Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Autoserve Inc. is a US-based manufacturer and distributor of automobile parts and accessories. Recently, the company's management has been in discussions regarding diversifying the

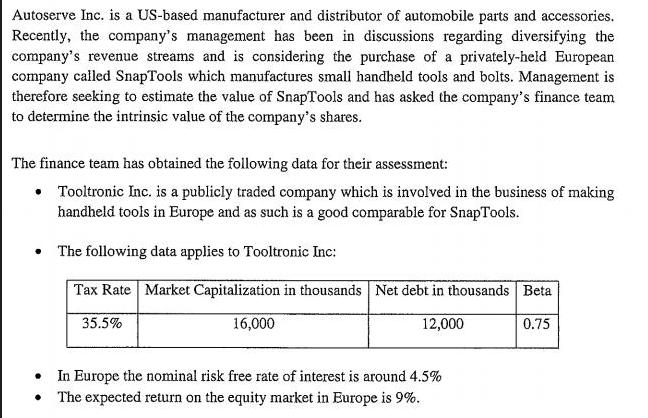

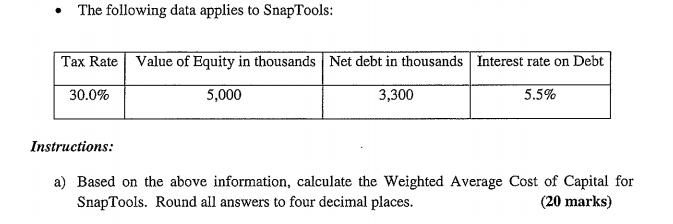

Autoserve Inc. is a US-based manufacturer and distributor of automobile parts and accessories. Recently, the company's management has been in discussions regarding diversifying the company's revenue streams and is considering the purchase of a privately-held European company called SnapTools which manufactures small handheld tools and bolts. Management is therefore seeking to estimate the value of SnapTools and has asked the company's finance team to determine the intrinsic value of the company's shares. The finance team has obtained the following data for their assessment: Tooltronic Inc. is a publicly traded company which is involved in the business of making handheld tools in Europe and as such is a good comparable for SnapTools. The following data applies to Tooltronic Inc: Tax Rate Market Capitalization in thousands Net debt in thousands Beta 12,000 35.5% 16,000 In Europe the nominal risk free rate of interest is around 4.5% The expected return on the equity market in Europe is 9%. 0.75

Step by Step Solution

★★★★★

3.57 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Weighted Average Cost of Capital WACC for Snaptools WACC formula WACC EV x Re DV x Rd x 1 Tc ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started