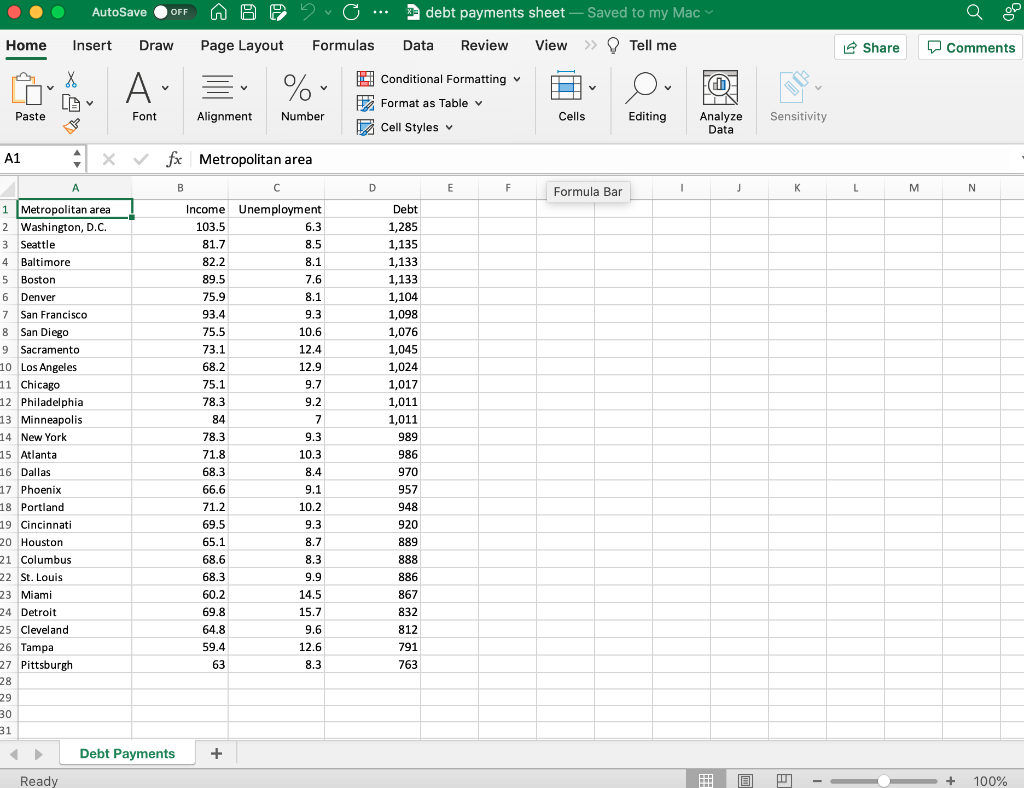

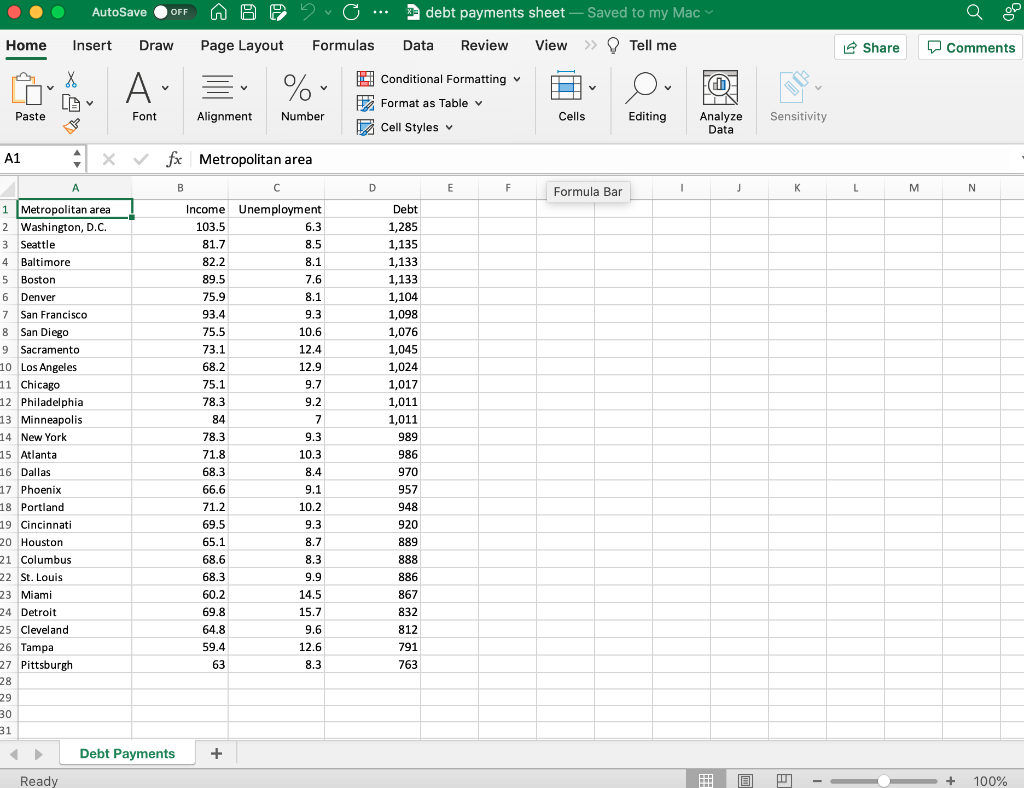

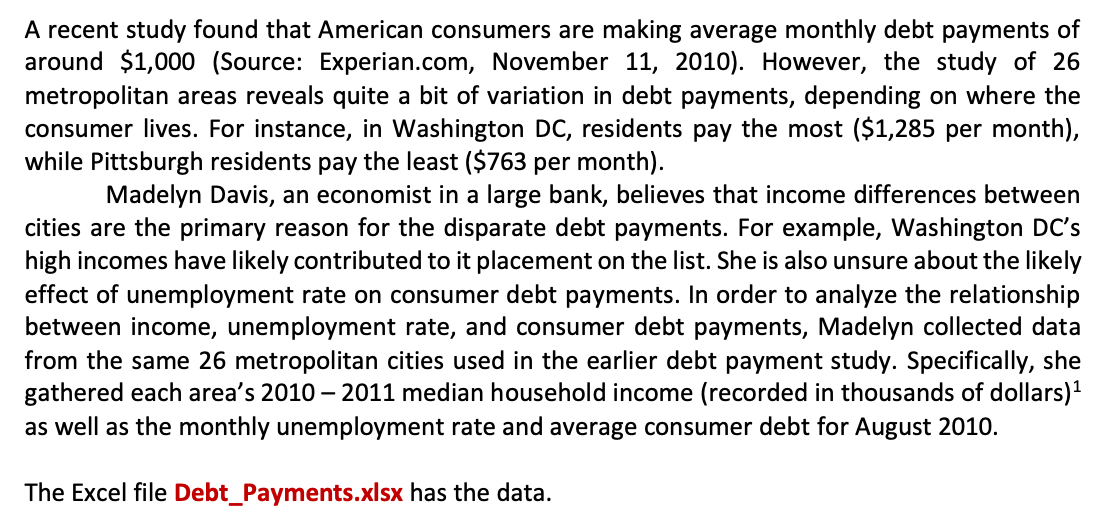

AutoSave OFF @yo. debt payments sheet - Saved to my Mac Data Review View Tell me Home Insert Draw Page Layout Formulas Share Comments X LO A % y o FO Conditional Formatting Format as Table Cell Styles NIN Paste Font Alignment Number Cells Editing Analyze Data Sensitivity A1 X fx Metropolitan area A D E F Formula Bar J K L M N 73.1 1 Metropolitan area 2 Washington, D.C. 3 Seattle 4 Baltimore 5 Boston 6 Denver 7 San Francisco 8 San Diego 9 Sacramento 10 Los Angeles 11 Chicago 12 Philadelphia 13 Minneapolis 14 New York 15 Atlanta 16 Dallas 17 Phoenix 18 Portland 19 Cincinnati 20 Houston 21 Columbus 22 St. Louis 23 Miami 24 Detroit 25 Cleveland 26 Tampa 27 Pittsburgh 28 29 30 31 B Income Unemployment 103.5 6.3 81.7 8.5 82.2 8.1 89.5 7.6 75.9 8.1 93.4 9.3 75.5 10.6 12.4 68.2 12.9 75.1 9.7 78.3 9.2 84 7 78.3 9.3 71.8 10.3 68.3 8.4 66.6 9.1 71.2 10.2 69.5 9.3 65.1 8.7 68.6 8.3 68.3 9.9 60.2 14.5 69.8 15.7 64.8 9.6 59.4 12.6 63 8.3 Debt 1,285 1,135 1,133 1,133 1,104 1,098 1,076 1,045 1,024 1,017 1,011 1,011 989 986 970 957 948 920 889 888 886 867 832 812 791 763 Debt Payments + Ready - + 100% A recent study found that American consumers are making average monthly debt payments of around $1,000 (Source: Experian.com, November 11, 2010). However, the study of 26 metropolitan areas reveals quite a bit of variation in debt payments, depending on where the consumer lives. For instance, in Washington DC, residents pay the most ($1,285 per month), while Pittsburgh residents pay the least ($763 per month). Madelyn Davis, an economist in a large bank, believes that income differences between cities are the primary reason for the disparate debt payments. For example, Washington DC's high incomes have likely contributed to it placement on the list. She is also unsure about the likely effect of unemployment rate on consumer debt payments. In order to analyze the relationship between income, unemployment rate, and consumer debt payments, Madelyn collected data from the same 26 metropolitan cities used in the earlier debt payment study. Specifically, she gathered each area's 2010 - 2011 median household income (recorded in thousands of dollars)1 as well as the monthly unemployment rate and average consumer debt for August 2010. The Excel file Debt_Payments.xlsx has the data. a) Describe the problem background and purpose of the study b) Describe the variables included in the case c) Outline the statistical methods required to answer the research questions d) Apply the statistical methods to answer both research questions a. Follow all steps required to conduct a complete analysis and validation of methods, including assumption checks e) Presentation of the results and their interpretations a. If using multiple models, perform a comparison to select the best one. Justify your choice. f) Final conclusions, decision-making and recommendations based on the results to the economist AutoSave OFF @yo. debt payments sheet - Saved to my Mac Data Review View Tell me Home Insert Draw Page Layout Formulas Share Comments X LO A % y o FO Conditional Formatting Format as Table Cell Styles NIN Paste Font Alignment Number Cells Editing Analyze Data Sensitivity A1 X fx Metropolitan area A D E F Formula Bar J K L M N 73.1 1 Metropolitan area 2 Washington, D.C. 3 Seattle 4 Baltimore 5 Boston 6 Denver 7 San Francisco 8 San Diego 9 Sacramento 10 Los Angeles 11 Chicago 12 Philadelphia 13 Minneapolis 14 New York 15 Atlanta 16 Dallas 17 Phoenix 18 Portland 19 Cincinnati 20 Houston 21 Columbus 22 St. Louis 23 Miami 24 Detroit 25 Cleveland 26 Tampa 27 Pittsburgh 28 29 30 31 B Income Unemployment 103.5 6.3 81.7 8.5 82.2 8.1 89.5 7.6 75.9 8.1 93.4 9.3 75.5 10.6 12.4 68.2 12.9 75.1 9.7 78.3 9.2 84 7 78.3 9.3 71.8 10.3 68.3 8.4 66.6 9.1 71.2 10.2 69.5 9.3 65.1 8.7 68.6 8.3 68.3 9.9 60.2 14.5 69.8 15.7 64.8 9.6 59.4 12.6 63 8.3 Debt 1,285 1,135 1,133 1,133 1,104 1,098 1,076 1,045 1,024 1,017 1,011 1,011 989 986 970 957 948 920 889 888 886 867 832 812 791 763 Debt Payments + Ready - + 100% A recent study found that American consumers are making average monthly debt payments of around $1,000 (Source: Experian.com, November 11, 2010). However, the study of 26 metropolitan areas reveals quite a bit of variation in debt payments, depending on where the consumer lives. For instance, in Washington DC, residents pay the most ($1,285 per month), while Pittsburgh residents pay the least ($763 per month). Madelyn Davis, an economist in a large bank, believes that income differences between cities are the primary reason for the disparate debt payments. For example, Washington DC's high incomes have likely contributed to it placement on the list. She is also unsure about the likely effect of unemployment rate on consumer debt payments. In order to analyze the relationship between income, unemployment rate, and consumer debt payments, Madelyn collected data from the same 26 metropolitan cities used in the earlier debt payment study. Specifically, she gathered each area's 2010 - 2011 median household income (recorded in thousands of dollars)1 as well as the monthly unemployment rate and average consumer debt for August 2010. The Excel file Debt_Payments.xlsx has the data. a) Describe the problem background and purpose of the study b) Describe the variables included in the case c) Outline the statistical methods required to answer the research questions d) Apply the statistical methods to answer both research questions a. Follow all steps required to conduct a complete analysis and validation of methods, including assumption checks e) Presentation of the results and their interpretations a. If using multiple models, perform a comparison to select the best one. Justify your choice. f) Final conclusions, decision-making and recommendations based on the results to the economist