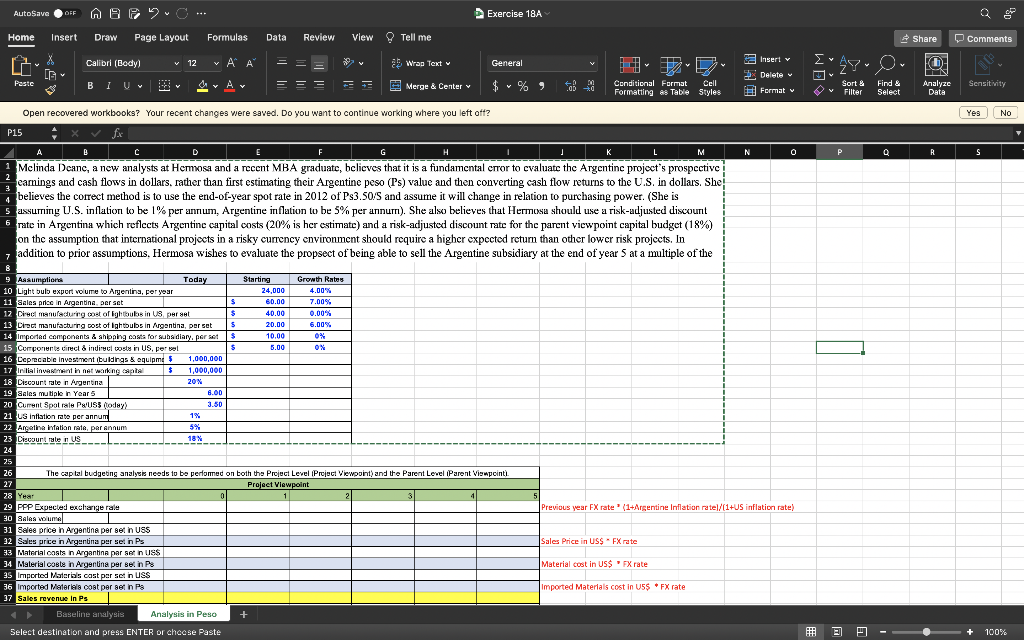

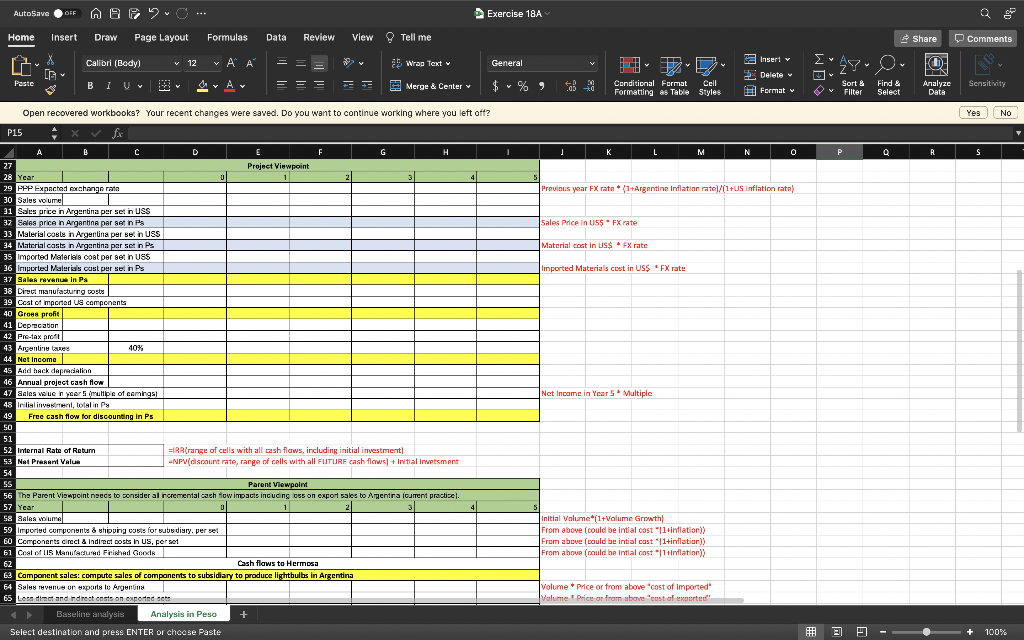

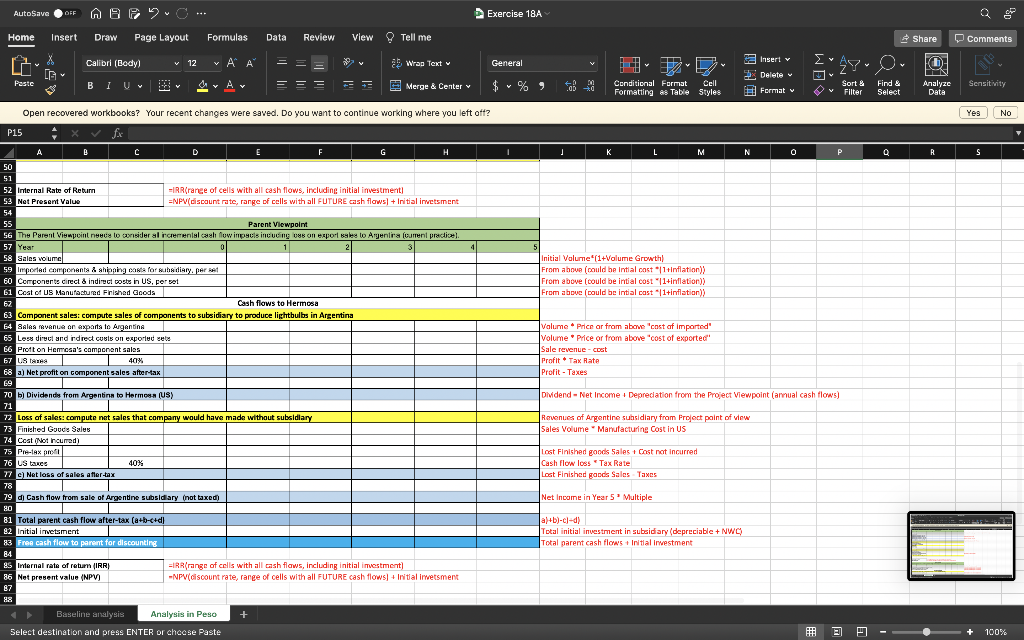

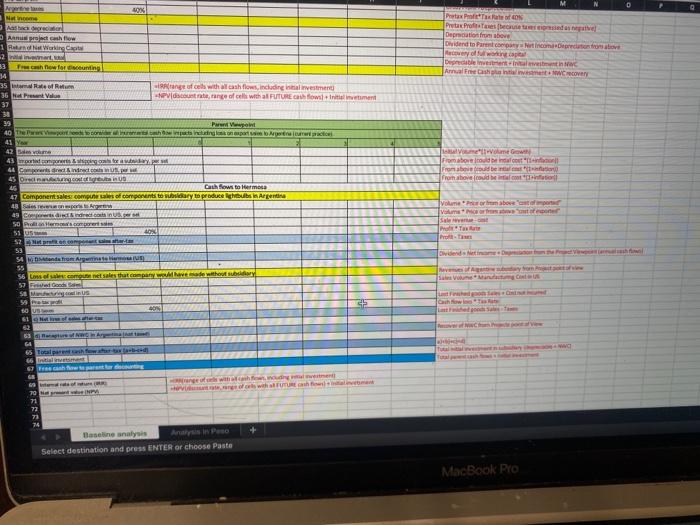

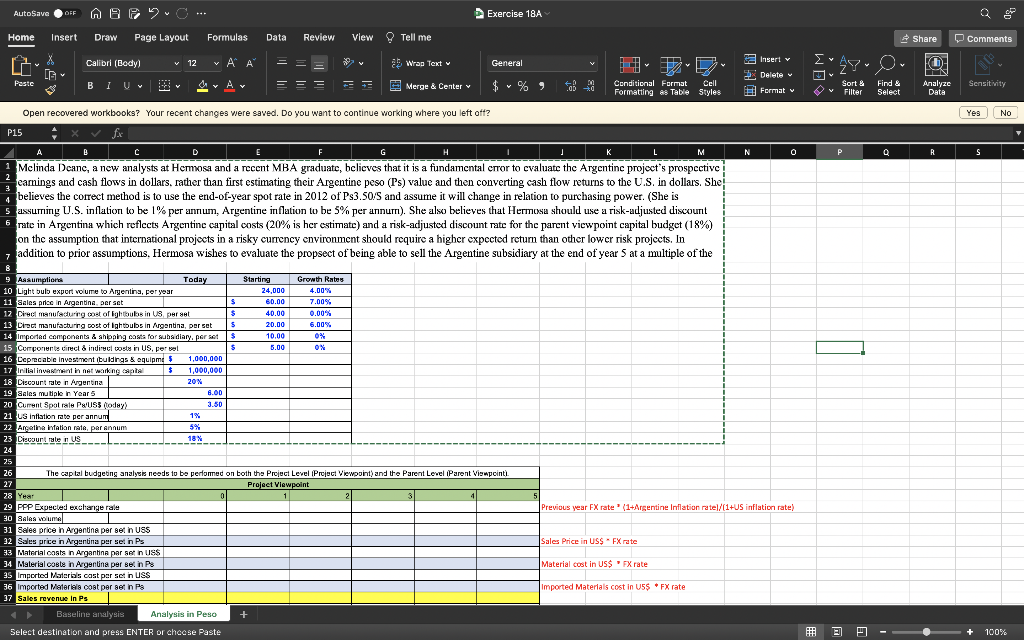

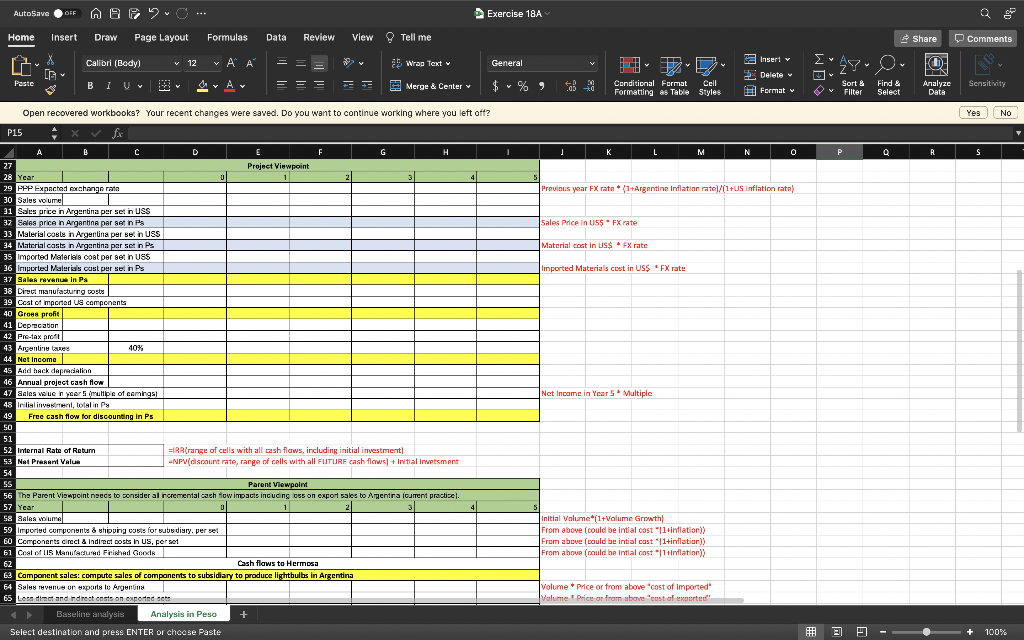

AutoSave OFF OFF ABPC --- Exercise 18A Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments Calibrl (Body) Insert v v 12 A General ab Wrap Text , 06 X Delete v Paste BIU av A Merge & Center $ % Y Conditional Format Cell Formatting as Table Styles Sort Filter # Format Find & Select Analyze Data Sensitivity Yes No K M N 0 0 P R S Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left oft? P15 fx D E F G LI L Melinda Deanc, a new analysts at Hermosa and a recent MBA graduate, believes that it is a fundamental error to evaluate thc Argentinc project's prospective eamings and cash flows in dollars, rather than first estimating their Argentine Peso (Cs) value and then converting cash flow returns to the U.S. in dollars. She believes the correct method is to use the end-of-year spot rate in 2012 of Ps3.50/S and assume it will change in relation to purchasing power. (She is Sassuming U.S. inflation to be 1% per annun, Argentine inflation to be 5% per annum). She also believes that Hermosa should use a risk-adjusted discount 5 rate in Argentina which reflects Argentine capital costs (20% is her estimate) and a risk-adjusted discount rate for the parent viewpoint capital budget (18%) on the assumption that international projects in a risky currency environment should require a higher expected return than other lower risk projects. In addition to prior assumptions. Hermosa wishes to evaluate the propsect of being able to sell the Argentine subsidiary at the end of years at a multiple of the 4 5 0 9 Assumption Today Starting Growth Rates 10 Light bulb expert volume to Argentina, per year 24,000 4.00% 11 Sales price in Argentine per set $ 60.00 7.00% 12 Direct menulacturing cost of Eghubs in US per set $ 40.00 0.00% 13 Cisc manufacturrg post of lightbulbs in Argentina, per set 20.00 6.00% 14 Imported components & ahoning costs for subsidiary. per set $ 10.00 0% % 15 Components Cirect & indirect costs in US, perbel $ 5.00 0% 16 Deprecable Investment buldings & equipme 5 1,000,000 17 Initial invatath net work ng capital $ 1,000,000 18 Ciscourt rate Argentina 20% 19 Belas multiple In Year 8.00 20 Current Spotrale PWUSS Coday) 3.50 21 US Inflation rato per annum 1% 22 Aratina infation rate, parannum % 5% 18% 23 Discount totes US --- ralen 24 25 26 The captal budgeting analysis needs to be perfomed on both the Project Level Project Viewpoint) and the Parent Level Parent Viewpoint. 27 Project Viewpoint 28 Year 0 41 29 PPP Expected exchange rate 30 Sales volume 31 Salee price in Argentina per set in USS 32 Sales price in Argentina per set in Ps 33 Material con Argantina par set in USS 34 Material coste in Argentina per set in 95 Imported Materials cast per sct in USS 36 Imported Materials cost per set in PS 37 Sales revenue in Ps Baseline analysis Analysis in Peso + Select destination and press ENTER or choose Paste 5 Previous year FX rate (1+Argentine Inflation ratel/(1+US inflation rate) Sales Price in US$ - FX rate Material cost in US$ FX rate Imported Materials cost in 5$ * FX rate # 2 - + 100% AutoSave OFF DEF ABPC --- Exercise 18A Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments Calibrl (Body) v 12 Insert v A 2 ab Wrap Text General ' , , O o 06 X Delete v Pastc BIU B T U V av A Merge & Center v Y Conditional Format Cell Formatting as Table Styles # Format Sort Filter Ov Find & Select Sensitivity Analyze Data Yes No I K L . N 0 P R S U 5 Previous year FX rate *(1+Argentine Inflation rate)/(1+US Inflation rata) Sales Price in US$ FX rate Material cost in US$. EX rate Imported Materials cost in US$ FX rate Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left oft? P15 X V fx A B D E F H 27 Project Viewpoint 28 Year 1 2 1 41 29 PPP Expected exchange rata 30 Salus volume 31 Sales price in Argentina per set in USS 32 Sales price in Argentina par set in PS 33 Material coste in Argentina per set in USS 34 Material casts in Argentina per set in Ps 35 Imported Materials cost per set in USS 36 Imported Materials cost per set in Ps 37 Sales revenue in Pa 38 Direct manufacturing posts 29 Cost of mported us components 40 Gross profit 41 Depucation 42 Pretax pro 43 Argentina 40% 44 Net Income 45 Add hack depredation 46 Annual project cash flow 47 Sales veuen years multiple of Gemings 48 Initial investment, total in Py 49 Free cash flow for discounting in Ps SO 51 52 Internal Rate of Return =lRR(range of cells with all cash flows, including initial investment 53 Nat Present Value -NPV(discount rate, range of cells with all FUTURE cash flows) + Initial Irwetsment 54 55 Parent Viewpoint 56 The Parent Viewpoint needs to consider al incremental cash flow impacts including ces on export sales to Argentina current practice. 57 Year 0 58 SAAs volume 59 Imported componenty & shipping costs for subs diary, per se 60 Components direct & Indirect costs In US, perset 61 Coal of Us Manufactured Frihed Good 62 Cash flows to Hermosa 13 Component sales: compute sales of components to subsidiary to produce lightbulbs in Argentina 64 Sales tuvenue or export to Argentina 65 Loss diet and direct costs on exported cete Baseline analysis Analysis in Peso + Select destination and press ENTER or choose Paste Net Income in Years Multiple S Initial Volume*(1+Volume Growth From above (could be intal cost "11+inflation)) From above could be intal cost "1+inflation)) From above (could be intal cost * 1+Inflation)) Volume * Price or from above "cost of imported Valurne Price or from above "cost of exported" # 2 - + 100% % AutoSave OFF DEF ABPC --- Exercise 18A Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments Calibrl (Body) v 12 A Insert v 9v General ab Wrap Text WE , 0. LG X Delete v Pastc BIU Merge & Center Y th Conditional Format Cell Formatting as Table Styles Sort Filter Format Find & Select Analyze Data Sensitivity Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left oft? Yes No I K L M N 0 P Q R S 5 Initial Volume' (1+Volume Growth From above (could be Intial cost *1+Inflation) From above (could be intial cost "11+inflation)) From above (pould be intial cast 1+inflation) Valume * Price ar fram above "cost of imported' Volume * Price or from above cost of exported * Sale revenue-cost - Profit Tax Rate Profit - Taxes P15 X fix A B E F G 50 51 52 Internal Rate of Return -IR(range of cells with all cash flows, including initial investment) 53 Net Present Value =NPV(discount rate, range of cells with all FUTURE cash flows] + Initial invetsment 54 55 Parent Viewpoint 56 The Parent Viewpoint neece lo consider al incremental cash flow impacts incucing on export sales to Argentina (current practice 57 Year 0 2 58 Sales volume 59 Imported components & Shipping costs for suhe diary. per 60 Components direct & indirect costs in US, per sot 61 Cost of US Manufactured Finished Goods 62 Cash flows to Hermosa 63 Component sales: compute sales of components to subsidiary to produce lightbulbs in Argentina 64 Sales venue on aspartato Argentina 65 Less direct and direct cusis on exported sets 66 Protton Hemcsa's component sales 67 US tarea 40% 68 a) Net profit on component sales after-tax 69 70 b) Dividends from Argentina to Hermosa (US) 71 72 Loss of sales: compute net sales that company would have made without subsidiary 73 Finished Goude Salus 74 Cost (Not incurred) 75 Pax pro 76 us takes 40% 77 c) Netloss of sales after-tax 78 79 di Cash flow from sale of Argentine subsidiary not taxed) 80 81 Total parent cash flow after-tax (a+b-c+d] 82 Initial invetsment 83 Free cash flow to parent for discounting 84 85 Internal rate of return (IRR) =IRR(range of cells with all cash flows, including initial investment 86 Net present value (NPV) -NPV(discount rate, range of cells with all FUTURE cash flows) + Initial invetsment 87 88 Baseline analysis Analysis in Peso + Select destination and press ENTER or choose Paste Dividend - Net Income Depreciation from the Project Viewpoint (annual cash flows) Revenues of Argentine subsidiary from Project paint of view Sales Volume Manufacturing Cost in US Lost Finished goods Sales + Cost not incurred Cash flow loss Tax Rate Lost Finished goods Sales Taxes Net Income in Year 5 Multiple a+b)-c)-d) Total initial investment in subsidiary (depreciable + NWC) Total parent cash flow's+Initial Investment # 2 - + 100% Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Delete Conditional Format Call Formatting as Table Styles Format 53 N Q C Hermosa Components, Inc. of Califomia exports 24,000 sets of low-density light bus per year to Argentina eran por los that expires in five years In Argentina the puts used for the Agent event of 60 persecuting costs in the United States and shipping together amount to 540 perseti pod path but components $10 for subsidiary and manufacturing those co$5 persent for Homes the market for this type of but in Argentina and Famosa holds the major portion of the mail. Hem whes to explore the implications of being able to grow sales volume by 4% per year. Argentine Inflation is expected to res per year, so se price and costs of 7% and 65 per year, respectively, are thought resonable. Although materials in Argentina an expected to US con expected to change over the five year period The Argentine govement has invited Mermatopen a manufacturing plants moted bubs can be placed by local production Homosawl be allowed to meet all come to the United States each year undertaken the project will require investment of $1.000.000 in building and ment, and actional $1.000.000 as evestment in Ne Woning Capital. Hemos aditionally evaluates foreign Westments in US dollars. Hemosas management wishes the analysis to be dedin damland.imelines the handshol A Today ang 40 S 6. US GD 7 dan 2009 can 9 Codred 10 5 1 1 1 3 1 18.00 Thered 14 15 16 from . 12. pa 20 21 22 23 24 25 26 27 AM 20 29 de 30 HDPE LV Baseline analysis Aline Select destination and press ENTER or choose Paste MacBook Pro Aper Nunc X Pretax Proff Preto Profesional Depreciation from above Dividend to Parentincome young Dupdate interview Annual Free Cashment. We cover Anjosh 1 Randi Working Cat 2 art, 33 how for wounting 34 35 mm range of cols with all cash flows, including investment 36 Prestolus PVG, ang cells with a FREE fowl intentment 37 31 99 Pipelit 40 Things 41 Ya 42 lewe 43 mortaliter way, 44 CAN 45.colligi UD 46 Cashflows to Hermes 47 Component: sales.com es compostowary to produce lightbulbs in Argentina 48 Sales 49 Corner so Politecore 51 US Mutta 53 SA de Arte 55 56 msc.COM sales that company have with 57 Gandhi SE MUS 99 Pro 10 US Velium G Fromboemde out Fromber From above could be comfort volume Parfum above Vasco Sale Pour Pro end vom SV Toon on www 66 India with her 70 was with FUTURE 71 72 72 74 Baseline analysis Analysis in Peso Select destination and press ENTER or choose Paste MacBook Pro AutoSave OFF OFF ABPC --- Exercise 18A Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments Calibrl (Body) Insert v v 12 A General ab Wrap Text , 06 X Delete v Paste BIU av A Merge & Center $ % Y Conditional Format Cell Formatting as Table Styles Sort Filter # Format Find & Select Analyze Data Sensitivity Yes No K M N 0 0 P R S Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left oft? P15 fx D E F G LI L Melinda Deanc, a new analysts at Hermosa and a recent MBA graduate, believes that it is a fundamental error to evaluate thc Argentinc project's prospective eamings and cash flows in dollars, rather than first estimating their Argentine Peso (Cs) value and then converting cash flow returns to the U.S. in dollars. She believes the correct method is to use the end-of-year spot rate in 2012 of Ps3.50/S and assume it will change in relation to purchasing power. (She is Sassuming U.S. inflation to be 1% per annun, Argentine inflation to be 5% per annum). She also believes that Hermosa should use a risk-adjusted discount 5 rate in Argentina which reflects Argentine capital costs (20% is her estimate) and a risk-adjusted discount rate for the parent viewpoint capital budget (18%) on the assumption that international projects in a risky currency environment should require a higher expected return than other lower risk projects. In addition to prior assumptions. Hermosa wishes to evaluate the propsect of being able to sell the Argentine subsidiary at the end of years at a multiple of the 4 5 0 9 Assumption Today Starting Growth Rates 10 Light bulb expert volume to Argentina, per year 24,000 4.00% 11 Sales price in Argentine per set $ 60.00 7.00% 12 Direct menulacturing cost of Eghubs in US per set $ 40.00 0.00% 13 Cisc manufacturrg post of lightbulbs in Argentina, per set 20.00 6.00% 14 Imported components & ahoning costs for subsidiary. per set $ 10.00 0% % 15 Components Cirect & indirect costs in US, perbel $ 5.00 0% 16 Deprecable Investment buldings & equipme 5 1,000,000 17 Initial invatath net work ng capital $ 1,000,000 18 Ciscourt rate Argentina 20% 19 Belas multiple In Year 8.00 20 Current Spotrale PWUSS Coday) 3.50 21 US Inflation rato per annum 1% 22 Aratina infation rate, parannum % 5% 18% 23 Discount totes US --- ralen 24 25 26 The captal budgeting analysis needs to be perfomed on both the Project Level Project Viewpoint) and the Parent Level Parent Viewpoint. 27 Project Viewpoint 28 Year 0 41 29 PPP Expected exchange rate 30 Sales volume 31 Salee price in Argentina per set in USS 32 Sales price in Argentina per set in Ps 33 Material con Argantina par set in USS 34 Material coste in Argentina per set in 95 Imported Materials cast per sct in USS 36 Imported Materials cost per set in PS 37 Sales revenue in Ps Baseline analysis Analysis in Peso + Select destination and press ENTER or choose Paste 5 Previous year FX rate (1+Argentine Inflation ratel/(1+US inflation rate) Sales Price in US$ - FX rate Material cost in US$ FX rate Imported Materials cost in 5$ * FX rate # 2 - + 100% AutoSave OFF DEF ABPC --- Exercise 18A Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments Calibrl (Body) v 12 Insert v A 2 ab Wrap Text General ' , , O o 06 X Delete v Pastc BIU B T U V av A Merge & Center v Y Conditional Format Cell Formatting as Table Styles # Format Sort Filter Ov Find & Select Sensitivity Analyze Data Yes No I K L . N 0 P R S U 5 Previous year FX rate *(1+Argentine Inflation rate)/(1+US Inflation rata) Sales Price in US$ FX rate Material cost in US$. EX rate Imported Materials cost in US$ FX rate Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left oft? P15 X V fx A B D E F H 27 Project Viewpoint 28 Year 1 2 1 41 29 PPP Expected exchange rata 30 Salus volume 31 Sales price in Argentina per set in USS 32 Sales price in Argentina par set in PS 33 Material coste in Argentina per set in USS 34 Material casts in Argentina per set in Ps 35 Imported Materials cost per set in USS 36 Imported Materials cost per set in Ps 37 Sales revenue in Pa 38 Direct manufacturing posts 29 Cost of mported us components 40 Gross profit 41 Depucation 42 Pretax pro 43 Argentina 40% 44 Net Income 45 Add hack depredation 46 Annual project cash flow 47 Sales veuen years multiple of Gemings 48 Initial investment, total in Py 49 Free cash flow for discounting in Ps SO 51 52 Internal Rate of Return =lRR(range of cells with all cash flows, including initial investment 53 Nat Present Value -NPV(discount rate, range of cells with all FUTURE cash flows) + Initial Irwetsment 54 55 Parent Viewpoint 56 The Parent Viewpoint needs to consider al incremental cash flow impacts including ces on export sales to Argentina current practice. 57 Year 0 58 SAAs volume 59 Imported componenty & shipping costs for subs diary, per se 60 Components direct & Indirect costs In US, perset 61 Coal of Us Manufactured Frihed Good 62 Cash flows to Hermosa 13 Component sales: compute sales of components to subsidiary to produce lightbulbs in Argentina 64 Sales tuvenue or export to Argentina 65 Loss diet and direct costs on exported cete Baseline analysis Analysis in Peso + Select destination and press ENTER or choose Paste Net Income in Years Multiple S Initial Volume*(1+Volume Growth From above (could be intal cost "11+inflation)) From above could be intal cost "1+inflation)) From above (could be intal cost * 1+Inflation)) Volume * Price or from above "cost of imported Valurne Price or from above "cost of exported" # 2 - + 100% % AutoSave OFF DEF ABPC --- Exercise 18A Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments Calibrl (Body) v 12 A Insert v 9v General ab Wrap Text WE , 0. LG X Delete v Pastc BIU Merge & Center Y th Conditional Format Cell Formatting as Table Styles Sort Filter Format Find & Select Analyze Data Sensitivity Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left oft? Yes No I K L M N 0 P Q R S 5 Initial Volume' (1+Volume Growth From above (could be Intial cost *1+Inflation) From above (could be intial cost "11+inflation)) From above (pould be intial cast 1+inflation) Valume * Price ar fram above "cost of imported' Volume * Price or from above cost of exported * Sale revenue-cost - Profit Tax Rate Profit - Taxes P15 X fix A B E F G 50 51 52 Internal Rate of Return -IR(range of cells with all cash flows, including initial investment) 53 Net Present Value =NPV(discount rate, range of cells with all FUTURE cash flows] + Initial invetsment 54 55 Parent Viewpoint 56 The Parent Viewpoint neece lo consider al incremental cash flow impacts incucing on export sales to Argentina (current practice 57 Year 0 2 58 Sales volume 59 Imported components & Shipping costs for suhe diary. per 60 Components direct & indirect costs in US, per sot 61 Cost of US Manufactured Finished Goods 62 Cash flows to Hermosa 63 Component sales: compute sales of components to subsidiary to produce lightbulbs in Argentina 64 Sales venue on aspartato Argentina 65 Less direct and direct cusis on exported sets 66 Protton Hemcsa's component sales 67 US tarea 40% 68 a) Net profit on component sales after-tax 69 70 b) Dividends from Argentina to Hermosa (US) 71 72 Loss of sales: compute net sales that company would have made without subsidiary 73 Finished Goude Salus 74 Cost (Not incurred) 75 Pax pro 76 us takes 40% 77 c) Netloss of sales after-tax 78 79 di Cash flow from sale of Argentine subsidiary not taxed) 80 81 Total parent cash flow after-tax (a+b-c+d] 82 Initial invetsment 83 Free cash flow to parent for discounting 84 85 Internal rate of return (IRR) =IRR(range of cells with all cash flows, including initial investment 86 Net present value (NPV) -NPV(discount rate, range of cells with all FUTURE cash flows) + Initial invetsment 87 88 Baseline analysis Analysis in Peso + Select destination and press ENTER or choose Paste Dividend - Net Income Depreciation from the Project Viewpoint (annual cash flows) Revenues of Argentine subsidiary from Project paint of view Sales Volume Manufacturing Cost in US Lost Finished goods Sales + Cost not incurred Cash flow loss Tax Rate Lost Finished goods Sales Taxes Net Income in Year 5 Multiple a+b)-c)-d) Total initial investment in subsidiary (depreciable + NWC) Total parent cash flow's+Initial Investment # 2 - + 100% Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Delete Conditional Format Call Formatting as Table Styles Format 53 N Q C Hermosa Components, Inc. of Califomia exports 24,000 sets of low-density light bus per year to Argentina eran por los that expires in five years In Argentina the puts used for the Agent event of 60 persecuting costs in the United States and shipping together amount to 540 perseti pod path but components $10 for subsidiary and manufacturing those co$5 persent for Homes the market for this type of but in Argentina and Famosa holds the major portion of the mail. Hem whes to explore the implications of being able to grow sales volume by 4% per year. Argentine Inflation is expected to res per year, so se price and costs of 7% and 65 per year, respectively, are thought resonable. Although materials in Argentina an expected to US con expected to change over the five year period The Argentine govement has invited Mermatopen a manufacturing plants moted bubs can be placed by local production Homosawl be allowed to meet all come to the United States each year undertaken the project will require investment of $1.000.000 in building and ment, and actional $1.000.000 as evestment in Ne Woning Capital. Hemos aditionally evaluates foreign Westments in US dollars. Hemosas management wishes the analysis to be dedin damland.imelines the handshol A Today ang 40 S 6. US GD 7 dan 2009 can 9 Codred 10 5 1 1 1 3 1 18.00 Thered 14 15 16 from . 12. pa 20 21 22 23 24 25 26 27 AM 20 29 de 30 HDPE LV Baseline analysis Aline Select destination and press ENTER or choose Paste MacBook Pro Aper Nunc X Pretax Proff Preto Profesional Depreciation from above Dividend to Parentincome young Dupdate interview Annual Free Cashment. We cover Anjosh 1 Randi Working Cat 2 art, 33 how for wounting 34 35 mm range of cols with all cash flows, including investment 36 Prestolus PVG, ang cells with a FREE fowl intentment 37 31 99 Pipelit 40 Things 41 Ya 42 lewe 43 mortaliter way, 44 CAN 45.colligi UD 46 Cashflows to Hermes 47 Component: sales.com es compostowary to produce lightbulbs in Argentina 48 Sales 49 Corner so Politecore 51 US Mutta 53 SA de Arte 55 56 msc.COM sales that company have with 57 Gandhi SE MUS 99 Pro 10 US Velium G Fromboemde out Fromber From above could be comfort volume Parfum above Vasco Sale Pour Pro end vom SV Toon on www 66 India with her 70 was with FUTURE 71 72 72 74 Baseline analysis Analysis in Peso Select destination and press ENTER or choose Paste MacBook Pro