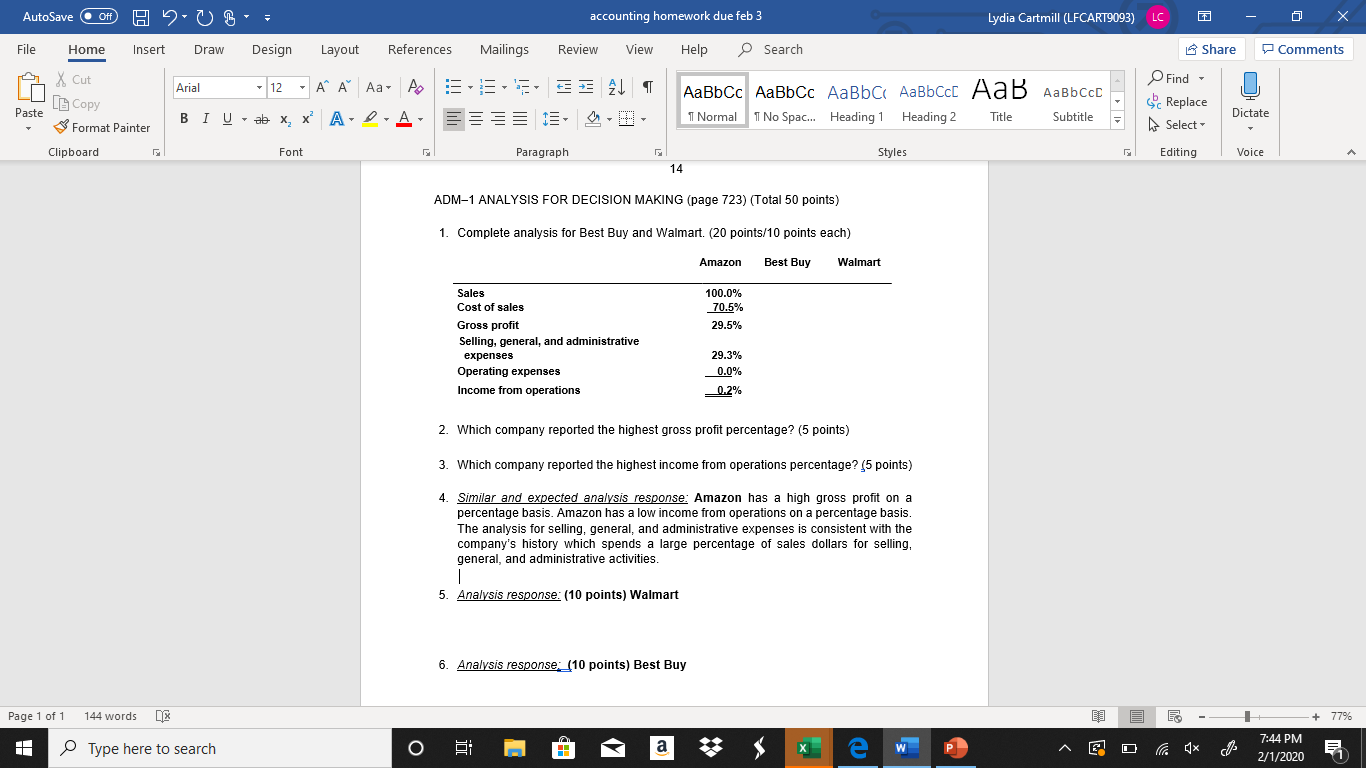

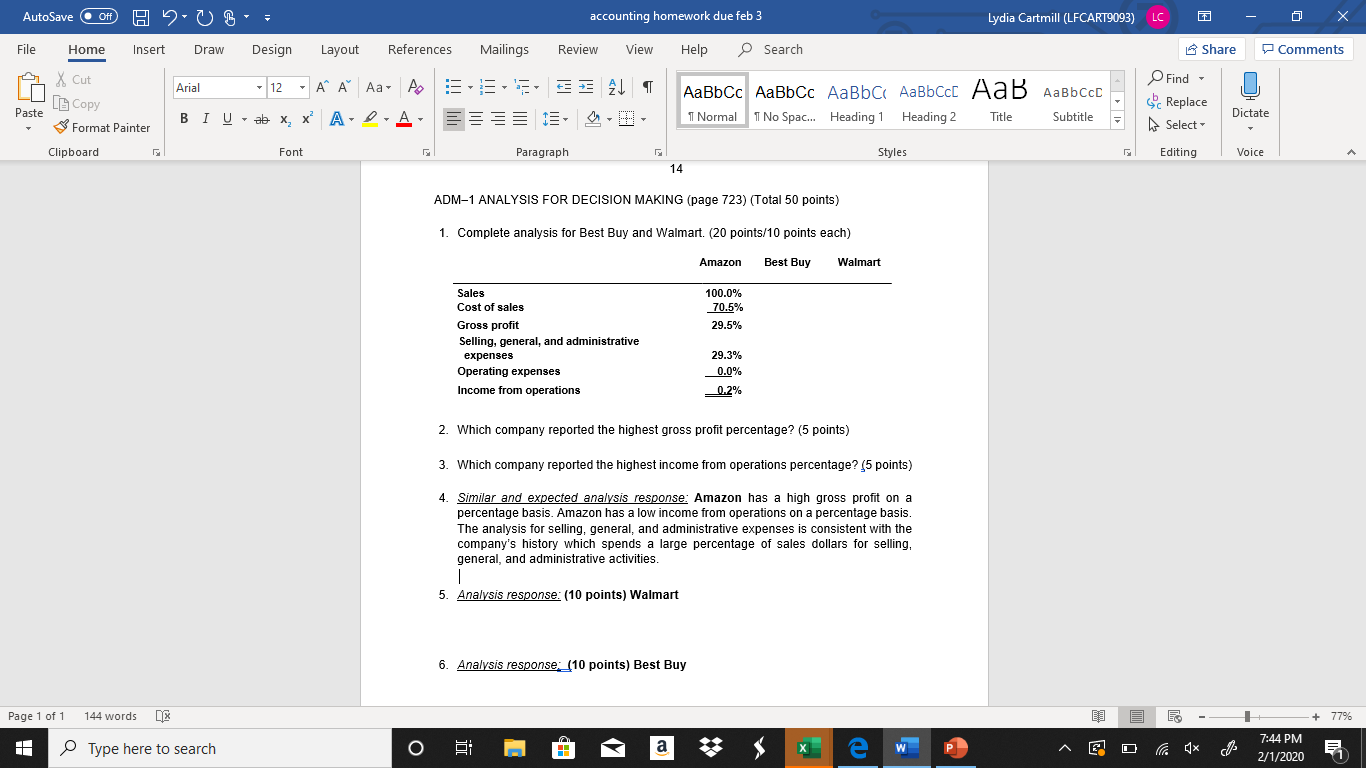

AutoSave of H20B; accounting homework due feb 3 Lydia Cartmill (LFCART9093) LC - 0 X Draw Design Layout References Mailings Review View Help Search Comments E File Home Insert X Cut LE Copy Paste - Format Painter Clipboard Arial - 12 - A A Aar to E BI U ab X, X A-D-A- EE ALT - - - AaBbcc AaBb Cc AaBb C AaBbcc AaB AaBb CCD 1 Normal 1 No Spac... Heading 1 Heading 2 Title Subtitle Share Find - Replace Dictate Select 5 h Font Paragraph Styles Editing Voice 14 ADM-1 ANALYSIS FOR DECISION MAKING (page 723) (Total 50 points) 1. Complete analysis for Best Buy and Walmart. (20 points/10 points each) Amazon Best Buy Walmart 100.0% 70.5% 29.5% Sales Cost of sales Gross profit Selling, general, and administrative expenses Operating expenses Income from operations 29.3% 0.0% 0.2% 2. Which company reported the highest gross profit percentage? (5 points) 3. Which company reported the highest income from operations percentage? (5 points) 4. Similar and expected analysis response: Amazon has a high gross profit on a percentage basis. Amazon has a low income from operations on a percentage basis. The analysis for selling, general, and administrative expenses is consistent with the company's history which spends a large percentage of sales dollars for selling, general, and administrative activities. 5. Analysis response: (10 points) Walmart 6. Analysis response_(10 points) Best Buy Page 1 of 1 144 words DX - + 77% 1 o Type here to search e a * E -- la dx J x H 7:44 PM . e, ^ E o E AutoSave of H20B; accounting homework due feb 3 Lydia Cartmill (LFCART9093) LC - 0 X Draw Design Layout References Mailings Review View Help Search Comments E File Home Insert X Cut LE Copy Paste - Format Painter Clipboard Arial - 12 - A A Aar to E BI U ab X, X A-D-A- EE ALT - - - AaBbcc AaBb Cc AaBb C AaBbcc AaB AaBb CCD 1 Normal 1 No Spac... Heading 1 Heading 2 Title Subtitle Share Find - Replace Dictate Select 5 h Font Paragraph Styles Editing Voice 14 ADM-1 ANALYSIS FOR DECISION MAKING (page 723) (Total 50 points) 1. Complete analysis for Best Buy and Walmart. (20 points/10 points each) Amazon Best Buy Walmart 100.0% 70.5% 29.5% Sales Cost of sales Gross profit Selling, general, and administrative expenses Operating expenses Income from operations 29.3% 0.0% 0.2% 2. Which company reported the highest gross profit percentage? (5 points) 3. Which company reported the highest income from operations percentage? (5 points) 4. Similar and expected analysis response: Amazon has a high gross profit on a percentage basis. Amazon has a low income from operations on a percentage basis. The analysis for selling, general, and administrative expenses is consistent with the company's history which spends a large percentage of sales dollars for selling, general, and administrative activities. 5. Analysis response: (10 points) Walmart 6. Analysis response_(10 points) Best Buy Page 1 of 1 144 words DX - + 77% 1 o Type here to search e a * E -- la dx J x H 7:44 PM . e, ^ E o E