Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AutoSave Off Nilsen Mgris (version 2) Search File Home Insert Draw Page Layout Formulas Data Review View Help 70 Draw with Touch Inle to Shape

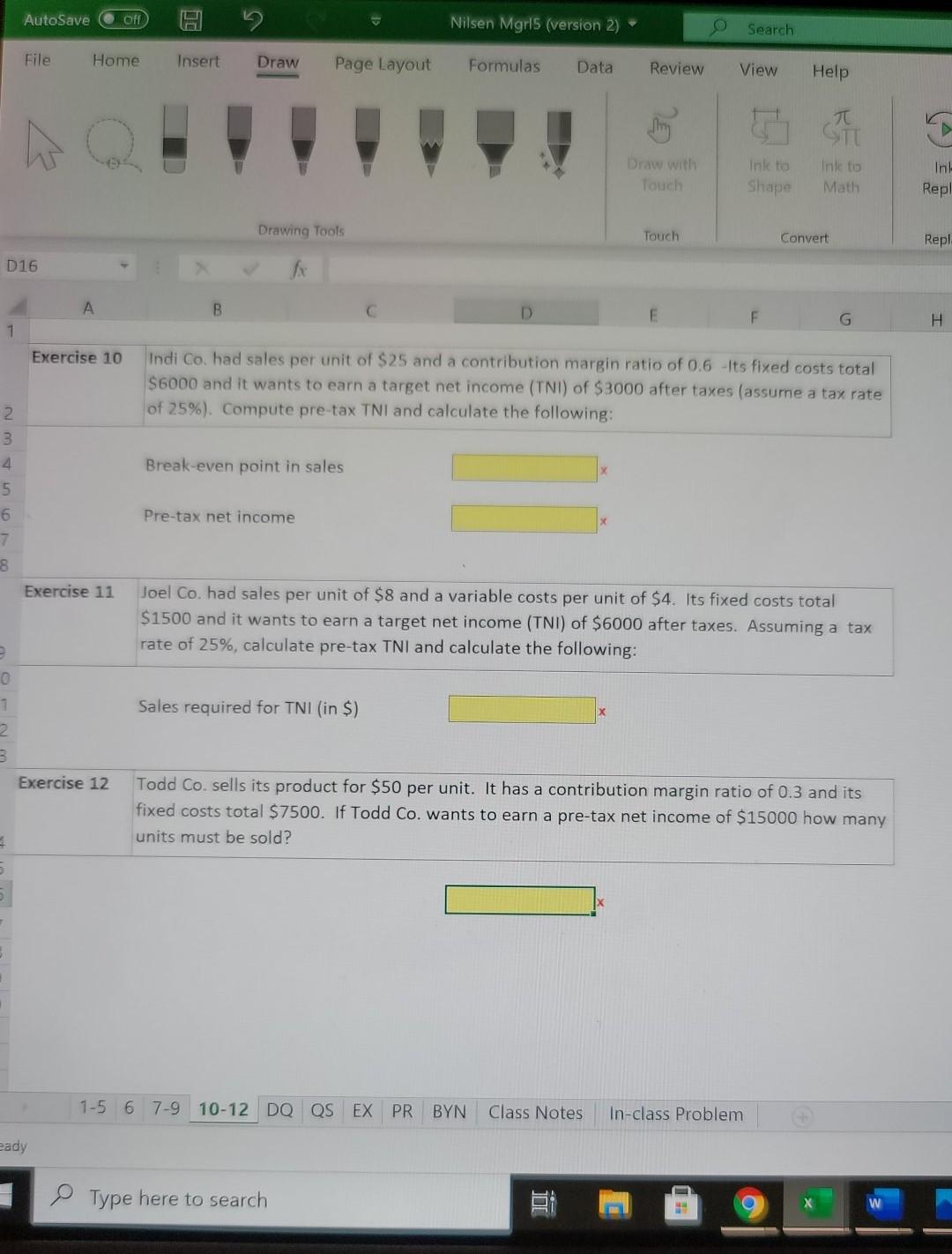

AutoSave Off Nilsen Mgris (version 2) Search File Home Insert Draw Page Layout Formulas Data Review View Help 70 Draw with Touch Inle to Shape Inte to Math Inl Repl Drawing Tools Touch Convert Repl D16 B D E F G H 1 Exercise 10 Indi Co. had sales per unit of $25 and a contribution margin ratio of 0.6 -Its fixed costs total $6000 and it wants to earn a target net income (TNI) of $3000 after taxes (assume a tax rate of 25%). Compute pre-tax TNI and calculate the following: Break-even point in sales 2 3 4 5 6 7 8 Pre-tax net income Exercise 11 Joel Co. had sales per unit of $8 and a variable costs per unit of $4. Its fixed costs total $1500 and it wants to earn a target net income (TNI) of $6000 after taxes. Assuming a tax rate of 25%, calculate pre-tax TNI and calculate the following: 1 Sales required for TNI (in $) 2 Exercise 12 Todd Co. sells its product for $50 per unit. It has a contribution margin ratio of 0.3 and its fixed costs total $7500. If Todd Co. wants to earn a pre-tax net income of $15000 how many units must be sold? 1-5 6 7-9 10-12 DO QS EX PR BYN Class Notes In-class Problem eady Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started