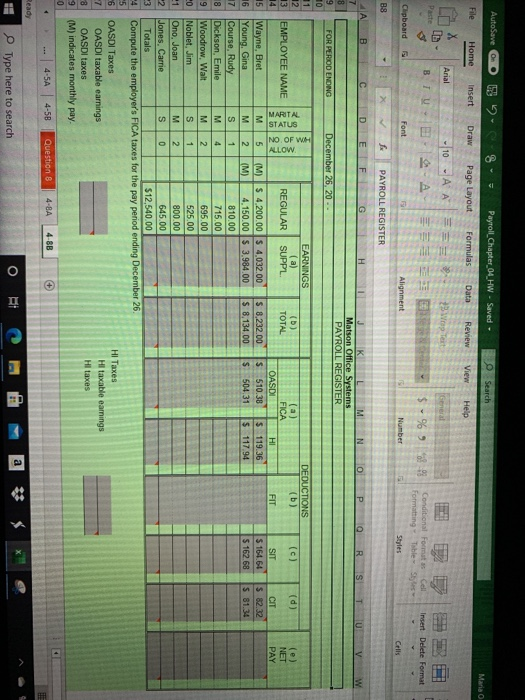

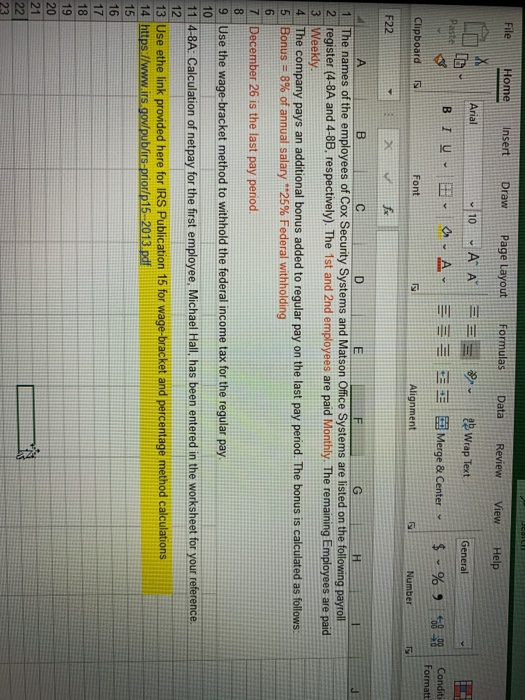

AutoSave On Payroll_Chapter 04 HW - Saved - Search Maria o File Home Insert Draw Page Layout Formulas Data Review View Help DE Paste Arial -10 - A A General BTU A R$ % 898 Conditional Formst as Cell. Insert Delete Format Formatting Table Clipboard Font Alignment Number Styles Cells BS f PAYROLL REGISTER LA B C D E F G M N o P R 7 STU v w Matson Office Systems 8 PAYROLL REGISTER 9 FOR PERIOD ENONO December 26, 20.. 10 11 EARNINGS DEDUCTIONS 12 (a) (b) (a) (c) 13 (b) EMPLOYEE NAME (d) REGULAR SUPPL TOTAL FICA NET 4 OASDI HI FIT SIT CIT PAY 15 Wayne, Bret M (M) $ 4,200.00 S 4.032.00 S 8.232.00 s 510.38 $ 119.36 $164.64 $ 82.32 16 Young, Gina M (M) 4,150.00 $ 3.984.00 $ 8,134.00 $ 504.31 $117.94 $ 162.68 S 81.34 17 Course, Rudy S 810.00 18 Dickson, Emile M 715.00 9 Woodrow, Walt M 695.00 20 Noblet, Jim s 1 525.00 21 Ono, Joan M 2 800.00 2 Jones, Carrie S 0 645.00 3 Totals $12,540.00 4 Compute the employer's FICA taxes for the pay period ending December 26 -5 6 OASDI Taxes HI Taxes 7 OASDI taxable earnings Hi taxable eamings OASDI taxes Hl taxes 9 (M) indicates monthly pay. 0 4-5A 4-5B Question 8 4-BA 4-8B STATUS ALLOW 3 3 NALNO. OF WH O i Type here to search @ a Jed! File Home Insert Draw Page Layout Formulas Data Review View Help X UB Arial 10 AA General Paste BI UB A Wrap Text Merge & Center $ % 48_92 Conditi Formatt Clipboard Font Alignment Number F22 * for B D E F G H 1 The names of the employees of Cox Security Systems and Matson Office Systems are listed on the following payroll 2 register (4-8A and 4-8B, respectively). The 1st and 2nd employees are paid Monthly. The remaining Employees are paid 3 Weekly. 4 The company pays an additional bonus added to regular pay on the last pay period. The bonus is calculated as follows: 5 Bonus = 8% of annual salary **25% Federal withholding 6 7 December 26 is the last pay period. 8 9 Use the wage-bracket method to withhold the federal income tax for the regular pay 10 11 4-8A: Calculation of netpay for the first employee, Michael Hall, has been entered in the worksheet for your reference. 12 13 Use ethe link provided here for IRS Publication 15 for wage bracket and percentage method calculations 14 https://www.irs gov/pub/irs-prior/p15--2013.pdf 15 16 17 18 19 20 21 22 23 AutoSave On Payroll_Chapter 04 HW - Saved - Search Maria o File Home Insert Draw Page Layout Formulas Data Review View Help DE Paste Arial -10 - A A General BTU A R$ % 898 Conditional Formst as Cell. Insert Delete Format Formatting Table Clipboard Font Alignment Number Styles Cells BS f PAYROLL REGISTER LA B C D E F G M N o P R 7 STU v w Matson Office Systems 8 PAYROLL REGISTER 9 FOR PERIOD ENONO December 26, 20.. 10 11 EARNINGS DEDUCTIONS 12 (a) (b) (a) (c) 13 (b) EMPLOYEE NAME (d) REGULAR SUPPL TOTAL FICA NET 4 OASDI HI FIT SIT CIT PAY 15 Wayne, Bret M (M) $ 4,200.00 S 4.032.00 S 8.232.00 s 510.38 $ 119.36 $164.64 $ 82.32 16 Young, Gina M (M) 4,150.00 $ 3.984.00 $ 8,134.00 $ 504.31 $117.94 $ 162.68 S 81.34 17 Course, Rudy S 810.00 18 Dickson, Emile M 715.00 9 Woodrow, Walt M 695.00 20 Noblet, Jim s 1 525.00 21 Ono, Joan M 2 800.00 2 Jones, Carrie S 0 645.00 3 Totals $12,540.00 4 Compute the employer's FICA taxes for the pay period ending December 26 -5 6 OASDI Taxes HI Taxes 7 OASDI taxable earnings Hi taxable eamings OASDI taxes Hl taxes 9 (M) indicates monthly pay. 0 4-5A 4-5B Question 8 4-BA 4-8B STATUS ALLOW 3 3 NALNO. OF WH O i Type here to search @ a Jed! File Home Insert Draw Page Layout Formulas Data Review View Help X UB Arial 10 AA General Paste BI UB A Wrap Text Merge & Center $ % 48_92 Conditi Formatt Clipboard Font Alignment Number F22 * for B D E F G H 1 The names of the employees of Cox Security Systems and Matson Office Systems are listed on the following payroll 2 register (4-8A and 4-8B, respectively). The 1st and 2nd employees are paid Monthly. The remaining Employees are paid 3 Weekly. 4 The company pays an additional bonus added to regular pay on the last pay period. The bonus is calculated as follows: 5 Bonus = 8% of annual salary **25% Federal withholding 6 7 December 26 is the last pay period. 8 9 Use the wage-bracket method to withhold the federal income tax for the regular pay 10 11 4-8A: Calculation of netpay for the first employee, Michael Hall, has been entered in the worksheet for your reference. 12 13 Use ethe link provided here for IRS Publication 15 for wage bracket and percentage method calculations 14 https://www.irs gov/pub/irs-prior/p15--2013.pdf 15 16 17 18 19 20 21 22 23