 $72.2 S90.7 $134.3 $149.8 $159.4 After the 10th year, TTC's financial planners anticipate that its free cash flow will grow at a constant rate of 5%. Also, the firm concluded that the new product caused the WACC to fall to 9%. The market value of TTC's debt is $1,200 million, it uses no preferred stock, it has zero nonoperating assets; and there are 20 million of common stock outstanding. Use the corporate valuation model to value the stock. Round your answer to the nearest cent. A $ per share Check My Work Reset Problem Back Autosaved at 12:02 PM Next