Answered step by step

Verified Expert Solution

Question

1 Approved Answer

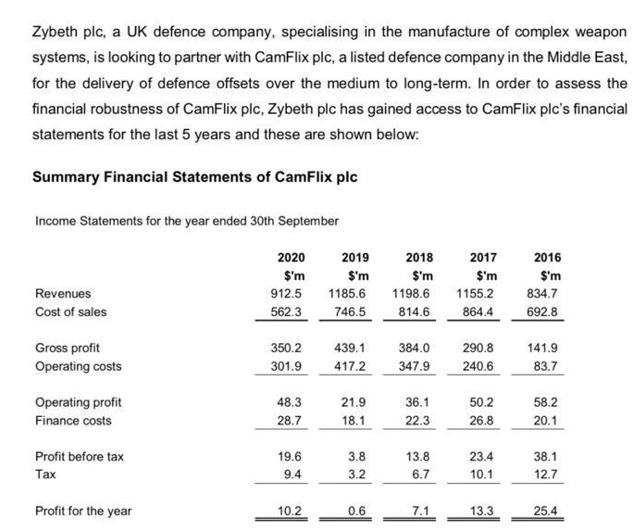

Zybeth plc, a UK defence company, specialising in the manufacture of complex weapon systems, is looking to partner with CamFlix plc, a listed defence

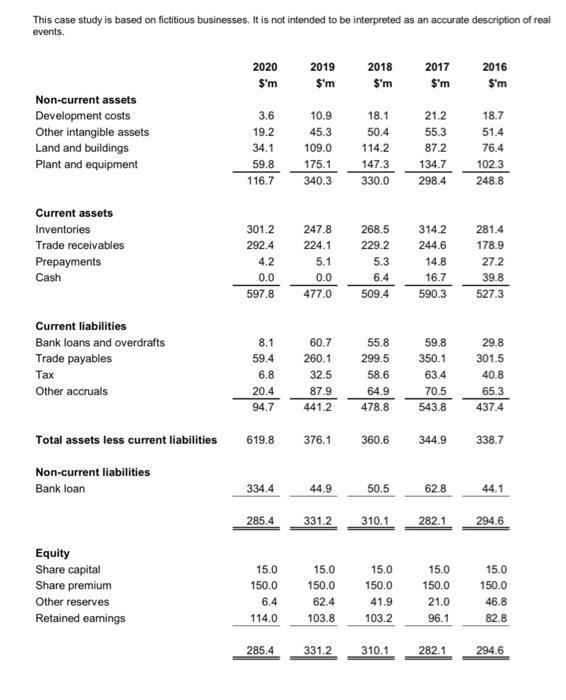

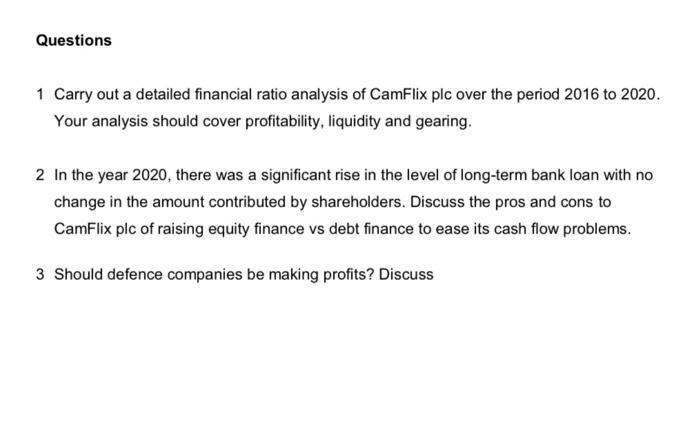

Zybeth plc, a UK defence company, specialising in the manufacture of complex weapon systems, is looking to partner with CamFlix plc, a listed defence company in the Middle East, for the delivery of defence offsets over the medium to long-term. In order to assess the financial robustness of CamFlix plc, Zybeth plc has gained access to CamFlix plc's financial statements for the last 5 years and these are shown below: Summary Financial Statements of CamFlix plc Income Statements for the year ended 30th September Revenues Cost of sales Gross profit Operating costs Operating profit Finance costs Profit before tax Tax Profit for the year 2020 $'m 912.5 562.3 350.2 301.9 48.3 28.7 19.6 9.4 10.2 2019 2018 $'m 1185.6 1198.6 $'m 746.5 814.6 439.1 417.2 21.9 18.1 3.8 3.2 0.6 384.0 347.9 36.1 22.3 13.8 6.7 7.1 2017 $'m 1155.2 834.7 864.4 692.8 290.8 240.6 50.2 26.8 23.4 10.1 2016 $'m 13.3 141.9 83.7 58.2 20.1 38.1 12.7 25.4 This case study is based on fictitious businesses. It is not intended to be interpreted as an accurate description of real events. Non-current assets Development costs Other intangible assets Land and buildings Plant and equipment Current assets Inventories Trade receivables Prepayments Cash Current liabilities Bank loans and overdrafts Trade payables Tax Other accruals Total assets less current liabilities Non-current liabilities Bank loan Equity Share capital Share premium Other reserves Retained earnings 2020 $'m 3.6 19.2 34.1 59.8 116.7 301.2 292.4 4.2 0.0 597.8 8.1 59.4 6.8 20.4 94.7 619.8 334.4 285.4 15.0 150.0 6.4 114.0 285.4 2019 $'m 10.9 18.1 45.3 50.4 109.0 114.2 175.1 147.3 340.3 330.0 247.8 224.1 5.1 0.0 477.0 60.7 260.1 32.5 87.9 441.2 376.1 44.9 331.2 15.0 150.0 62.4 103.8 2018 2017 $'m $'m 331.2 268.5 229.2 5.3 6.4 509.4 55.8 299.5 58.6 64.9 478.8 360.6 50.5 310.1 15.0 150.0 41.9 103.2 310.1 21.2 55.3 87.2 134.7 298.4 314.2 244.6 14.8 16.7 590.3 59.8 350.1 63.4 70.5 543.8 344.9 62.8 282.1 15.0 150.0 21.0 96.1 282.1 2016 $'m 18.7 51.4 76.4 102.3 248.8 281.4 178.9 27.2 39.8 527.3 29.8 301.5 40.8 65.3 437.4 338.7 44.1 294.6 15.0 150.0 46.8 82.8 294.6 Questions 1 Carry out a detailed financial ratio analysis of CamFlix plc over the period 2016 to 2020. Your analysis should cover profitability, liquidity and gearing. 2 In the year 2020, there was a significant rise in the level of long-term bank loan with no change in the amount contributed by shareholders. Discuss the pros and cons to CamFlix plc of raising equity finance vs debt finance to ease its cash flow problems. 3 Should defence companies be making profits? Discuss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Financial Ratio Analysis for CamFlix plc 20162020 Profitability Ratios a Gross Profit Margin GrossProfitMarginGrossProfit Revenue100 Gross Profit Margin3502 83471004192 The gross profit margin indic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started