Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Autotechs LLP is an engineering performance enhancement specialist in the provision of a particular performance testing service for high-performance road cars. Autotechs seeks to

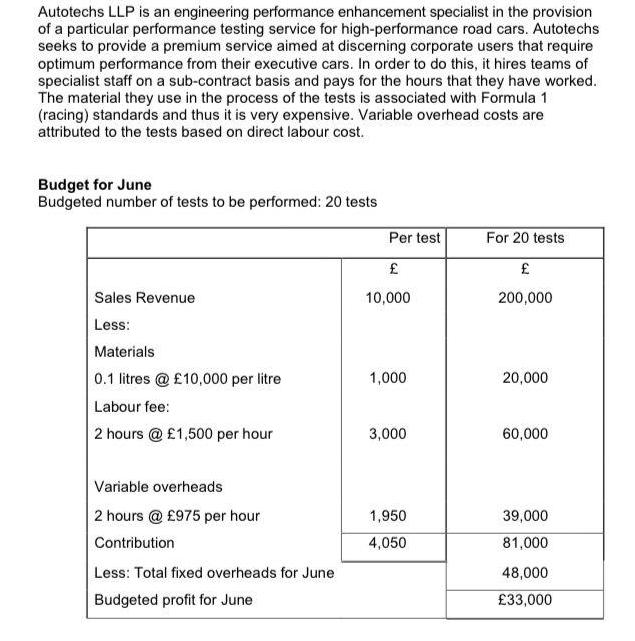

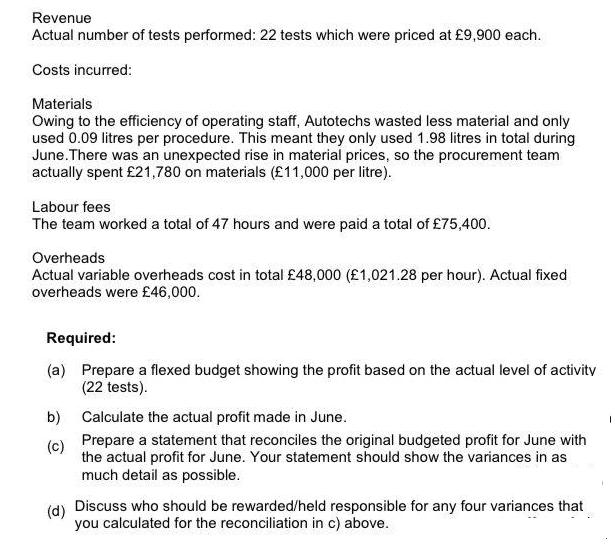

Autotechs LLP is an engineering performance enhancement specialist in the provision of a particular performance testing service for high-performance road cars. Autotechs seeks to provide a premium service aimed at discerning corporate users that require optimum performance from their executive cars. In order to do this, it hires teams of specialist staff on a sub-contract basis and pays for the hours that they have worked. The material they use in the process of the tests is associated with Formula 1 (racing) standards and thus it is very expensive. Variable overhead costs are attributed to the tests based on direct labour cost. Budget for June Budgeted number of tests to be performed: 20 tests Per test For 20 tests Sales Revenue 10,000 200,000 Less: Materials 0.1 litres @ 10,000 per litre 1,000 20,000 Labour fee: 2 hours @ 1,500 per hour 3,000 60,000 Variable overheads 2 hours @ 975 per hour 1,950 39,000 Contribution 4,050 81,000 Less: Total fixed overheads for June 48,000 Budgeted profit for June 33,000 Revenue Actual number of tests performed: 22 tests which were priced at 9,900 each. Costs incurred: Materials Owing to the efficiency of operating staff, Autotechs wasted less material and only used 0.09 litres per procedure. This meant they only used 1.98 litres in total during June. There was an unexpected rise in material prices, so the procurement team actually spent 21,780 on materials (11,000 per litre). Labour fees The team worked a total of 47 hours and were paid a total of 75,400. Overheads Actual variable overheads cost in total 48,000 (1,021.28 per hour). Actual fixed overheads were 46,000. Required: (a) Prepare a flexed budget showing the profit based on the actual level of activity (22 tests). b) Calculate the actual profit made in June. Prepare a statement that reconciles the original budgeted profit for June with (c) the actual profit for June. Your statement should show the variances in as much detail as possible. (d) Discuss who should be rewarded/held responsible for any four variances that you calculated for the reconciliation in c) above.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Flexible Budget Actual number of tests 22 Sales 220000 2210000 Less Materials 22000 221000 Labor f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started